What might trigger the next financial crisis and recession? Private debt tops the list, explains Steve Keen, an economics professor who heads the School of Economics, Politics and History at Kingston University. It’s a potent threat, in part because debt has increased since the 2008 financial crisis and interest rates appear poised to trend higher in the years ahead. Yet the risk bound up with private debt is widely underappreciated in the economics profession, Keen explains in his recent book: Can We Avoid Another Financial Crisis? “Even after the [last] crisis, mainstream economists still reject out of hand arguments that the aggregate level and rate of change of debt matters,” he writes. History suggests otherwise, Keen insists, citing the empirical record as proof. The Capital Spectator recently asked Keen for a summary of why debt matters for the business cycle and how the US and other economies currently rank on this critical risk factor.

What is the basic explanation for why private debt is a critical factor for evaluating the potential for a financial crisis?

The basic reason is that bank lending creates money, which is then spent by the borrower. The assets of the banking sector rise (this is the change in debt) and their liabilities rise equally (this is the credit-based increase in the money supply). This adds to demand, but it comes at the cost of an increased claim by the banking sector on the cash flow generated by the non-bank sectors of the economy. When debt is paid down – or the borrower goes bankrupt – money is destroyed, which reduces demand. Money that would otherwise be spent on goods and services is instead cancelled against outstanding debt, or reduces the equity of the banking sector when bankruptcies exceed the loan loss provisions of the banks.

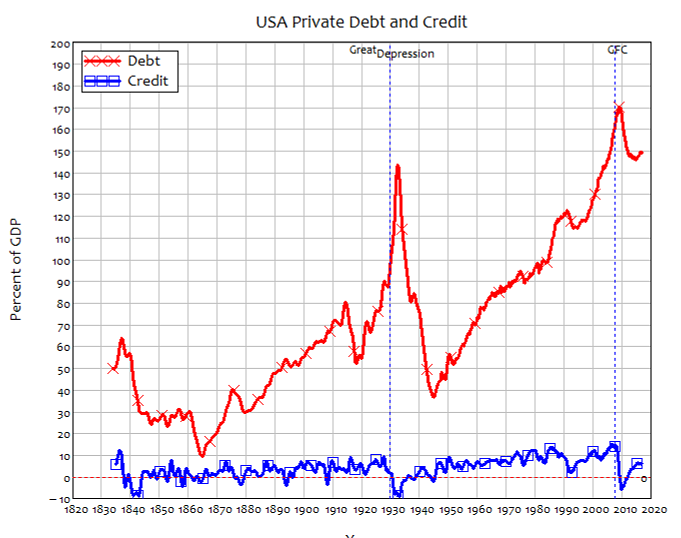

When debt levels are relatively low, this is not a problem: in the 1950s, when US private debt was less than 40% of GDP and interest rates were around 3%, servicing debt took only about 1% of GDP. Now, with private debt four times as high relative to GDP, debt service takes around 5% of GDP – even with low rates today. Changes in debt, which are identical to the creation or destruction of credit-based money, reached 15% of GDP in the US in 2007, and plunged to minus 6% in 2009. That caused a huge collapse in aggregate demand, which caused the Great Recession.

You mention in your book that the Bank for International Settlements (BIS) publishes useful data on debt. What data set do you recommend to monitor the potential for a new financial crisis?

There are several. The BIS was the only formal economic body to see the last crisis coming, because its then research director Bill White understood Hyman Minsky and his “Financial Instability Hypothesis” at a time when all other bodies were followers of the deluded mainstream “neoclassical” approach to economics and finance. Since his retirement (Bill now holds a senior position at the OECD), his successor Claudio Borio has led a brilliant program to assemble data sets that Minsky’s theory indicated are crucial.

The key resource is credit to the non-financial sector, which shows lending to both the private (households and firms) and government sectors. There are several others to watch, including house prices, consumer prices, and exchange rates.

Is your thesis about debt and its relationship with financial crises widely held among economists?

No. The mainstream of economics has always treated capitalism as a barter system, and has ignored the role of money and debt in macroeconomics. This began with Adam Smith’s nonsense about money evolving from barter (which anthropologists and historians have established is an historical and empirical fallacy) and Jean-Baptiste Say’s deluded argument that people do not want to accumulate money, but instead only use it to buy goods and services. These simplistic notions became embedded in conventional economics with macroeconomic models in which the economy was always in equilibrium, or near it and heading back towards it after an “exogenous shock”, and in which banks, money and debt were either completely absent or played no essential role. Even in Milton Friedman’s so-called monetarism, money was generated outside the economy (“helicopter money” dropped from the skies by the central bank) and only caused inflation without affecting “real” variables, such as the levels of output, employment, and the rate of growth.

The mainstream models of money insulate their macroeconomic models from the role of private debt by pretending that banks don’t actually originate loans, and asserting instead that they are mere “intermediaries” between savers and lenders. I call this the Ashley Madison theory of banking: Ashley Madison doesn’t actually provide sexual services, but provides a link-up mechanism between people who want to provide them to each other.

The reality, as central banks themselves are now asserting, is the case my sub-group of economists have been asserting for over half a century: Banks originate loans, these loans simultaneously create money and add to total expenditure in the economy. Attempting to model capitalism without them is like trying to model birds without wings.

How do the US, Eurozone, and other key economies stack up in terms of debt these days? Are there any large countries that stand out at the moment as unusually risky from a debt perspective?

Key economies – including those two plus the UK and Japan — are what I call the “Walking Dead of Debt”. They have all had private debt crises already – Japan starting in 1990 and the others in 2007-2008 – and in the aftermath debt has fallen somewhat. Credit turned negative during the crisis and in the aftermath credit-based demand is anemic and therefore their economies are growing sluggishly.

The economies in danger are all those that avoided a crisis in 2008 by continuing or setting off private debt bubbles. Crucially, this includes China, but China has the advantage of being able to rapidly ramp up government spending without the political limitations that apply in the West. I have seen claims that China’s government deficit is 15% of GDP — 1.5 times the scale of the Obama stimulus during the financial crisis (a colleague of mine in large-scale infrastructure funding claims it is much higher than this).

China will necessarily have a credit crunch, after an unprecedented credit bubble, but it will be seriously attenuated by government spending. The other countries that I foresee having problems won’t respond anywhere near as well or as quickly.

What is the key metric (or metrics) to monitor for deciding if debt is excessive?

There are two: the private debt-to-GDP ratio and the annual change in debt (divided by GDP). The two act together, as I illustrate in this arithmetic example from my book Can We Avoid Another Financial Crisis?

Imagine an economy where private debt is growing twice as fast as GDP (debt is growing at 20% per annum in nominal terms and GDP is growing at 10%) and where credit is 100% used for asset purchases, rather than for goods and services. Ignore for the moment any feedback between credit and GDP growth. Consider what happens to aggregate expenditure on goods and services and assets if debt’s rate of growth simply slows down to the same as GDP growth.

If GDP is $1 trillion a year, and the debt ratio is 50%, then debt is $500 billion and credit that year is $100 billion (20% of $500 billion). Total expenditure is $1.1 trillion: $1 trillion from the turnover of existing money, and $100 billion from credit. Next year, if GDP grows by 10%, and debt growth slows down from 20% a year to 10%, total demand will be $1.16 trillion: $1.1 trillion from GDP, and $60 billion from credit (10% of $600 billion). This is $40 billion less demand from credit than the year before, but overall demand is $60 billion higher than in the previous year, because of the increase in GDP.

However, if the debt ratio starts at 200% of GDP, then total expenditure in the first year is $1.4 trillion ‒ $1 trillion from the turnover of existing money and $400 billion from credit (20% of $2 trillion). When the growth of credit slows to 10% the following year, total demand is $1.34 trillion: $1.1 trillion from GDP, and $240 billion from credit (10% of $2.4 trillion). This is $60 billion less expenditure than the year beforehand ‒ even though both GDP and debt have continued to grow.

Pingback: What Might Trigger the Next Financial Crisis? - TradingGods.net

Dear Professor Keen,

Very succinctly put, as usual. I would mention one minor point that might dramatically improve your message. You are so used to saying just “credit” when you really mean “credit growth” (delta). I know what you mean. Others might. But most probably don’t get your shorthand, and being explicit in this one area would certainly make it clear for others… Cheers,

And if we import to Austria 200,000 immigrants… Equates to 70000 extra dwellings…

The existing private investor home loans get their high rent, which covers the mortgage, we all feel rich, equity stays “artificially” high, the system keeps going… We convince ourselves there’s a shortage of land, prices of property stays high, states get rich of stamp duty, local council gets rich of rates, the Commonwealth gets more tax from building and migrant spending, we convince the migrants there’s a shortage of land and Australia is booming, so they get a woping home loan which gives equity to a local… So, the Private debt goes U, everyone seems to win in debt land, as you go up the equity spiral, so long the government keeps up the immigration, and we all maintain the property religion of a “shortage” of land…

How’s that now fit into the debt models…