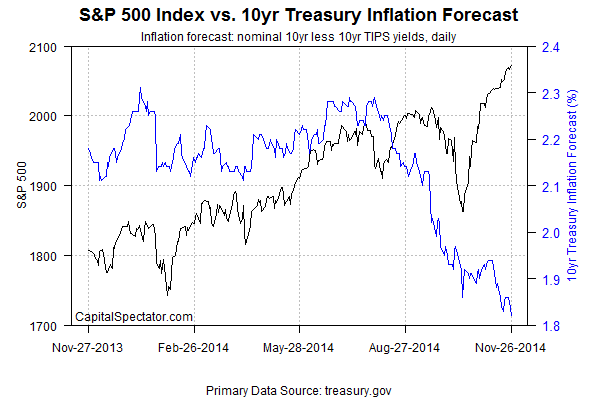

The Federal Reserve may start raising interest rates next year for the first time in nearly a decade, but the focus at the moment is on deflation risk, or so it seems by way of the market’s softer inflation forecast via a closely followed yield spread in Treasuries. The implied outlook for inflation slumped to a three-year low of 1.82% on Nov. 26, based on the difference for the nominal 10-year yield less its inflation-indexed counterpart. This market-based estimate is down sharply from the recent peak of 2.29% as of this past July 30. It’s unclear how much of the market’s focus on deflation risk is tied to worries about the macro outlook in Europe and Asia vs. the US. This much is clear: if Mr. Market continues to lower his inflation estimate, it’s going to be tougher to argue that the US economy is immune to the macro troubles that are bubbling elsewhere in the world.

Then again, maybe the crowd will rethink its recent appetite for lesser inflation estimates in the wake of today’s news that Europe’s biggest economy can hang on to a mild degree of growth. Retail spending in Germany rebounded last month after tumbling in the previous month—a tumble that raised worries that the so-called growth engine for Europe was sputtering or worse. One data point is hardly conclusive, but for the moment at least the prospects for Germany have improved slightly.

Q4 GDP in Europe is still expected to tread water, although recent estimates have been inching higher lately, according to Now-casting.com. There’s also some evidence for thinking that the recent slowdown in China’s growth may be stabilizing. This week’s update of business sentiment for China in October shows a mild degree of improvement.

Nonetheless, the crowd has turned cautious lately, spurring a rally in bonds around the world. “I don’t see much that can hurt this rally right now, I would stick with the trend,” Padhraic Garvey at ING Groep NV in London tells Bloomberg. “There’s a real comfort at the moment in extending out curves because of the disinflationary impulse that’s dominating globally.”

The ongoing slide in oil prices is certainly adding to the notion that disinflation/deflation risk is rising, if only slightly. Crude is trading at three-year lows, although it’s worth noting that the decline is largely due to excess supply. You can argue that this reflects weak demand, and that’s true up to a point. But the global economy still looks poised to grow, albeit at a comparatively mild rate. Granted, global business confidence is bumping along at a five-year low, but the J.P.Morgan Global Manufacturing & Services PMI is still trending positive, albeit at the slowest pace in six months as of October.

The antidote to deflation concerns, of course, is stronger growth. The global outlook is a bit more challenged, but that’s old news. The question is whether the US economy, which has been fairly resilient so far, is now stumbling as well? Wednesday’s macro updates for the US gave us a mixed bag, including modest if uninspiring growth for personal income and spending in October. Headline durable goods orders posted a decent advance, but so-called business investment (non-military orders less aircraft) slumped while moderate year-over-year prevails in both cases. The sight of jobless claims last week rising above 300,000 for the first time since September is worrisome, but it’s too soon to tell if this is noise vs. a darker signal of things to come.

We’ll have a better sense of how the US economy is holding up (or not) after reading next week’s releases, including the ISM Manufacturing Index on Monday (Dec. 1), ADP’s private-sector payrolls estimate on Wednesday (Dec. 3), and the government’s jobs report for November on Friday (Dec. 5).

Recent numbers have been strong enough to persuade economists at Wells Fargo to anticipate higher interest rates in 2015:

Our expectation next year is for the Federal Reserve to begin normalizing monetary policy in June by increasing the target fed funds rate. In advance of the Fed’s rate hike, we expect interest rates, particularly at the shorter end of the yield curve, to gradually migrate higher while longer-term interest rates should remain relatively anchored.

Modest growth for the US remains a compelling forecast, although Mr. Market seems to have his doubts. But if the crowd’s marginally darker shade of worry lately is overdone, we’ll see the evidence in next week’s data — payrolls in particular.