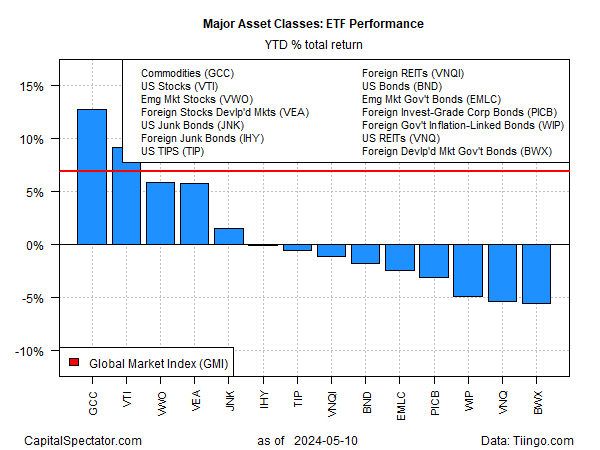

April was a rough month for global markets, but commodities and stocks are still the performance leaders for the major asset classes this year, based on a set of ETFs through Friday’s close (May 10).

The rebound so far this month following April’s correction has helped keep the winners winning. The top performer this year: commodities (GCC) via a 12.7% return. In second place: US stocks (VTI), posting a 9.2% year-to-date rise.

Tied for third and fourth place: equities in emerging markets (VWO) and developed markets ex-US (VEA) with 5.8% and 5.7% year-to-date returns, respectively.

Losses in 2024 remain concentrated in bonds and real estate securities. The deepest setback this year is in government bonds issued in developed markets ex-US (BWX) via a 5.6% decline.

Thanks to the robust gains in commodities and stocks, however, the overall trend for globally diversified portfolios is still comfortably positive this year, based on the Global Market Index (GMI). Beta risk, in other words, is providing a solid tailwind. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) holds all the major asset classes (except cash) in market-value weights and represents a competitive benchmark for multi-asset-class portfolios.

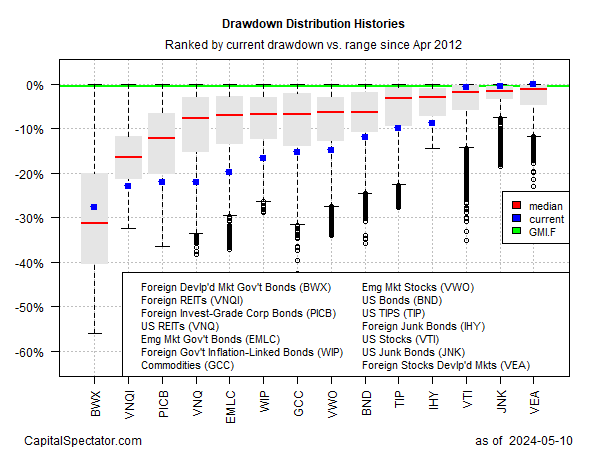

Profiling global markets based on drawdown, however, reminds that a relatively extreme degree of division prevails. While a handful of markets are close to previous peaks (foreign developed market stocks (VEA), US junk bonds (JNK) and US equities (VTI), most of the global markets are still posting relatively steep peak-to-trough declines. Indeed, the majority of current drawdowns for the major asset classes are below -10%.

Markets will be keenly focused on this week’s US consumer inflation report (Wed., May 15), which will likely set the tone for where risk assets go from here. Economists are looking for a dip in the year-over-year pace for headline and core CPI. If correct, it will mark renewed progress in taming inflation following stalled disinflation in April.

“The CPI report could go a long way towards really furthering the narrative that rate cuts are coming this year,” says Gennadiy Goldberg, head of U.S. rates strategy at TD Securities.