US companies added more workers than expected in March, boosting confidence that the labor market’s strength will keep economic growth humming. Private payrolls increased 263,000 last month vs. February, according to yesterday’s ADP Employment Report. The rise marks the fifth monthly advance above 200,000. That’s a strong pace and it hints at the possibility that the macro trend may be stronger than sluggish first-quarter GDP growth projections of late suggest. But looking at employment numbers through the filter of the more-reliable year-over-year change still leaves room for a cautious interpretation of the numbers.

Recall that the annual pace of growth in private payrolls has been decelerating over the past two years, sliding from a peak annual rate of roughly 2.5% in early 2015 to as low as 1.7% at the end of 2016. Growth has picked up a bit this year, as the March ADP data show. But it’s premature to assert that the labor market’s expansion is accelerating or even that the deceleration phase has run its course. Future updates may tell us otherwise, but for the moment it’s reasonable to describe the trend as stabilizing after two years of downshifting. That’s encouraging because it implies that moderate growth is on a sustainable course for the foreseeable future. Assuming that employment growth will accelerate in year-over-year terms, by contrast, remains mostly speculation until we see how the next several months compare.

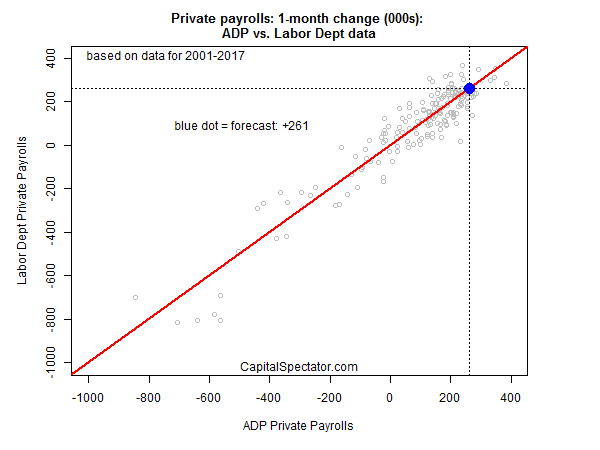

Nonetheless, the latest ADP results are encouraging. Using a regression model (see chart below) to forecast tomorrow’s official employment report from the government points to a strong 261,000 increase in company payrolls for March–a solid improvement over the 227,000 advance in the previous month and far above the 170,000 gain projected via Econoday.com’s consensus forecast.

If tomorrow’s prediction is accurate, the outlook for the GDP growth in the first quarter will probably perk up. In particular, keep an eye on the Atlanta Fed’s GDPNow model, which is currently estimating that output will rise just 1.2% in Q1 (as of Apr. 4), down from the moderate 2.1% increase in the previous quarter. If tomorrow’s employment report shows a robust improvement in growth, it’s likely that the GDPNow estimate will turn up in the revision that’s scheduled to follow tomorrow’s update on payrolls.

The outlook for another rate hike is still considered unlikely for next month’s FOMC meeting, but the following month is a stronger possibility. Fed funds futures are pricing in a roughly 66% probability that the Federal Reserve will lift its target rate range on June 14, according to CME data as of Apr. 5. By contrast, the probability for a rate hike in May is priced at just 5%.

Meantime, let’s see how the government’s employment report for March compares. Considering the upbeat numbers via ADP, it’s likely that we’ll see some upside confirmation from the Labor Dept. tomorrow. But that will still leave a key question: Is employment growth re-accelerating or merely stabilizing at a softer pace? Keep in mind, too, that despite yesterday’s upbeat data it’s too early to rule out noise, which leaves open the possibility that the deceleration in growth will resume. Whatever the reality, the forthcoming answer will be a critical factor in the Fed’s calculus for “normalizing” monetary policy in the months ahead.

Pingback: US Companies Add More Workers Than Expected in March - TradingGods.net

Pingback: US Employment Growth Slows Sharply In March - Investing Matters