In mid-December, CapitalSpectator.com mused: “Are Commodities A Compelling Contrarian Trade For 2024?” The answer so far this year continues to be “yes,” as a rally for prices of raw materials continues to bubble after a rough 2023 in this corner of global markets.

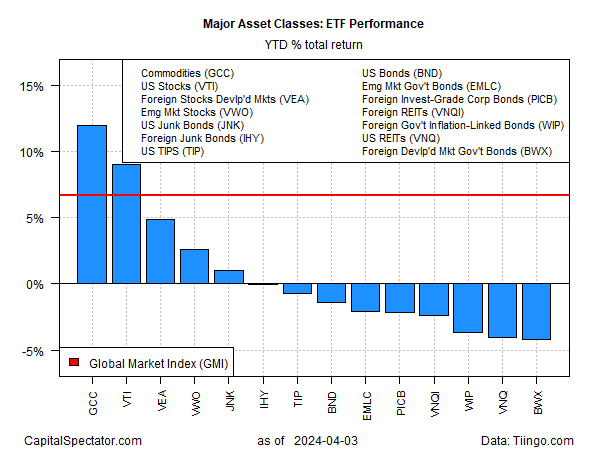

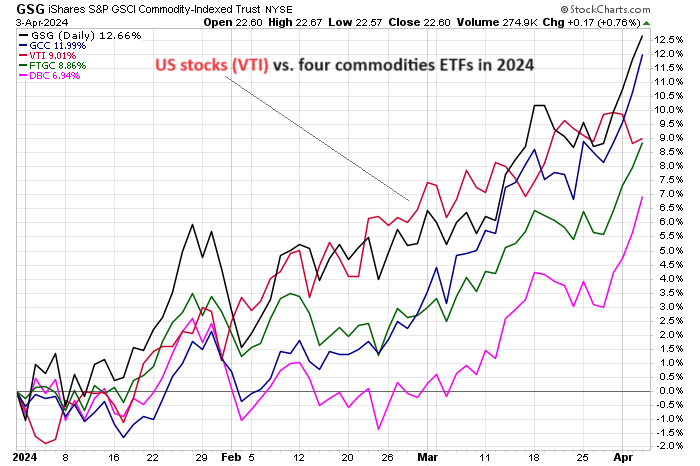

Two weeks ago I noted that commodities had overtaken US stocks as the top performer for global assets in 2024, and that leadership shift remains intact through yesterday’s close (Apr. 3), based on a set of ETFs. In fact, the commodities edge has widened recently via WisdomTree Enhanced Commodity Strategy Fund (GCC). This ETF, which holds a variety of commodities, is up 12% year to date vs. a 9.0% gain for US stocks (VTI) so far in 2024.

It’s important to recognize that defining “commodities” and managing the mix comes in a wide array of variations. The asset class, if you can call it that, is, in a word, complicated — for several reasons.

First, there’s debate about how to weight commodities in a portfolio. In contrast to market capitalization for equities, there’s no obvious counterpart for defining a passive mix of commodities. One possibility is using the value of futures trading as a guide. Another is estimating the economic relevance for a given commodity vs. the counterparts. Not surprisingly, energy tends to be a leading slice of commodities portfolios.

What is clear is that a number of broad-brush commodity funds are rebounding in 2024 after a down year for the asset class in 2023. As usual, results for commodities are sensitive to how you define and manage the basket of holdings, as the chart below reminds. In contrast with market-cap-weighted index funds for stocks, a much deeper dive is required for understanding and choosing broadly defined commodities funds.

“What’s going on right now is that the market’s sniffing out the possibility that global growth is going to be better than expected,” and supporting global inflation and commodity prices, says Nanette Abuhoff Jacobson, global investment strategist at Hartford Funds. In turn, that makes it a “much more difficult environment” for the Fed to cut interest rates, she predicts.

Veteran trader Jim Rogers sees support for commodity prices coming from monetary policy. “Since there has been a lot of money printing in the world, demand for commodities should be strong,” he predicts. “So, if you own some sugar, don’t sell it. I wouldn’t sell my oil either. If you own some silver, don’t sell it.”

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno