The question went viral this week after Paul Westra, an analyst at Stifel Financial Corp., raised the possibility in a research note. Bloomberg on Tuesday published a news story about the implied forecast, noting that the “this doesn’t just bode ill for restaurants, but could point to trouble across the economy as a whole.” The main takeaway, we’re told, is that the US could slide into a recession in early 2017. There’s only one problem: the possibilities for different macro scenarios between today and six months forward are close to infinite, thanks to the complexity of an $18 trillion economy and the constancy of an uncertain future.

Don’t misunderstand: a weak restaurant industry could be the straw that breaks the recovery’s back. But so could countless other indicators. Every recession has one or more catalysts, but it’s an evolving cast of characters and they’re only conspicuous after a recession has started. Even then, the evidence may be sufficiently warm and fuzzy to keep analysts debating for years about the reasons for a downturn.

The 1973-74 recession is a glaring exception, offering a rare bit of clarity—in something approximating real time. OPEC’s decision in October 1973 to impose an oil embargo on the US in retaliation for America’s support of Israel in the Yom Kippur War delivered a shock to the economy by sharply raising energy prices over a short period. The blowback was swift and deep at a time when the economy had long been accustomed to cheap fuel. NBER dates the peak in the US business cycle as November 1973, just one month after OPEC unleashed its oil weapon.

Most recessions, however, aren’t so easily diagnosed, even in retrospect. Although every downturn has common themes—rising unemployment, lower consumption, etc.—the specific mix of factors that create the conditions that lead to any given slump is a complex brew of interactions that are virtually impossible to see in advance. A six-month forecast might as well be six years in this context.

It’s tempting to think otherwise, in part because the media’s always fishing around for compelling stories. But it’s never clear if weakness in one corner will be the spark that leads to a widespread fire or a false alarm.

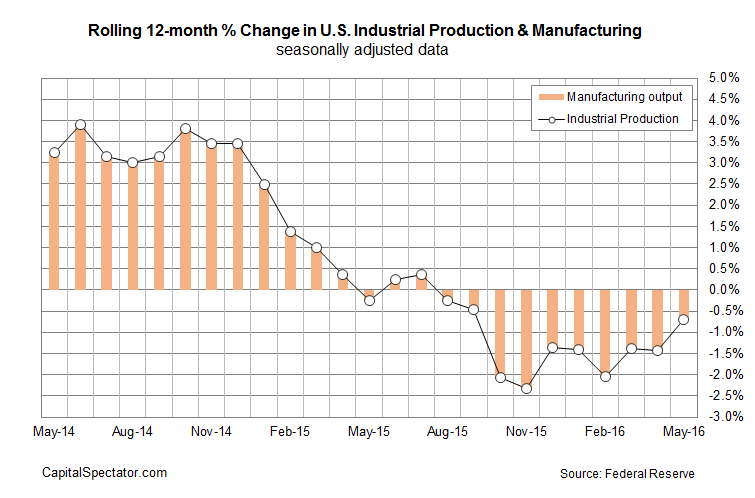

Consider the manufacturing sector, which may or may not be recovering from a recession over the past year or so. But the slide in output has been strong enough to pull down US industrial activity in year-over-year terms for ten straight months through June—the longest stretch of red ink since the last recession. By some accounts, the weakness in manufacturing (the biggest component in industrial output) provides near certainty that the US was/is headed for a new recession. But we’ve been hearing that for a year or more. So far, however, the economy has only wobbled without falling down, and there are hints that a firmer trend may again be unfolding. Last week’s June update of the Chicago Fed National Activity’s 3-month average all but confirms that the US recovery remained intact last month. (July’s profile, by contrast, remains mostly a mystery at the moment due to a limited data.)

Could a soft restaurant industry change the trajectory? Yes, of course, as could a range of other scenarios. But looking for smoking guns, one factor at a time, by extrapolating the implied forecast into the future is effectively rolling the dice and hoping that your number comes up.

Let’s cut to the chase and recognize that monitoring recession risk is crucial for any number of reasons (including investment strategy, as history suggests). All the more reason that a robust methodology is essential, which starts with analyzing data across a broad set of indicators in the cause of nowcasting rather than forecasting. Why? Because no one’s sure where the next recession is coming from and so there’s no substitute for looking far and wide in an effort to understand the trend in recent history. For added reliability, it’s wise to combine nowcasts from a mix of models and indicators.

It’s also reasonable to look ahead, but only slightly via relatively objective econometric modeling techniques that a) have shown a degree of accuracy; and b) combine multiple projections in order to minimize the inevitable errors that infect any single estimate. As an example, consider the encouraging vintage results shown here (bottom chart).

There’s still no guarantee that we won’t be blindsided. One-hundred-percent certainty is a phrase that should never be used in business-cycle analysis. Rather, it’s all about probabilities. There are many paths for boosting the probabilities of success in the dark art/science of recession nowcasting, but there are many more dead ends.

If the goal is maximizing the reliability and timeliness of business-cycle signals, looking for clarity in one or two indicators will likely to lead you to failure. On the other hand, it’s a great way to generate flattering press coverage.

Pingback: Could the US Economy Slide into a Recession in 2017? - TradingGods.net

Pingback: 07/31/16 – Sunday’s Interest-ing Reads | Compound Interest-ing!