Is this the year of commodities? It’s a plausible narrative, based on the early days of trading in 2025 for a set of ETFs that track the major asset classes through Tuesday’s close (Jan. 21). Although these are early days for evaluating the calendar year, the initial results show a broad measure of commodities with a solid lead.

WisdomTree Enhanced Commodity Strategy Fund (GCC) is up 4.3% year to date, leading the rest of the field. The second-best performer: stocks in developed markets ex-US (VEA) with a 3.5% return. US equities (VTI), after 20%-plus gains in each of the past two years that led global markets, is in third place so far in 2025 with a 3.2% increase.

Notably, all the major asset classes are posting gains year to date. The Global Market Index (GMI) is up 2.7% in 2025 to date. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios.

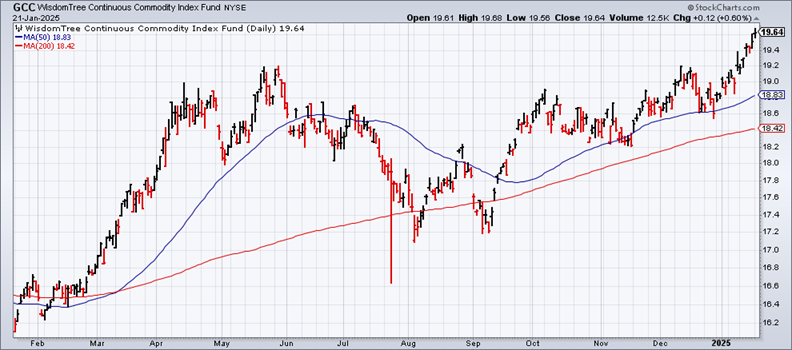

The strength in commodities (GCC) has been conspicuous for several months. The current run higher dates to September.

In mid-December, The ETF Portfolio Strategist (a sister publication to CapitalSpectator.com) noted that commodities (GCC) were an upside outlier relative to most other markets. For the moment, the relative and absolute strength of this asset class roll on in 2025.