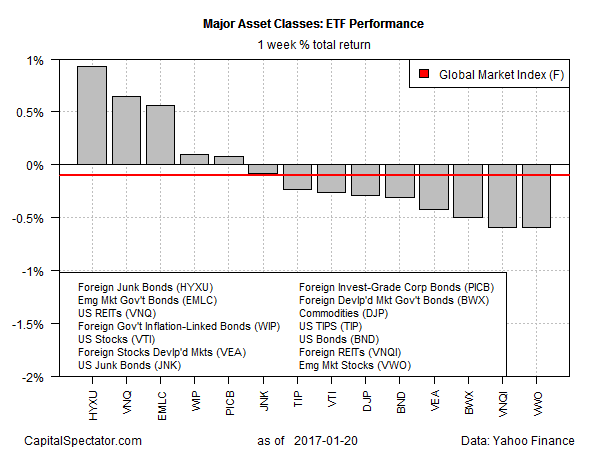

Global markets traded in a tight range last week, based on a set of exchange-traded products representing the major asset classes. The subdued trading ended the week through Jan. 20 with a new US President and prices that were little changed from the previous week’s close.

Foreign high-yield bonds inched higher, posting the best performance for the shortened four-day trading week in the US. iShares International High Yield Bond (HYXU) edged up 0.9% on a total return basis—the fund’s fifth straight weekly gain.

The bottom performer last week: Vanguard FTSE Emerging Markets (VWO), which shed 0.6%, marking the ETF’s first weekly loss since mid-December.

Last week’s results took a slight toll on an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights dipped 0.1% over the four trading days through Friday.

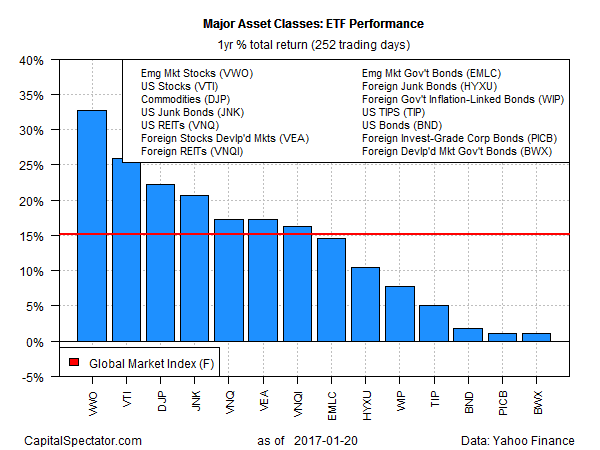

Moving on to one-year results, all the major asset classes are currently posting gains. At the top of the list is emerging market equities. VWO is ahead by a strong 33.0% for the 12 months through Friday, comfortably ahead of the 26.4% one-year gain for the number-two performer: US stocks via Vanguard Total Stock Market (VTI).

At the end of the line for one-year results is SPDR Bloomberg International Treasury Bond (BWX), which is up a thin 1.2% over the past year (in unhedged US dollar terms).

The positive momentum continues to provide a solid advance for GMI.F, which is ahead 15.2% over the last 12 months.

For some perspective on what to expect from the major asset classes in the long run, take a look at the current update for risk premia projections.