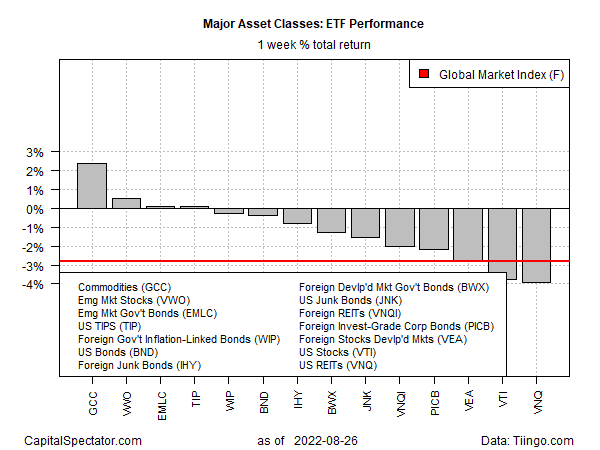

A broad measure of commodities sidestepped the widespread losses found elsewhere for most of the major asset classes during the trading week through Friday, Aug. 26, based on a set of ETFs.

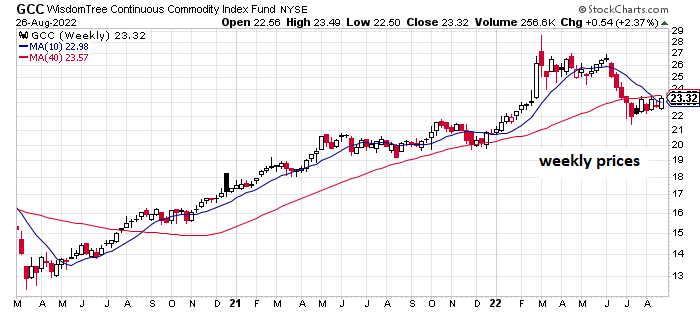

WisdomTree Commodity Strategy Fund (GCC) rose 2.4% last week, extending its gradual recovery of recent weeks after a sharp correction in June and July. The fund is still well below its previous peak, set early in 2022, but some analysts are starting to turn positive again on the outlook for raw materials prices generally.

Goldman Sachs is newly bullish on the asset class, Bloomberg reports, in part because the investment bank forecasts that commodities will rebound on the tailwind from higher energy prices. “Our economists view the risk of a recession outside Europe in the next 12 months as relatively low,” Goldman analyst advise in a note to clients. “With oil the commodity of last resort in an era of severe energy shortages, we believe the pullback in the entire oil complex provides an attractive entry point for long-only investments.”

From a cross-asset perspective, equities could suffer as inflation stays elevated and the Fed is more likely to surprise on the hawkish side… Commodities, on the other hand, are the best asset class to own during a late-cycle phase where demand remains above supply.

Stocks and bonds in emerging markets (VWO and EMLC, respectively) and inflation-indexed Treasuries (TIP) also posted gains last week, albeit well behind GCC’s rally.

Otherwise, the rest of the major asset classes lost ground for the trading week ended Friday. US real estate investment trusts (VNQ) posted the biggest setback with a 3.9% weekly slide – the second in a row.

The Global Market Index (GMI.F) continued to fall last week, dropping 2.8%, which extends the previous week’s decline. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive index for portfolio strategy analytics.

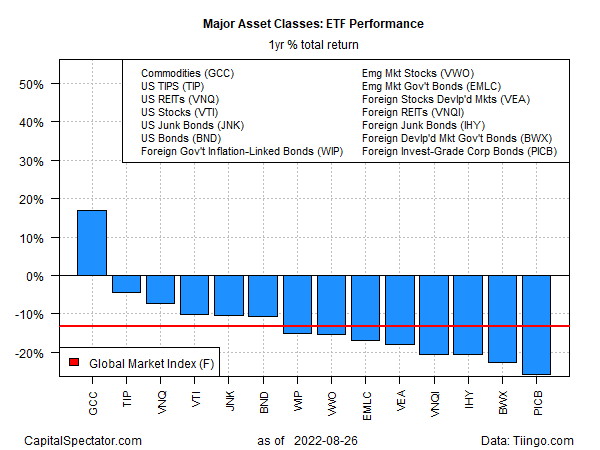

For the one-year window, commodities (GCC) are still the only winner — by a wide margin via a 16.8% gain.

Losses dominate otherwise. The biggest setback for the major asset classes over the past year: a nearly 26% decline in foreign corporate bonds (PICB).

GMI.F is down 13.2% over the trailing one-year window.

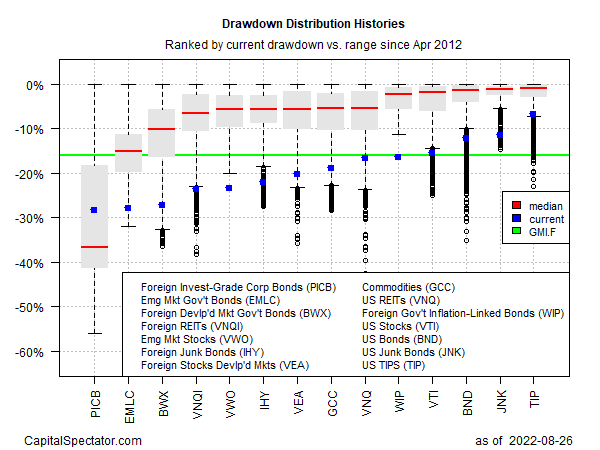

Using a drawdown lens to review the major asset classes shows that all but one of the major asset classes are posting peak-to-trough declines deeper than -10%. The outlier: inflation-protected Treasuries (TIP), which closed on Friday with a relatively light drawdown of -6.8%.

GMI.F’s drawdown: -16.1% (green line in chart below).

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report