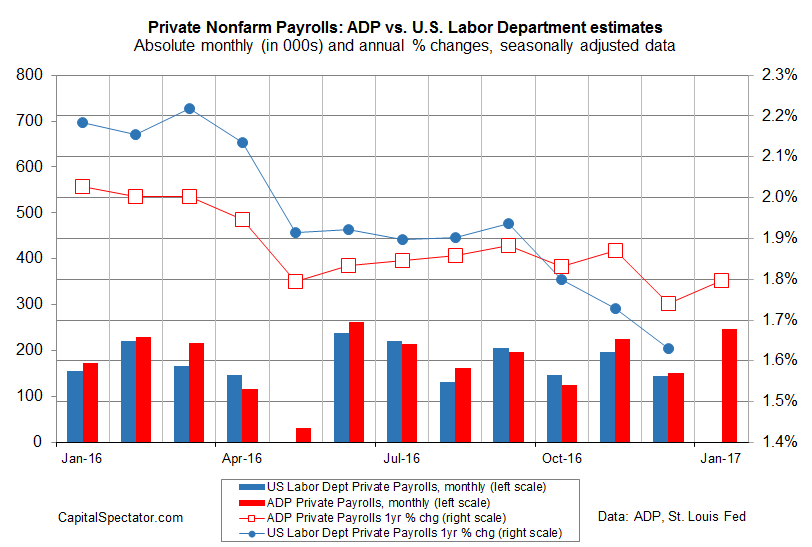

Is the labor market re-accelerating? It’s easier to make that case after reading today’s January update of the ADP Employment Report.

US companies added significantly more jobs last month — 246,000 — than expected. The strong rise marks the biggest monthly increase since last June, providing support for expecting a solid advance in Friday’s official employment report for January from the Labor Dept.

“The US labor market is hitting on all cylinders and we saw small and midsized businesses perform exceptionally well,” says Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Further analysis shows that services gains have rebounded from their tepid December pace, adding 201,000 jobs. The goods producers added 46,000 jobs, which is the strongest job growth that sector has seen in the last two years.”

The latest pop lifted the year-over-year increase for ADP’s employment estimate to 1.80%. Note, however, that a 1.80% annual increase still represents growth that’s near the softest pace in nearly four years.

The question is whether today’s results signal a reversal in the slowdown in employment growth that’s been unfolding over the last two years? It’s too soon to know. One month doesn’t tell us much, in part because short-term noise is a constant pest. The improvement in the one-year change is encouraging, but it’s not obvious that the slow fade in job growth has ended, much less reversed.

We’ll know more in Friday’s release from the government. Meanwhile, the implied forecast via the ADP paints a rosy picture for the official January update. Crunching the numbers with a linear regression model translates into a projected rise of 242,000 in private-sector payrolls for last month – dramatically higher than the 170,000 consensus forecast via Econoday.com.

Sounds good, but keep in mind that month-to-month numbers can be deeply misleading at times.

Recall that last May the government reported that job growth collapsed: private payrolls contracted slightly after posting a modest increase of 147,000. The slide was the first monthly loss in six years, prompting some pundits to declare that the end was near for the US economic expansion. (Initially, the government reported growth of just 25,000 jobs, which is an usually low number; the monthly change has since been revised down to a loss of 1,000 for the month.) The pessimism turned out to be dead wrong. The lesson: assuming the worst based on one employment report is asking for trouble, as a broad measure of the US macro trend suggested in last year’s May and June economic profiles.

What’s true on the dark side has relevance on the upside, and so it’s best to remain cautious in assuming that a bullish regime shift for employment is at hand. That may turn out to be true, but for the moment the numbers overall suggest that moderate growth is still the path of least resistance for the economy. In sum, more of the same.

True, recession risk is quite low at the moment, as last week’s analysis of the US macro profile shows. Meanwhile, there are hints that a firmer pace may be unfolding for the first quarter, as my near-term econometric projections have shown in recent months via the weekly updates of The US Business Cycle Risk Report. It’s possible that today’s ADP update is a down payment on that forecast.

Ultimately, it’ll take several months to know for sure. Meantime, let’s see how Friday’s release stacks up. Given what we know right now, however, it would be surprising (and troubling) if the year-over-year change for the government’s estimate of private payrolls doesn’t at least stabilize in January after posting worrisome bouts of deceleration in last year’s fourth quarter.