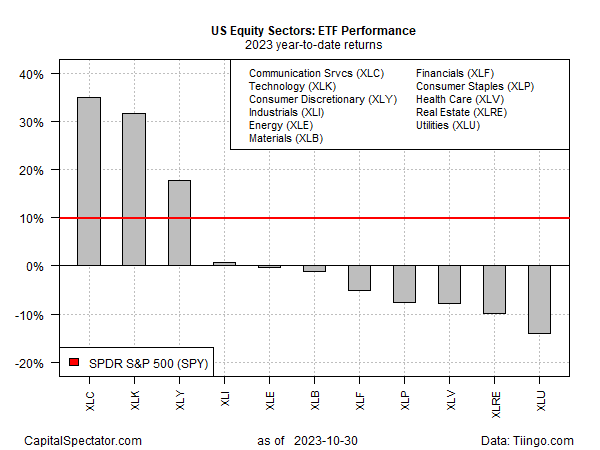

The US stock market continues to post a moderate gain year to date, in large part due to strong sector performances in the communications services and technology sectors. Both slices of the market are still enjoying red-hot gains in 2023 through yesterday’s close (Oct. 30), based on a set of ETFs.

Communication Services Select Sector SPDR Fund (XLC) is up 35.1% so far this year. A close second-place performer: Technology Select Sector SPDR Fund (XLK) with a 31.7% year-to-date gain. Both rallies are far ahead of their sector counterparts and US equities overall.

SPDR S&P 500 ETF (SPY), a proxy for American shares, is up 9.9% for the year. Meanwhile, more than half of the sectors are underwater.

The deepest sector loss: Utilities Select Sector SPDR Fund (XLU). This interest-rate-sensitive corner of stocks is off more than 14% in 2023. The silver lining: XLU’s trailing 12-month yield has increased and is currently 3.6%, or a bit more than two-thirds of the current 10-year Treasury yield, which is 4.88%, according to Morningstar.com.

Meanwhile, Energy Select Sector SPDR Fund (XLE) is essentially flat this year. The performance suggests that the fund is set to deliver a weak results in 2023 after two straight calendar years of stellar returns.

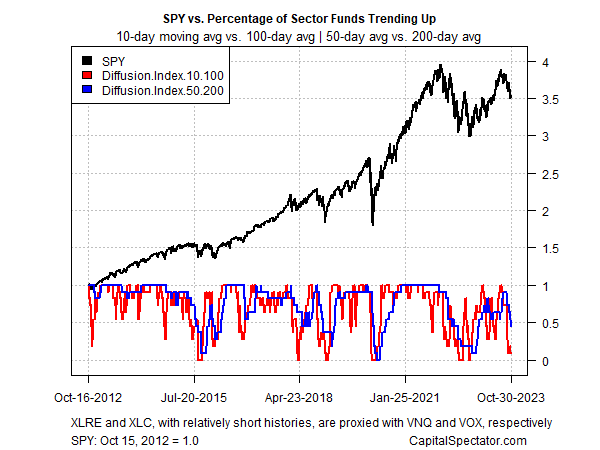

Profiling all the sector funds listed above suggests that the correction that started in the summer has yet to run its course, based on a set of moving averages. The percentage of sector ETFs trending down, based on short-term averages, is nearing a trough (red line in chart below), but the medium-term indicator has only fallen by roughly half from its previous peak (blue line).

If history is a guide, only when the blue line is well below the 50% mark will the odds skew strongly in favor of a sustained rebound for sector funds generally. By that standard, the downside bias still has room to run.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno