The trend in consumer spending posted an encouraging profile during the last full month of the Obama adminstration’s tenure, prompting some analysts to reaffirm the case for another round of raising interest rates.

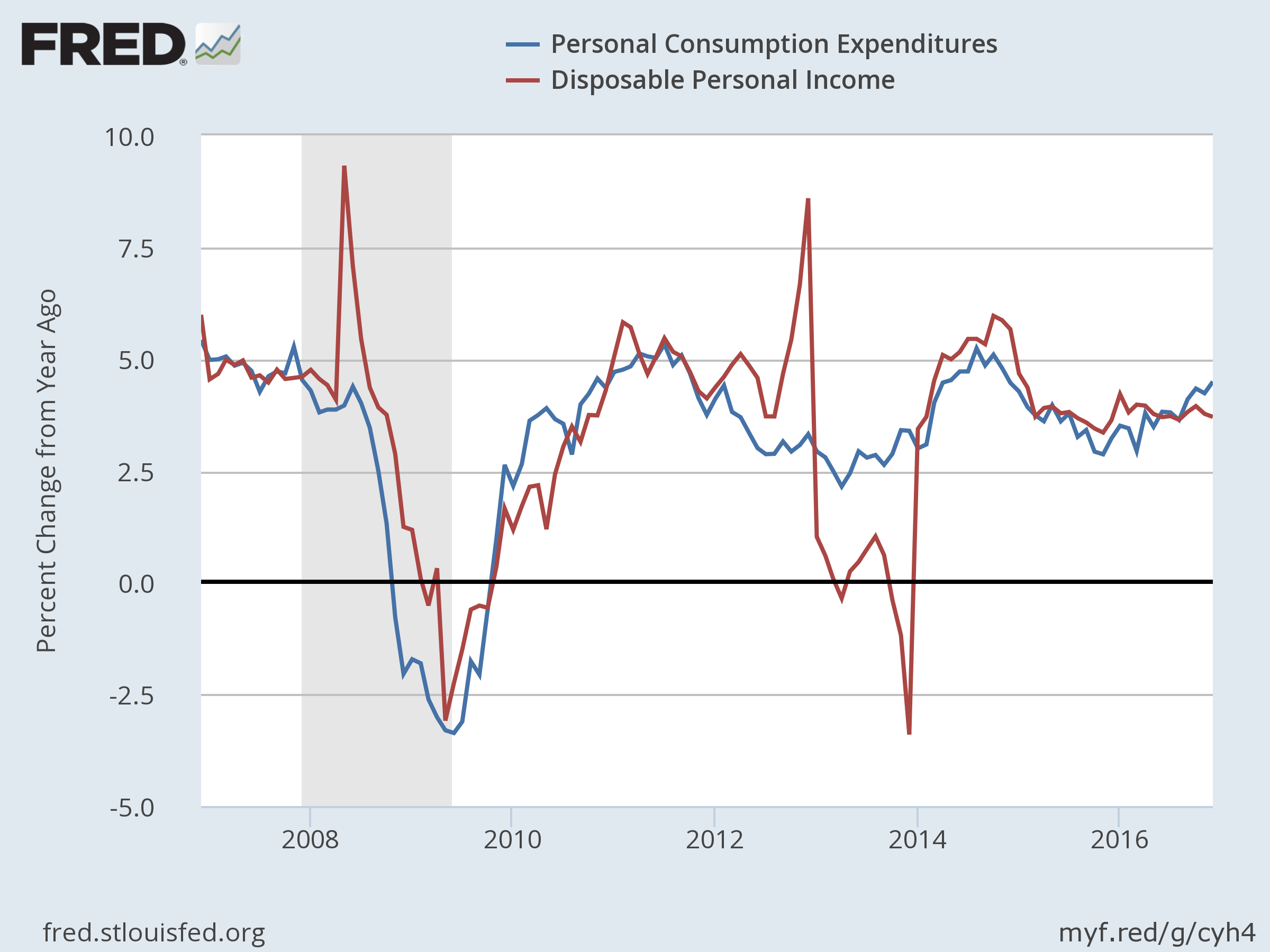

The year-over-year change for personal consumption expenditures (PCE) ticked up to 4.5% in December, according to the Bureau of Economic Analysis. That puts the annual trend for spending at the highest rate since Nov. 2014.

“Consumers keep on spending to help the economy grow and inflation is stirring,” says Chris Rupkey, chief economist at MUFG Union Bank. “The economy is at full employment. Time for the Fed to hoist sail on interest rates.”

The numbers for personal income, however, offer a counterpoint. While the year-over-year change for PCE continues to accelerate, the equivalent comparison for disposable personal income (DPI) was generally flat in 2016. DPI increased 3.7% for the year through December, which is close to the slowest pace recorded for last year.

DPI data can be volatile at times and so it’s wise to focus on the trend over several months. But even by that standard, recent history offers a cautious view. It’s too soon to know if DSPI’s flatlining will bring new headwinds for consumer spending, although a weaker trend for income in the months ahead would be worrisome after a year of treading water.

In fact, the case for deciding if US economic growth will pick in the new year is a bit murky at the moment. The Atlanta Fed’s GDPNow model is currently projecting a mildly firmer trend in the first quarter. But the Jan. 30 estimate for a 2.3% rise in GDP in Q1 is only marginally better than the sluggish 1.9% advance reported for Q4.

The positive spin on the Q4 GDP trend is that the year-over-year change remains par for the course in terms of the economy’s history since the recession ended in 2009. Output is strong enough to keep recession risk low, but it’s debatable if the economy is poised to heat up.

Hope springs eternal, however, in large part at the moment via expectations that the Trump administration’s economic policies will lift growth by cutting taxes and regulation and rolling out a new phase of infrastructure spending. Maybe, but if the efforts at juicing the economy are as chaotic as Trump’s first week-plus in the White House, there’s reason to keep expectations in check on the macro outlook.

Meantime, it’s not obvious that a tumultuous start to a new Presidency will stay the Fed’s hand on the matter of tightening monetary policy. The Federal Reserve has raised interest rates two times in the last 13 months and the central bank appears to be laying the groundwork for a third hike in the near-term future, based on the real (inflation-adjusted) base money supply. The M0 measure of money fell 9.9% in December vs. the year-earlier level—the tenth straight month of year-over-year declines.

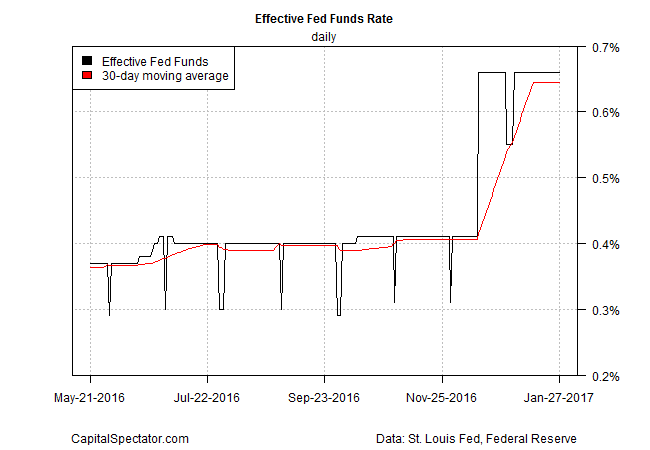

Another clue for thinking that the Fed will soon squeeze policy again is the bullish profile in the effective Fed funds rate, which continues to hold above its 30-day moving average.

Almost no one’s expecting a rate hike in tomorrow’s FOMC announcement, based on Fed funds futures, but firming inflation numbers have convinced some analysts that the clock is ticking. The Fed’s preferred yardstick of inflation (based on PCE prices) ticked up to the highest pace in over two years in annual terms, rising 1.6% for the 12 months through December via the headline data. Although that’s still below the Fed’s 2% target, the upward bias of late implies that the inflation objective will be reached at some point in this year’s first half.

It’s all good if economic growth firms up as well. Consumer spending is certainly doing its part. Will employment play along? The last update on payrolls leaves room for doubt, in part because the annual growth trend for job creation continues to slow. The crucial question for this week: Will Friday’s employment report for January paint a brighter picture? It’s too close to call at this point. Econoday.com’s consensus forecast sees private-sector jobs rising 170,000 in January, which translates to a fractionally higher year-over-year change vs. the previous month. But the mild improvement leaves no margin for error.

All of which brings us back to Trump’s economic policies, and the burning question: How much confidence do you have in the White House’s capacity for extending/reinvigorating an aging economic recovery?

Pingback: Consumer Spending Posted an Encouraging Profile - TradingGods.net

Pingback: 02/01/17 – Wednesday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Consumer Spending Is Economy’s Bright Spot - TradingGods.net