Financial and technology stocks remain the top sector performers for the trailing one-year period, based on a set of ETFs. The bullish momentum has cooled in recent weeks for these equities, but the same is true for the market generally, leaving the two sectors comfortably in the lead vs. the rest of the field.

Echoing last month’s update, Financial Select Sector SPDR (XLF) still holds the top spot for one-year results. Although it’s off its recent highs, XLF’s total return is currently a sizzling 29.5% for the year through Tuesday (Aug. 22).

Technology Select Sector SPDR (XLK) is almost as strong, posting a 25.2% total return for the past year.

In relative terms, the one-year returns for XLF and XLK translate into hefty premiums vs. the US stock market overall, based on SPDR S&P 500 (SPY), which is up 14.6% over the past 12 months.

The next chart below offers another review of how the sector ETFs have fared in relative terms via rebased performance indexes with a year-ago start date of Aug. 22, 2016. The obvious outliers: the financial ETF’s red-hot run (black line at top) and energy’s accelerating slump of late (purple line at bottom).

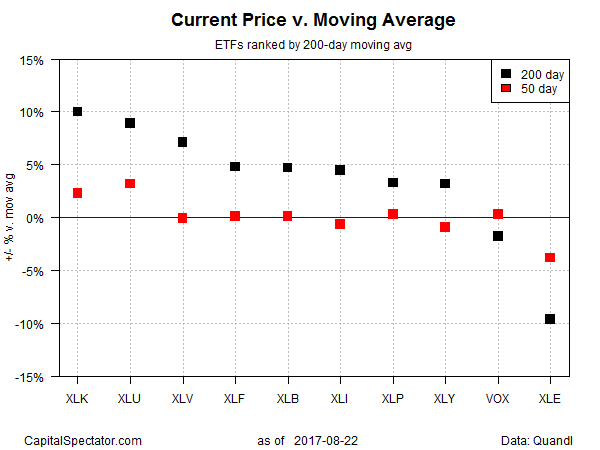

Ranking the sector ETFs by price relative to 200-day moving average shows that tech’s bull run is in first place. The number-two performer for current premium over the 200-day average is Utilities Select Sector SPDR (XLU), which edged up to a record high yesterday. Financials, on the other hand, reflect a relatively middling performance by this ranking.

Tech is also in the top spot when ranking returns through a risk lens via the Sharpe ratio, a metric that adjusts performance based on trailing volatility (standard deviation). Higher Sharpe ratios indicate stronger risk-adjusted performance. Reviewing daily returns for the past 12 months puts XLK is in the lead with a 2.2 profile at the moment — slightly ahead of financials and well above the broad equity market’s 1.7 Sharpe ratio (based on SPY’s daily returns for the past year).

For additional research on the sector ETFs cited above, here are links to the summary pages at Morningstar.com:

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financial (XLF)

Healthcare (XLV)

Industrial (XLI)

Materials (XLB)

Technology (XLK)

Utilities (XLU)

Telecom (VOX)

Pingback: Financial and Technology Stocks Are Top Sector Performers - TradingGods.net

Any chance to include XLRE going forward to track the real estate SPYder as compared to the other SPYders? Thank you!

Steven,

Yes, that’s in the works. Haven’t had the chance to code it up yet. Soon.

–JP