Equities in emerging markets advanced last week, posting the best performance among the major asset classes and touching a two-year high, based on a set of exchange-traded products.

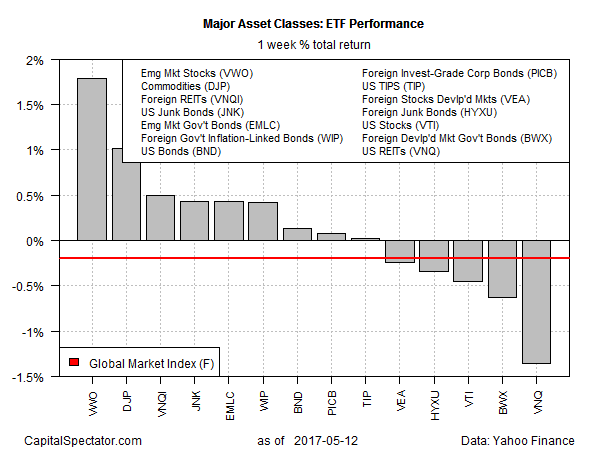

Vanguard FTSE Emerging Markets (VWO) increased 1.8% over the five trading days through May 12 – the best weekly increase in two months for the fund. The strong gain is substantially ahead of last week’s second-best performer: broadly defined commodities via iPath Bloomberg Commodity (DJP), which popped 1.0% last week.

Relatively inexpensive valuations in emerging markets is part of the allure, according to Barron’s. “At just 12 times forward earnings, emerging markets are trading at a hefty discount to US stocks, at 18 times, European shares, at 15, and Japanese equities, at 14,” the publication advises.

The long-term expected risk premium for equities in emerging markets was recently estimated at an annualized 9.3%, the second-highest forecast among the major asset classes.

The biggest loser among the major asset classes in the second week of trading for May: US real estate investment trusts (REITs). Vanguard REIT (VNQ) declined 1.4%, marking the third straight weekly loss for the fund.

The Global Markets Index (GMI.F) suffered a setback last week, in part due to softer US equity prices for the second week of May. GMI.F, an investable, unmanaged benchmark that holds all the major asset classes in market-value weights, eased 0.2%, the first weekly decline in a month for the benchmark.

In the one-year column, emerging-markets stocks continue to hold the top spot. VWO is currently posting a strong 25.5% total return for the past 12 months. The gain is comfortably ahead of the number-two performer: US equities via Vanguard Total Stock Market ETF (VTI), which is up 18.9% for the trailing one-year change.

The biggest loser for one-year performance: foreign government bonds in developed markets. SPDR Bloomberg Barclays International Treasury Bond (BWX) has been rebounding this year, but the modest rally has yet to lift the ETF out of its one-year hole. At last week’s close, BWX was down 4.0% for the trailing one-year window.

Meanwhile, GMI.F is still posting a solid one-year increase. The benchmark is ahead by 11.2% for the year through May 12.