The major asset classes took another hit for the trading week through Friday, May 6 – with a familiar exception: commodities. After a modest pullback in the second half of April, raw materials rebounded in the first week of May amid a broad selloff in markets elsewhere, based on a set of ETF proxies.

WisdomTree Commodity (GCC), which holds a broad set of commodities, edged up 0.3% last week. Although the fund stands out as the only winner last week, GCC continues to consolidate in a trading range. Is this the peaking process following a strong rally earlier in the year, fueled by supply shortages triggered by the Ukraine war?

JPMorgan still recommends holding commodities as a hedge against inflation. “The correlation with inflation, whether as a driver or consequence, has helped insulate portfolios in an inflationary regime and has also provided good diversification in portfolios in 2022,” the bank advised last week. “The mix [of drivers] may change in the years ahead, but the trajectory will likely be sustainable.”

Meanwhile, the rest of the field suffered setbacks last week. The deepest loss: US real estate investment trusts (REITs) via Vanguard Real Estate Index Fund (VNQ), which fell sharply for a second week, tumbling 3.9%.

The Global Market Index (GMI.F) fell for a fifth straight week, losing 1.0%. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETFs.

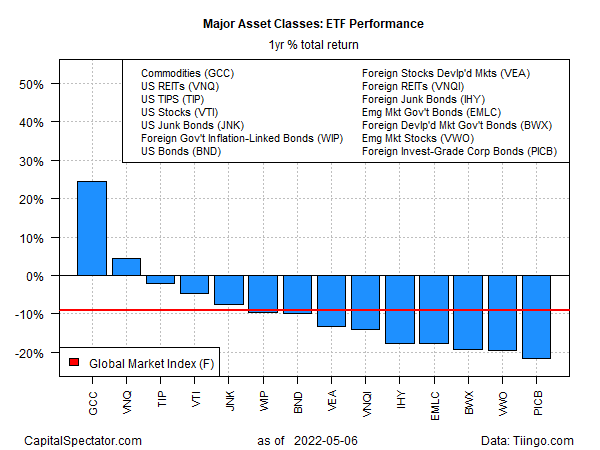

For the one-year return window, commodities continue to lead by a wide margin. WisdomTree Commodities (GCC) is up nearly 25% over the past 12 months, far ahead of the rest of the field.

The only other component of the major asset classes with a one-year gain: US real estate (VNQ), although the positive 12-month gain in this corner is fading fast.

GMI.F remains under water for the one-year result, sinking 9.0% at Friday’s close vs. its year-ago price on a total-return basis.

More than half of the major asset classes are now posting deeper drawdowns than GMI.F. The steepest peak-to-trough decline at last week’s close: government bonds issued in emerging markets via EMLC, which closed nearly 27% below its previous peak.

The smallest drawdown at the moment: inflation-indexed US government bonds (TIP), which closed on Friday with a 7.2% peak-to-trough decline.

GMI.F’s current drawdown: -14.5%.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno