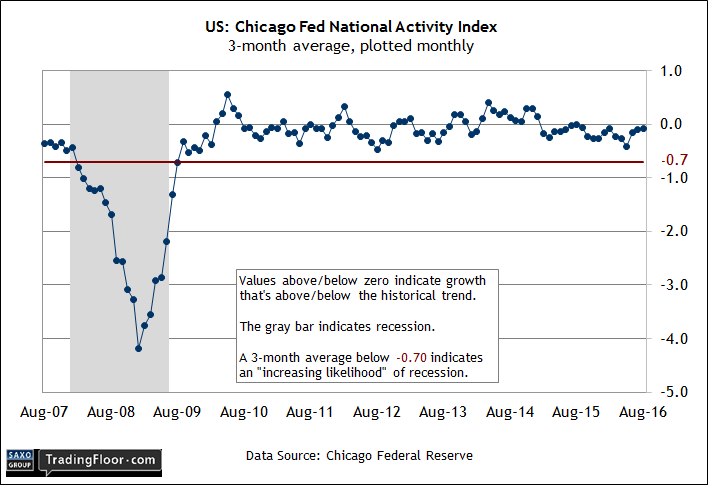

US economic output remained steady at a below-trend rate in August, based on this morning’s update of the three-month average of the Chicago Fed National Activity Index (CFNAI-MA3). Last month’s reading inched up to -0.07, the highest since Sep. 2015. But the slightly below-zero level reflects modest economic activity, which is in line with the data over the last several months.

Meantime, recession risk is still low, according to CFNAI-MA3. A decline below -0.70 for the index marks the start of a downturn, according to Chicago Fed guidelines. By that yardstick, the probability is low that August marked the first month of an NBER-defined recession.

But while the broad macro trend remains positive, the pace remains sluggish. The August review “suggests that growth in national economic activity was slightly below its historical trend,” the Chicago Fed advised in a statement. “The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.”

The continuation of a relatively soft economic trend via CFNAI-MA3 aligns with yesterday’s review of business-cycle risk by The Capital Spectator. “The US economy’s forward momentum remained sluggish in August,” I noted on Wednesday. “Although recession risk was low last month, a series of disappointing indicator updates in recent weeks suggest that the macro trend continues to struggle.”

The central bank seems to agree. The Federal Reserve’s yesterday decided to leave interest rates unchanged, which suggests that the monetary mavens, on balance, remain cautious after reviewing recent data. Although Fed Chair Janet Yellen said that “our decision [to forgo a rate hike] does not reflect a lack of confidence in the economy,” the new quarterly economic forecasts reflect flat to slightly lower expectations for growth and interest rates. In the wake of that decision, today’s report from the Chicago Fed implies that delaying a new round of monetary tightening remains a reasonable path for policy until or if the macro trend delivers more convincing evidence that growth is picking up and/or in no danger of slipping over to the dark side.

Pingback: 09/22/16 – Thursday’s Interest-ing Reads | Compound Interest-ing!

Pingback: US Economic Output Remains at a Below-Trend Rate in August - TradingGods.net