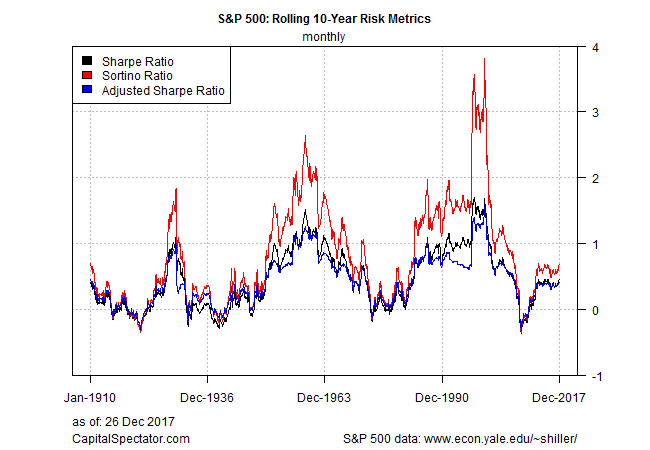

Earlier this month I profiled the US stock market’s performance in search of context for deciding if recent returns have gone off the deep end. The results suggest that on a rolling 10-year basis, the numbers look middling. Next question: how does the S&P 500 stack up after adjusting for risk via several metrics?

Let’s start by looking at the Sharpe Ratio (SR), Sortino Ratio (SORT), and Adjusted Sharpe Ratio (A-SR) via annualized calculations. A brief summary of each:

Sharpe Ratio: a performance metric that adjusts returns based on volatility.

Sortino Ratio: similar to the Sharpe ratio except that this metric only penalizes volatility associated with negative returns whereas SR treats all volatility equally.

Adjusted Sharpe Ratio: a variation of the standard Sharpe ratio that adjusts for skewness and kurtosis by penalizing returns for negative skewness and excess kurtosis. The metric was outlined in Pezier and White (2006).

For this simple review I used monthly S&P 500 returns published by Professor Robert Shiller. The start date for this test is 1900. Note, too, that the risk-free rate hasn’t been subtracted from the performance data, i.e., the results are based on S&P returns rather than risk premia. The main takeaway: the market’s current risk-adjusted performance still looks average, based on a rolling 10-year window.

In all three cases, the risk-adjusted performance metrics currently rank as modestly above their respective median results relative to the historical record for the past 100-plus years. The current 10-year Sharpe ratio, for instance, is 0.46 vs. the median 0.38. The current Sortino ratio: 0.68 vs. the 0.60 median. The Adjusted Sharpe Ratio is currently 0.40 vs. a median of 0.38. Here are the historical results at the quartiles:

Sharpe Ratio Sortino Ratio Adjusted Sharpe Ratio 0% -0.37 -0.36 -0.32 25% 0.07 0.22 0.15 50% 0.38 0.60 0.38 75% 0.84 1.35 0.69 100% 1.70 3.81 1.56

The relatively middling risk numbers don’t preclude the possibility of a correction or even an extended bear market. But from the perspective of a 10-year window, this trio suggests that the market’s current risk-adjusted performance ranks as modestly above average.

Tomorrow I’ll expand the analysis by running the S&P’s returns through an alternative set of risk metrics.

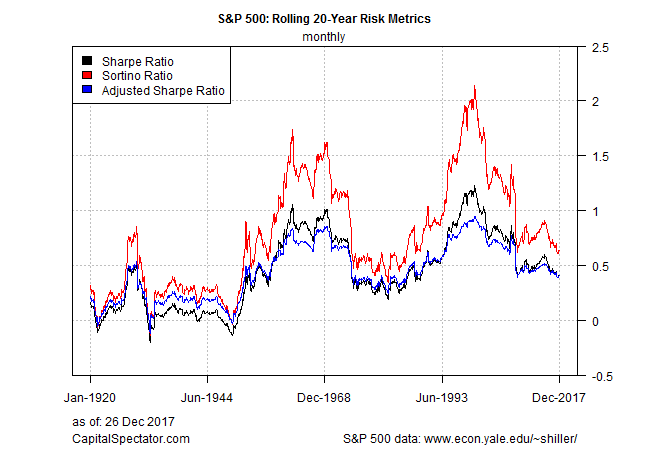

Editor’s note: A reader asks how the risk metrics would compare on a 5-year rolling basis, which would cut out the 2008 crash. Good question. The result: risk-adjusted return looks considerably higher vs. a 10-year window. But we can continue to torture the data. A 20-year rolling window, for instance, points to a moderate risk-adjusted return. The question: Which rolling window speaks the truth for putting performance into proper historical context? Hmm. While we’re thinking, let’s ponder a couple of charts.

For a 5-year window, all three risk metrics are in the top quartile, based on the last century-plus.

For the rolling 20-year window, by contrast, the trio of risk metrics are slightly below the median for history since 1920.

No wonder the risk-adjusted performance is ranking below average, as a 10-year window still includes the highly volatile 2008/2009.

May I ask why you chose 10 years? How would the chart look with e.g. a five year period (assuming thats the average length of a cycle with about four years of bull and one year of bear markets)? I would imagine that the (adjusted) sharpe ratio is at least one deviation above long term average, which would indicate rather excessive returns.

Alec,

Great questions. I choose the 10-year solely because it’s a nice round number. As you suggest, the analysis changes when you change the rolling time period. For example, see the 5- and 20-year charts I added at the bottom of the post.

–JP

James,

thanks for the additional charts. Let’s just assume that we might have to expect more drawdowns and volatility in the next few years, and state that two major bear markets (1999/2000 and 2008/2009) within less than a decade are statistically unusual.

And regarding chosing a time frame: frequently it’s the own confirmation bias playing tricks. If I want to confirm to myself that there’s a bull market ahead of us, I’ll subconsciously come up with other charts than if I was bearish.