Supported by the Federal Reserve’s recent pause on raising interest rates, corporate bonds are leading the US fixed-income sector higher in 2019. Junk bonds and long-term corporates are especially hot for the year-to-results through yesterday’s close (Feb. 6).

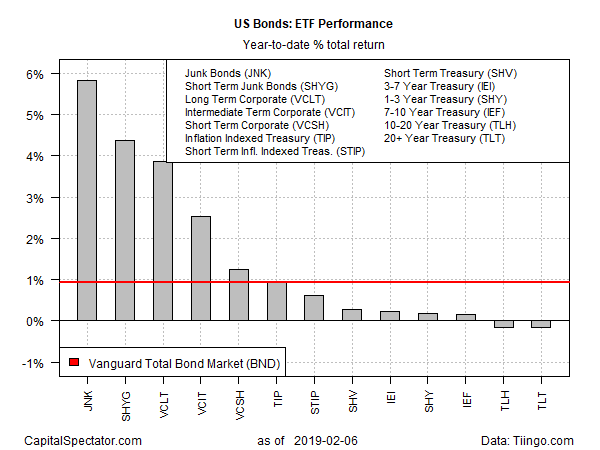

SPDR Bloomberg Barclays High Yield Bond (JNK) is posting the strongest performance so far this year, based on a set of exchanged-traded funds that represent the major slices of the US fixed-income markets. At the end of Wednesday’s trading, JNK was up a strong 5.8% so far this year.

A short-term junk fund — iShares 0-5 Year High Yield Corp Bond (SHYG) — is in second place with a 4.4% year-to-date pop.

Note that the third-strongest performer this year is in long-term corporates: Vanguard Long-Term Corporate Bond (VCLT), which is up 3.9%. VCLT’s rally suggests that there’s a fair amount of confidence in the market that the Fed will continue to keep interest rates steady for the near term.

A healthy tailwind is blowing for the US investment-grade bond market overall year to date, based on Vanguard Total Bond Market ETF (BND). This ETF has climbed 0.9% this year through yesterday’s close (red line in chart below).

The only year-to-date losers for the broad sweep of US bonds at the moment: two buckets of long-term Treasuries, which are essentially tied at a slight 0.2% decline each — iShares 10-20 Year Treasury Bond (TLH) and iShares 20+ Year Treasury Bond (TLT).

Otherwise, a bullish bias for prices is conspicuous for fixed income so far this year (bond prices move inversely to yields). Former Fed Chairwoman Janet Yellen thinks that bias may have legs, or at the very least it’s premature to rule out the possibility. CNBC yesterday asked if an interest-rate cut is possible, she replied:

Of course it’s possible. If global growth really weakens and that spills over to the United States where financial conditions tighten more and we do see a weakening in the U.S. economy, it’s certainly possible that the next move is a cut.

Recent data for the US economy suggests that moderate growth will prevail and so the case for a rate cut in the immediate future appears unlikely. But the same is true for estimating the odds that another rate hike is near, or so the crowd assumes. Fed funds futures this morning are pricing in a high probability that the current target range of 2.25%-to-2.50% will prevail for the rest of the year.

Considering the rally in bonds lately, the fixed-income crew seems to be pricing in no less.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Corporate Bonds Leading US Fixed-Income Sector Higher - TradingGods.net