The sharp tumble in technology stocks in recent days has yielded this year’s leading sector performance to consumer discretionary, based on a set of exchange-traded funds. Shares of consumer discretionary firms have also fallen in recent days, but the setback has been relatively mild compared with tech.

Consumer Discretionary Select Sector SPDR (XLY) is up 12.9% year to date through July 30, edging out the 11.3% performance so far in 2018 for Technology Select Sector SPDR (XLK).

Disappointing earnings and high valuations are weighing on several of the leading names in the tech sector. The so-called FANG shares – Facebook, Amazon, Netflix and Alphabet (aka Google) – slumped on Monday, extending last week’s weakness. The selling “presents us with the catalyst to shift toward value and valuations mattering,” Jefferies equity strategist Steven DeSanctis advised in a research note on Monday.

A New Book From The Capital Spectator:

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Tech’s stumble has left consumer discretionary with a small performance edge year to date. Note, however, that both sectors are still outperforming the broad market this year by wide margins. Indeed, SPDR S&P 500 (SPY) is up 5.8% in 2018 through Monday’s close – well below the year-to-date performances for XLY and XLK.

The worst sector performance so far this year: telecommunications firms. Vanguard Communication Services (VOX) is currently in the red by 5.9% for 2018.

Until recently, the tech sector was the clear performance leader. But as the chart below shows, XLK’s surge earlier this year has been followed by a dramatic tumble (green line), leaving XLY as the year’s top performer (black line).

Ranking the sector ETFs by current price relative to 200-day moving average shows that energy — Energy Select Sector SPDR ETF (XLE) — is posting the strongest momentum profile at the moment, followed by the consumer discretionary (XLY) and tech (XLK).

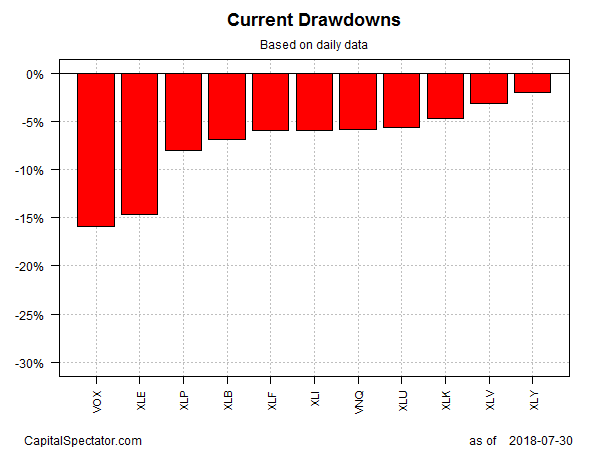

Note, too, that consumer discretionary (XLY) is posting the smallest drawdown. The ETF’s current peak-to-trough decline is a mild 2%. By contrast, telecom (VOX) has the biggest drawdown as of Monday’s close – a relatively steep 16% slide off its previous peak.

For additional research on the sector ETFs cited above, here are links to the summary pages at Morningstar.com:

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financial (XLF)

Healthcare (XLV)

Industrial (XLI)

Materials (XLB)

Technology (XLK)

Utilities (XLU)

Telecom (VOX)

Real Estate Investment Trusts (VNQ)

Pingback: Top Performing Sector for the Year is Consumer Discretionary - TradingGods.net