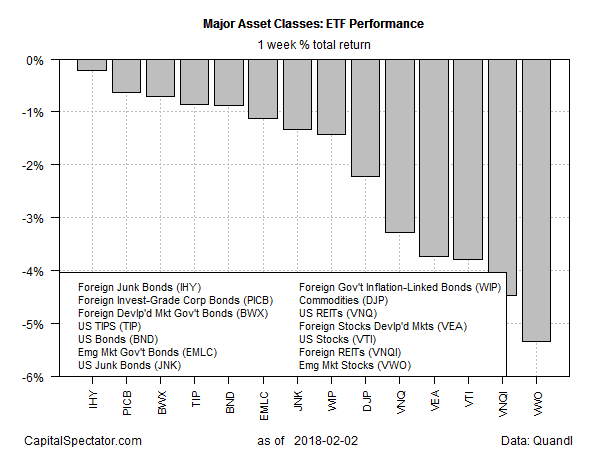

Red ink spilled across all corners of global markets last week, reversing the previous week’s clean sweep of gains, based on a set of exchange-traded products. The perfect storm of losses marks the first round of weekly declines in every market since Dec. 2016.

The softest setback was logged in foreign junk bonds. VanEck Vectors International High Yield Bond (IHY) eased a mild 0.2% over the five trading days through Feb. 2 — the first weekly setback for the ETF in two months.

The biggest victim last week: emerging-markets stocks. Vanguard FTSE Emerging Markets (VWO) tumbled a hefty 5.3% — the ETF’s first weekly decline in nine weeks.

When will the next recession strike? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Last week’s selling has spilled over into Monday’s trading with European and Asian markets posting losses ahead of the US market’s open today. A key worry is that bond yields are rising, supported by firmer inflation expectations. Higher rates represent tougher competition for stocks. The benchmark 10-year Treasury yield, for instance, jumped to 2.84% on Friday, a four-year high.

“If bond yields go higher, they offer more of a reward,” says Chris Harvey, head of equity strategy at Wells Fargo & Co. “At the margin, the buyer, the asset owner, is slightly enticed to put more money into fixed income than into the equity market.”

Last week’s market rout was unusually deep and broad, but the setback has yet to make more than a mild dent in the one-year numbers. All but one of the major asset classes continue to post mostly strong one-year returns.

Despite the latest setback in emerging-markets equities, this slice of the world’s stocks is still the top performer for the major asset classes for one-year performance. VWO is up by nearly 30% for the trailing 12-month period through Friday’s close.

Meanwhile, the biggest one-year loser is still US real estate investment trusts (REITs). Vanguard REIT (VNQ) is off 2.3% as of Friday’s close vs. the year-earlier price after adjusting for dividends.