The Federal Reserve recently introduced a new monthly measure of the US labor market—the Labor Market Conditions Index (LMCI)—and starting this week the series is available on the St. Louis Fed’s FRED database, an addition that makes it easy to download, analyze and monitor the data. Does LMCI offer deeper insight beyond what’s already available in the usual suspects, such as nonfarm payrolls and initial jobless claims? In particular, will LMCI dispense a superior set of timely and reliable signals for tracking critical changes in the US business cycle? Some analysts are skeptical—economist Tim Duy, for instance, isn’t impressed with LMCI’s debut. The acid test, of course, is evaluating the index on a real-time basis going forward. That’s going to take time. Meanwhile, let’s take a closer look at this newly minted series for some perspective.

The Fed describes LMCI as a “dynamic factor model of labor market indicators” that analyzes 19 separate data sets, including a number of familiar series—unemployment rate and private payrolls—along with figures from relatively obscure corners—quit rate and hiring plans, for instance. The reasoning for reviewing a wide set of numbers through a new statistical prism boils down to the Fed’s explanation that looking at the raw data in the aggregate tends to dispense conflicting signals. In short, confusion reigns supreme if you attempt to drink from the fire hose of labor market data without a filter.

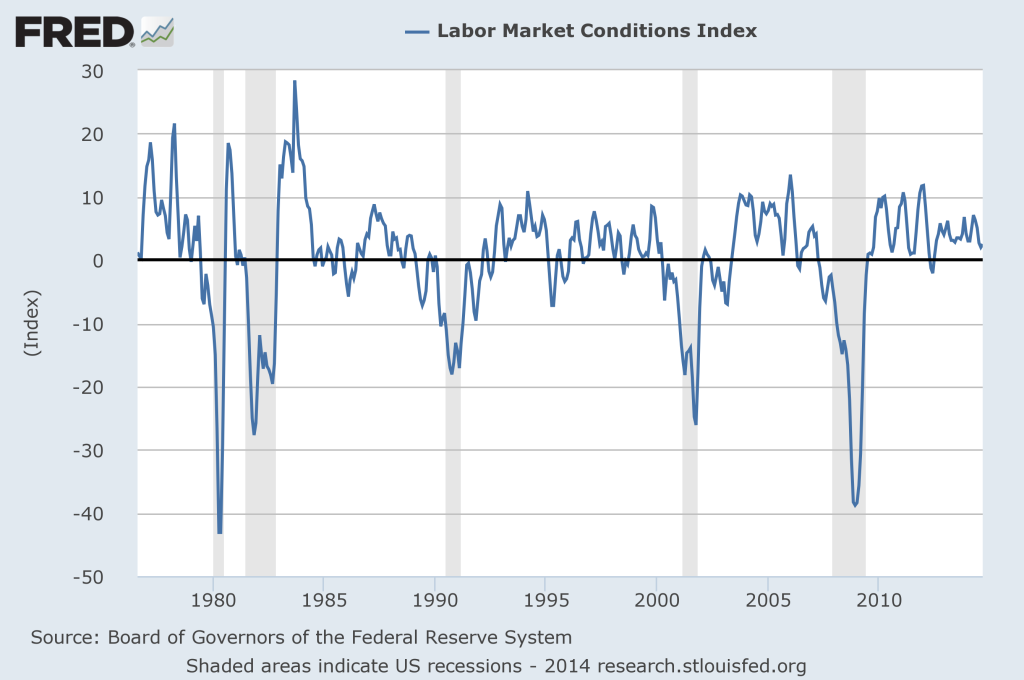

The new filter’s basic design: a diffusion index that’s formulated so that readings above zero are associated with growth/expansion and negative values imply decelerating growth/contraction. According to the Fed,

What we call the LMCI is the primary source of common variation among 19 labor market indicators. One essential feature of our factor model is that its inference about labor market conditions places greater weight on indicators whose movements are highly correlated with each other. And, when indicators provide disparate signals, the model’s assessment of overall labor market conditions reflects primarily those indicators that are in broad agreement.

The included indicators are a large but certainly not exhaustive set of the available data on the labor market, covering the broad categories of unemployment and underemployment, employment, workweeks, wages, vacancies, hiring, layoffs, quits, and surveys of consumers and businesses.

Sounds promising, but how does LMCI stack up for business cycle analysis? Pretty good, or so it seems based on the historical record using revised data. The new kid on the block has an encouraging record of signaling recession risk relatively early. In the second half of 2007, LMCI flashed warning signs on a consistent basis well ahead of the formal start of the recession in January 2008—a turning point that was officially announced by the National Bureau of Economic Research in December 2008, or well after the fact.

Next, here’s how LMCI measures up relative to the year-over-year percentage changes in private-sector payrolls. Here too LMCI delivered early warnings relative to the recession signals via payrolls.

But LMCI doesn’t seem to add much in terms of the quality and timeliness of the signals vs. initial jobless claims (inverted annual percentage changes for average monthly data).

Let’s also emphasize that the historical record for LMCI, which extends back to 1976, is compiled recently, using revised data and so there’s a lot of uncertainty about what this index will reveal on a real-time basis from here on out. The out-of-sample record, in short, has yet to be written. Nonetheless, LMCI is an intriguing addition to the analytical toolbox for estimating recession risk.

On that note, LMCI’s current reading suggests that the labor market is still expanding at a moderate rate. LMCI’s +2.5 value for September 2014 is below average for the trailing 12 months, but firmly on the growth side of the aisle. That’s not particularly surprising, given what we know from other sources of late. Yesterday’s update of the Macro-Markets Risk Index, for instance, still looks upbeat albeit a bit diminished these days. Meanwhile, the September review of US indicators at CapitalSpectator.com remains encouraging in a meaningful degree.

It’ll be interesting to see how, or if, LMCI brings anything new to the table for estimating macro risk. For the moment, however, it’s not really telling us anything we didn’t already know. But perhaps that will change in the future. The only way to know, of course, is to keep a close eye on this potentially useful but untested indicator.

Pingback: Thursday links: Gross’ Law | Abnormal Returns