Bond prices continued to rebound last week as investors worried that the turmoil in the banking sector could spread.

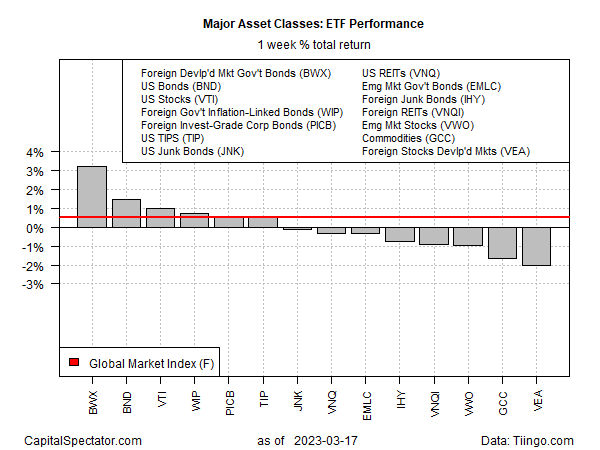

Government bonds in developed markets ex-US posted the strongest gain for the major asset classes in the trading week through Friday, Mar. 17, based on a set of ETF proxies. US stocks and bonds also rose while foreign equities and commodities suffered the biggest losses.

SPDR Bloomberg International Treasury Bond ETF (BWX) rallied 3.4% last week. The gain was partly fueled by a weaker US dollar in foreign exchange markets. The US Dollar Index fell for a third week as it traded near its lowest level in nearly a year.

The biggest loser last week: foreign stocks in developed markets ex-US. Vanguard Developed Markets Index Fund (VEA) fell 2.0%.

US equities, by contrast, rose last week. Vanguard Total US Stock Market (VTI) clawed back some of the sharp losses booked in the previous week with a 1.0% rally.

Despite last week’s rally in US shares, traders at JP Morgan advise that stocks are still vulnerable. “Longer-term, to achieve a rally, we need inflation materially lower (say 3.5% or less), earnings to accelerate higher, and you need the banking crisis solved,” they write. In the near-term, however, macro headwinds are lurking. “A recession seems to be a certainty given the banking crisis and the expectation for additional ‘unknown unknowns’ to emerge. Combined, this feels like another bear market rally rather than the beginning of a new bull market.”

The Global Market Index (GMI.F) rose last week, rebounding modestly with a 0.5% gain following a sharp decline previously. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies.

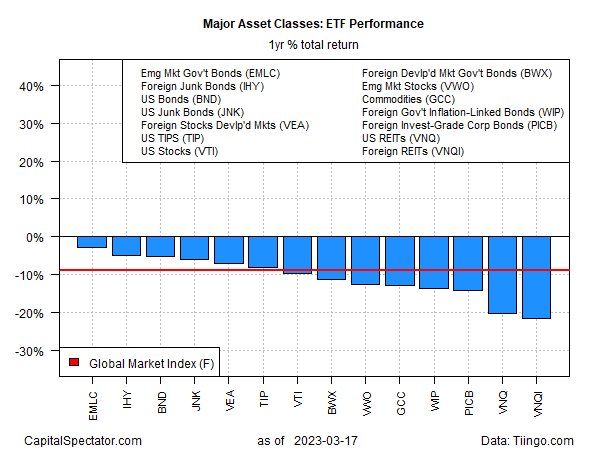

All the major asset classes continued to post losses for the trailing one-year trend. The deepest one-year loser: global real estate shares ex-US via Vanguard Global ex-US Real Estate Index Fund (VNQI), which is closed down nearly 22% on Friday vs. the year-ago level after factoring in distributions.

GMI.F is also in the red with an 8.9% loss over the past 12 months.

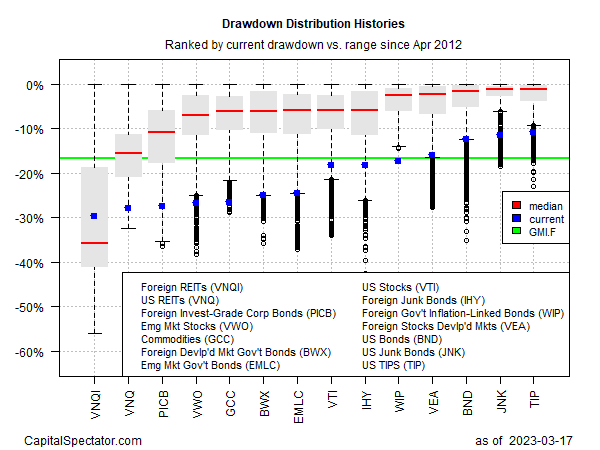

Comparing the major asset classes through a drawdown lens continues to show relatively steep declines from previous peaks for markets around the world. The softest drawdown at the end of last week: US inflation-indexed Treasuries (TIP), which ended the week with a 10.9% peak-to-trough loss.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report