It took a year, but the late-2015 recommendations by some analysts for overweighting energy stocks — at a time when the sector’s trend looked rather grim — is now bearing fruit. A year, in other words, can make a big difference in the cyclical fortunes of US equity sectors. Indeed, energy stocks now lead the field for trailing one-year return, based on a set of proxy ETFs.

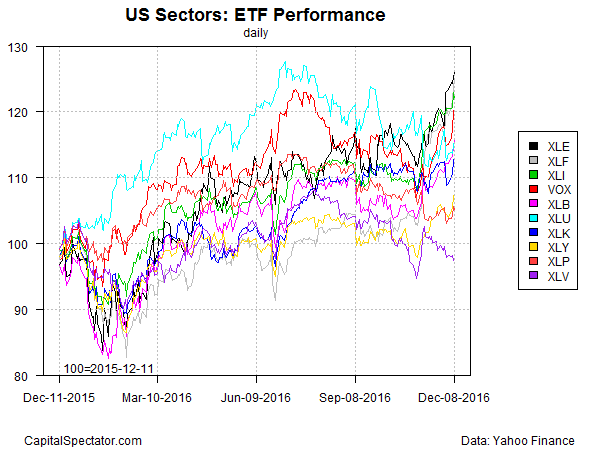

Energy Select Sector SPDR (XLE) is the number-one performing sector at the moment for the past year, courtesy of a 26% total return through yesterday, Dec. 8 (using 252-trading-day accounting). The gain marks a stunning recovery from this time last year, when XLE was in the red by almost 18%.

Meanwhile, the formerly high-flying health care sector has fallen on hard times. The Health Care Select Sector SPDR (XLV) is currently the worst performing sector fund. In fact, it’s the only sector with a loss at the moment in the one-year column: XLV is off more than 2% over the past 12 months.

The overall tide, however, is bullish, based on a broad read for US equities. The SPDR S&P 500 ETF (SPY) is currently ahead by a solid 12% for the trailing one-year period via 252-trading-day results.

The next chart offers a visual recap of the current state of sector momentum performances. XLE’s leadership position is conspicuous (black line at top far right), which contrasts sharply with XLV’s downward slide (purple line at bottom).

Looking at sector ETFs via 50- and 200-day moving averages reveals that financial stocks are leading the field. Financial Select Sector SPDR (XLF) closed yesterday at more than 14% above its 50-day average and 23%-plus above its 200-day average. XLE’s upside strength ranks second, while utilities (XLU), consumer staples (XLP), and health care (XLV) are suffering negative profiles on this front.

For additional research on the sector ETFs cited above, here are links to the summary pages at Morningstar.com:

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financial (XLF)

Healthcare (XLV)

Industrial (XLI)

Materials (XLB)

Technology (XLK)

Utilities (XLU)

Telecom (VOX)