The Treasury market’s 10-year estimate of future inflation rose above the Federal Reserve’s 2% target this week – the first time that level has been breached for this maturity since last March, based on daily yield-spread data via Treasury.gov. Official inflation numbers, which are published with a lag, continue to reflect pricing pressure that’s modestly below the Fed’s target. The Treasury market, however, is betting that inflation will accelerate this year.

The implied inflation forecast based on the yield spread for the nominal 10-year Treasury less its inflation-indexed counterpart ticked up to 2.01% on Thursday (Jan. 4), the highest level in ten months. The current 5-year Treasury inflation forecast is slightly lower at 1.92%, although that’s a 10-month high too.

Firmer inflation estimates in Treasuries align with comments in the Fed minutes for Dec. 12-13 FOMC meeting, when the central bank lifted interest rates for the fifth time since the recession ended in 2009. The latest minutes, published earlier this week, advise:

Many [Fed participants] indicated that they expected cyclical pressures associated with a tightening labor market to show through to higher inflation over the medium term. These participants generally judged that much of the softness in core inflation this year reflected transitory factors and that inflation would begin to rise as the influence of these factors wane

The Treasury market agrees. Indeed, the policy sensitive 2-year yield has been climbing sharply in recent months, rising to 1.96% yesterday – the highest since 2008. That’s a sign that the bond market is convinced that more rate hikes are coming in the months ahead.

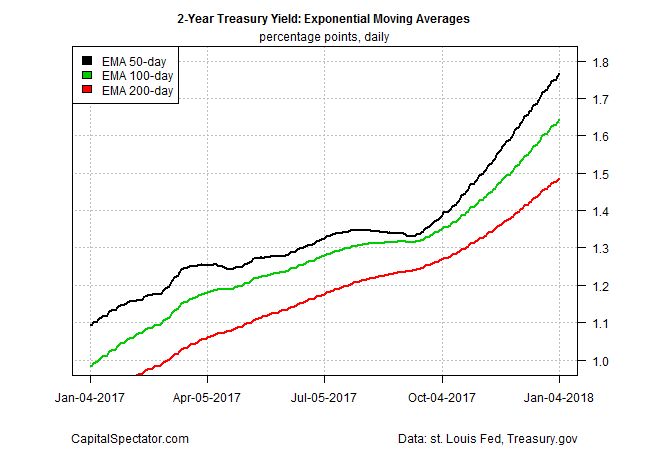

Trend analysis of the 2- and 10-year yields implies that rates will continue to increase in the near term. For example, three exponential moving averages (EMA) for the 2-year rate reflect a strong upside bias, based on the 50-day EMA that’s well above the 100-day EMA, which is above the 200-day EMA.

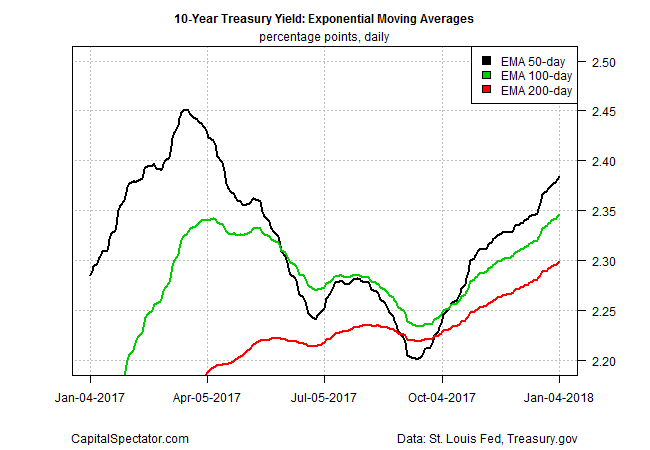

The benchmark 10-year yield’s momentum profile is skewed to the upside, too, marking a rebound from the downside trend that prevailed in mid-2017.

Some analysts advise that the Fed’s plans to continue raising interest rates this year could create headwinds. “The Fed may not have the luxury of a simple monotonic glide path back to equilibrium,” notes Lou Crandall, chief economist at Wrightson ICAP. “They’re going to have to objectively tighten monetary policy in order to increase unemployment and stabilize inflation at their target,” he tells Bloomberg in a story published today.

Michael Feroli, chief U.S. economist for JPMorgan Chase, via the same article, notes that “it’s not preordained, but the [macro] risks are higher.”

The Bloomberg reporter who penned the story opines that an increasingly hawkish Fed “is more likely to make a policy mistake and inadvertently push the economy into a recession if it is actively seeking to curb credit and boost joblessness, rather than just removing monetary accommodation from the financial system, as it is now.”

Perhaps, although the US macro profile at the moment remains solid. As outlined in the current issue of the US Business Cycle Risk Report that was published earlier this week, a broad set of indicators reflect a virtually nil probability that an NBER-defined recession has started, based on numbers published through the end of 2017. Projections for the immediate future also suggest that the upbeat macro will continue.

But with the stock market elevated, interest rates trending higher, and expectations that inflation could rise, the year ahead could present new challenges for monetary policy and investment strategies.

Keep in mind that Treasury market inflation forecasts aren’t flawless and in fact have a mixed record. Meantime, since the recession ended in 2009 many economists have been predicting that inflation was due to rebound – predictions that so far have been wrong.

In any case, with unemployment close to a 50-year low the Fed will be under increasing pressure to roll out more rate hikes. For the moment, the crowd is expecting no less.

The only mystery: Will the official inflation numbers support the Treasury market’s moderately hawkish attitude adjustment on pricing pressure for 2018? An early clue is due next week via the December update of the consumer price index.

Pingback: Weighing the Week Ahead: Should Investors Start Worrying About Inflation? – Dash of Insight

Pingback: Inflation Is the Big Worry for 2018 - TradingGods.net