Today’s US economic updates offer a profile of extremes. Initial jobless claims pulled back from the brink of what would have been a dark signal if new filings for unemployment benefits posted another rise. Instead, claims tumbled sharply last week, falling substantially more than expected, the Labor Deparment reports. As a result, it appears that claims are again flashing a bullish signal for the labor market after several weeks of worrisome gains. But any celebration should be muted in the wake of this morning’s monthly update on retail sales, which fell in February for the third month in a row–the longest stretch of monthly red ink in nearly three years. And this time we can’t blame weak gasoline sales, which increased last month. In short, the trend in retail spending is looking genuinely shaky for the first time in several years.

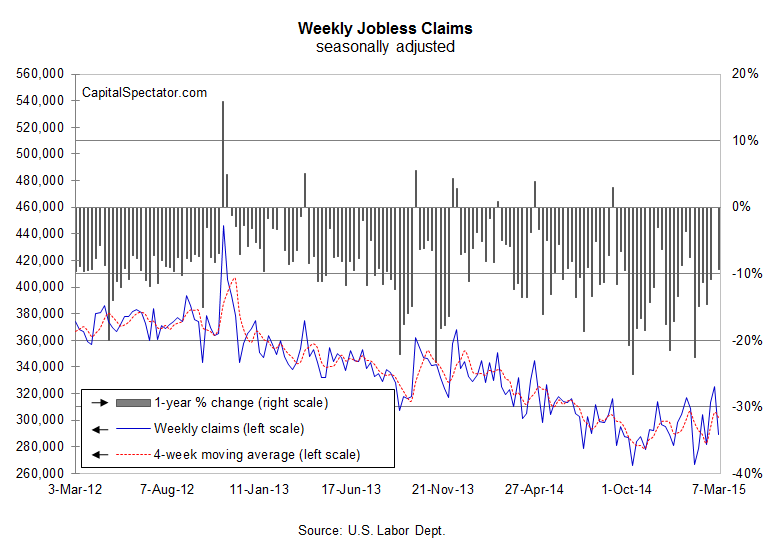

Let’s start with the good news. Jobless claims tumbled a hefty 36,000 last week to a seasonally adjusted 289,000. It’s unclear if claims can continue to fall further, but for the moment we can breathe a collective sigh of relief on this front. Indeed, claims marched higher through most of February, reaching the highest level since last summer. Another advance would have sent a bearish signal for the labor market and the economy. But in light of this morning’s update, this leading indicator looks a good deal less threatening. In particular, the 9% year-over-year decline through last week suggests that the previous turbulence was noise, which is hardly unprecedented for this volatile but valuable leading indicator.

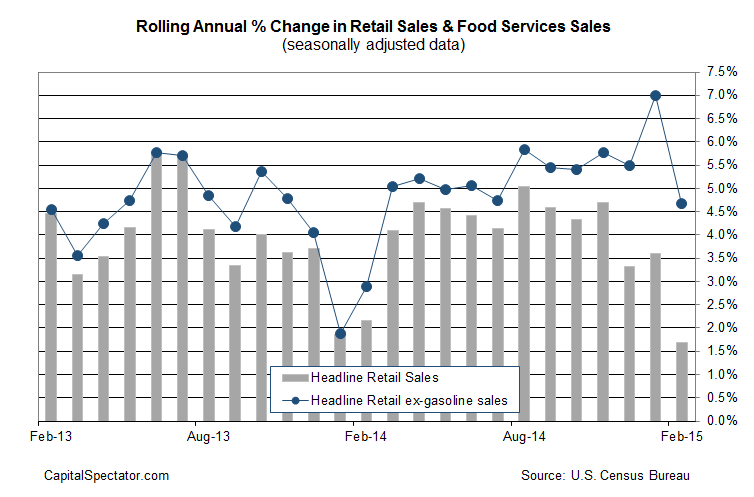

Retail sales, by contrast, are looking troublesome. Spending fell 0.6% in February—the third straight monthly decline and well below the modest 0.3% rise that was projected via Econoday.com’s consensus forecast. What’s more, gasoline isn’t to blame this time. Indeed, sales at fueling stations increased 1.5% last month—the first monthly advance since last May.

The main issue for business-cycle analysis is the year-over-year weakness in headline retail sales. Spending rose a slim 1.7% for the year through February—the weakest annual pace since late-2009, when the recession’s bite was only beginning to ease. If we strip out gasoline sales, the year-over-year change looks substantially stronger, posting a solid 4.7% rise. That’s at the lower range relative to recent history, although it’s still strong enough to raise questions about the validity of the much-weaker headline data.

In any case, retail spending has been soft. But with the labor market still showing strength, it’s premature to assume the worst based on today’s consumption data. The narrative would be quite a bit darker if today’s jobless claims report was bearish. But while we dodged a bullet, the escape was a bit too close to dismiss the near-miss entirely.

Meantime, it’s unclear what’s behind the recent slide in retail spending–a harsh winter, perhaps? Then again, the declines may be a sign of deeper troubles to come–troubles that aren’t yet resonating in other key indicators. But as long as the labor market holds up, it’s reasonable to assume that retail spending will revive. Last week’s news of a solid gain in nonfarm payrolls for February supports the case for seeing today’s retail figures as a bout of temporary weakness. Ditto for this morning’s encouraging update on jobless claims.

Keep in mind too that broad measures of the macro trend continue to look upbeat through January, The Chicago Fed National Activity Index’s current reading still points to a solid pace of growth. Meantime, my proprietary profiling of the US economy suggests that recession risk was low through the first month of this year. In other words, it’s still premature to go off the deep end with dark forecasts.

Nonetheless, one can’t help but wonder if the consumer is stressed. If the recent declines in retail spending are in fact an early warning, we’ll see the evidence in other metrics in the weeks to come. But for the moment, the bearish data is still the exception.

The next clue arrives in tomorrow’s update on consumer sentiment via the University of Michigan numbers. The consensus forecast calls for a slightly stronger reading in the wake of solid gains, according to Econoday.com. But if the report comes in substantially weaker than expected, today’s red ink for retail sales will look a bit more troubling.

Pingback: Jobless Claims Decline, Retail Sales Weak

Hard to blame the weather for the year-over-year decline in retail sales…last winter was fairly horrible, too.