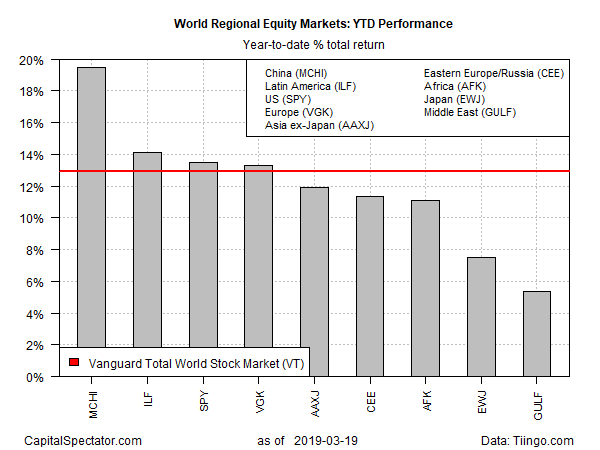

Bullish sentiment has lifted equity prices in every major region of the global market so far in 2019 and China’s shares continue to lead the rally by a wide margin, based on a set of exchange-traded products.

The iShares MSCI China (MCHI) is up a strong 19.5% year to date through yesterday’s close (Mar. 19). The rise is five percentage points higher vs. the ETF’s year-to-date gain a month earlier. Note, too, that MCHI’s rally is well ahead of the second-best regional performer: iShares Latin America 40 (ILF), which is currently posting a 14.1% return this year.

Despite the strength in Chinese stocks, some analysts wonder if the rally has gone too far as investors price in a favorable outcome to the ongoing US-China trade war. “In my opinion there’s still … too much hope priced in,” Rainer Michael Preiss, executive director of Taurus Wealth Advisors, told CNBC last Thursday. “There’s no easy way out of this, and that’s why I think there’s potentially a possibility that this outcome could actually disappoint the market. If there’s a so-called trade deal, in my opinion it could be rather cosmetic than really substantial.”

Sentiment appears to be shifting to a more cautious outlook today. As The Wall Street Journal reports this morning: “Global stocks sagged Wednesday as investors remained cautious ahead of another round of high-level trade talks between the US and China planned for next week.”

Nonetheless, there’s nothing cosmetic about the upside trend in global equity beta so far in 2019. Vanguard Total World Stock (VT) is up 12.9% as of Tuesday’s close, which more than makes up for the ETF’s 9.7% loss last year.

The US stock market is basically tracking the global equity rally, with a modest kicker. SPDR S&P 500 (SPY) is ahead 13.5% year to date, or just slightly above VT’s 12.9% rise.

The weakest gain in 2019 for the major equity regions: Mideast stocks. After a leading performance in 2018, WisdomTree Middle East Dividend (GULF) — the only US-listed regional Mideast equity ETF – has turned in a comparatively mild gain year to date via a 5.4% advance.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno