A Forbes columnist last week warned that asset allocation is falling on hard times. Rob Isbitts, founder and chief investment officer of Sungarden Investment Research, writes that “if you started investing in a typical asset allocation strategy any time since mid-2012, your returns have been progressively worse.” Using a set of BlackRock asset allocation ETFs as evidence, he says the standard asset allocation strategy has “lost its mojo.”

This sounds rather ominous. After all, if asset allocation’s efficacy is fading, successful portfolio design faces serious challenges. “And based on the precarious positions of the stock and bond markets today, I would not want to be in a position of counting on a return to glory any time soon,” he advises.

Perhaps, but unpacking this cautionary analysis leaves room for debate about the prospects for asset allocation in the years ahead. Yes, it’s fair game to take a cautious view these days on expected returns for risky assets. But that caveat should be separated from evaluating the value of asset allocation.

Let’s start by recognizing that minds will differ on the wisdom of using Blackrock’s iShares asset allocation funds as a benchmark for multi-asset class risk and return profiles. Consider the iShares Core Moderate Allocation (AOM), for instance. While it’s true that the ETF’s performance over the last three years has been moderate, perhaps even lackluster, it’s not obvious that this fund (or its counterparts at iShares) is the last word on what might be termed conventional asset allocation.

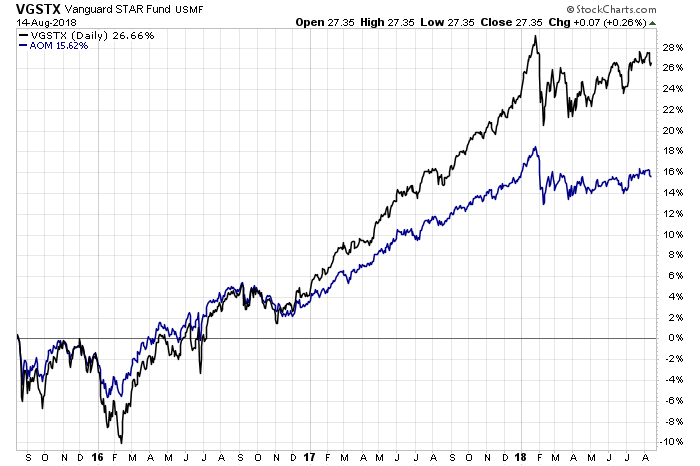

As one example, let’s compare AOM to Vanguard Star Fund (VGSTX), a simple but broad-minded mix of other Vanguard funds that offers a reasonable alternative as an asset allocation benchmark. Over the past three years, the two funds have diverged, with VGSTX posting conspicuously stronger results through yesterday’s close (August 14).

Yes, VGSTX’s trailing three-year results are softer compared with the equivalent in 2012. But equating return volatility with failure is short-sighted for the simple reason that the business cycle and asset performances are forever dynamic.

There’s also the question of the time period to use for assessing results. To state the obvious, performance can and does vary, depending on the window you select. As a result, you can torture the data to say just about anything you want, which is why it’s always dangerous to rely on one trailing period.

Meanwhile, defining asset allocation is tricky due to the myriad possibilities for designing and managing multi-asset class strategies. That’s a reason to use a benchmark that seeks to minimize the subjective aspects. One possibility: the Global Market Index (GMI), an unmanaged portfolio of all the major asset classes that uses market-value weights.

Note that GMI’s performance for a rolling 10-year window has been improving recently, based on risk premium (total return less the risk-free rate via a 3-month Treasury bill). GMI’s annualized risk premium ticked up to 5.5% for the decade through the end of last month, the strongest gain in about five years.

It’s crucial to point out that GMI’s annualized 10-year performance can and does vary quite a bit, including modestly negative results during the financial crisis a decade ago.

All of which leads us to the main event: expectations. What are you expecting from asset allocation? The main takeaway is that asset allocation comes in many flavors with a wide range of results. As a result, benchmarking is challenging, although GMI’s relatively objective methodology is a good place to start.

More importantly, there is no one-size-fits all for asset allocation. Customizing is essential, based on investment goals, risk tolerance, and other factors.

Isbitts argues that conventional asset allocation “is in decline,” as proxied by several iShares ETFs, which have posted “progressively worse” performance in recent years. “The message here is that the traditional way of allocating assets (global stocks and bonds, with emphasis on U.S. markets) lost its mojo a while ago.”

I’m not convinced that the iShares ETFs he cites represent asset allocation, but even if they do it’s premature to conclude that softer performance in recent years is the death knell for what might be considered plain-vanilla multi-asset class portfolios.

Some of what Isbitts identifies is simply part of the ebb and flow of the business cycle with respect to asset class returns. The strong results in asset allocation funds following the 2008 financial crisis were never long for this world. Granted, anyone lucky enough to buy at the bottom was treated with stellar results in subsequent years. But high trailing performance was always destined to fade as time went on.

What should you expect from a standard asset allocation strategy? The Vanguard Star Fund offers a robust, real-world benchmark by virtue of its simplicity, transparency, and low cost. Since inception in 1985, the portfolio has generated a 9.5% annualized total return. As a guide to the next 30 years that’s probably high, given current valuations and other factors. An expected return in the 6%-7% range may be more reasonable.

Isbitts recommends more aggressive approaches to asset allocation, and there’s a case for that. Tactical asset allocation, which comes in a rainbow of variations, can be productive, but there are also caveats to consider. A new study from Morningstar, for example, finds that “few alternative mutual funds have conferred meaningful diversification benefits in recent years.”

Whatever the future holds for asset allocation it’s clear that there’s no escaping this foundation for portfolio design. Every investor is subject to its influences for the simple reason that every investment decision is ultimately an asset allocation decision. Even if you made an extreme choice to own one stock to represent your portfolio, that’s still an asset allocation decision – a concentrated equity position on steroids plus what can be thought of as a short on every other asset class.

Suffice to say that asset allocation isn’t in decline and it’s wrong to assume otherwise simply because expected return and risk are in continual flux. Quite a lot of that flux is bound up with the business cycle, which in turn informs valuation and, by extension, ex ante risk and return.

The good news is that an intelligent approach to building and managing portfolios can generate satisfactory results through time. The basic building blocks are holding a mix of asset classes and periodically rebalancing the weights.

Is asset allocation fading as a viable investment tool? No, not by a long shot. In fact, it’s the only game in town. Meantime, results will continue to vary, albeit with a limited degree of predictability. Invest accordingly.

A New Book On Using R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Asset Allocation Falling on Hard Times? - TradingGods.net

Very well said Jim. Thank you!