As the US prepares to elect a new President today, inflation chatter is bubbling anew. Although pricing pressure remains low, there are hints that the next occupant of the White House may oversee an economy that’s running a bit hotter in terms of the inflation trend. We’ve heard this forecast before, only to learn that the reflation trade crashed and burned. Is time different? Maybe, although it’s too soon to say for sure. Meantime, let’s look at some numbers for considering what the future may bring.

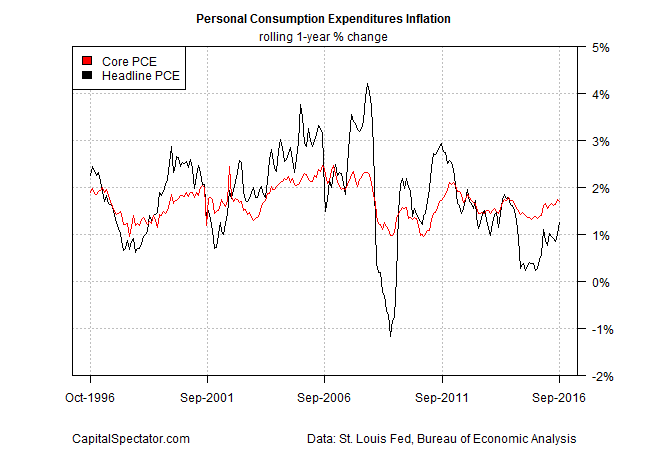

An obvious place to start: the personal-consumption expenditures (PCE) price index, the Federal Reserve’s preferred inflation yardstick. Headline PCE increased 1.2% in September vs. the year-earlier level—the highest reading in nearly two years. A 1.2% inflation rate is still low, but the upward bias of late suggests that the trend may be firming.

Keep in mind that core-PCE, which strips out energy and food prices, is running hotter at 1.7% (red line in chart below). Here, too, the trend has been inching up. Core inflation is considered a more reliable measure and one that tends to project where headline inflation will be in the near-term future.

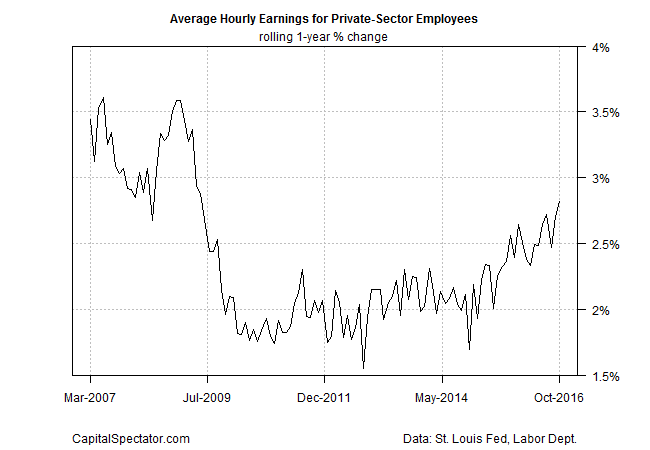

There’s also a firmer whiff of reflation in wages at the moment. Last week the Labor Department reported that the average hourly earnings for private-sector employees increased 2.8% in October vs. a year ago—the fastest pace since in seven years.

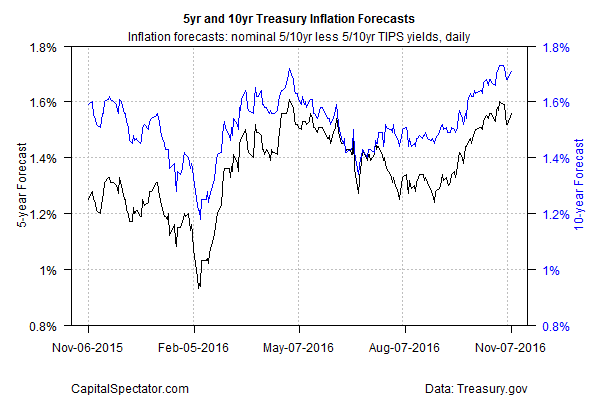

Meanwhile, the Treasury market’s pricing in higher inflation expectations these days. The yield spread for the nominal 10-year Note less its inflation-indexed counterpart was 1.71% yesterday (Nov. 7), based on daily data via Treasury.gov—close to the highest pace so far this year.

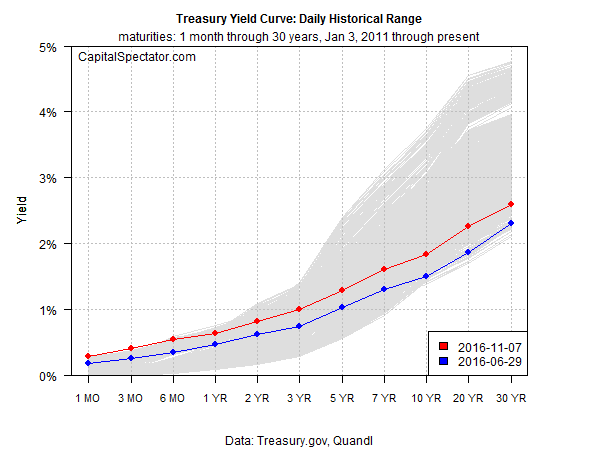

The Treasury curve has been steepening lately, albeit mildly so, and all the maturities are trading at higher yields compared with 90 trading days earlier.

Reuters reports that demand for inflation protection has jumped recently, in part because of “remarks from Federal Reserve Chair Janet Yellen in October on managing a ‘high-pressure economy,’ which gave rise to the view the US central bank would allow inflation to run above its 2 percent target.”

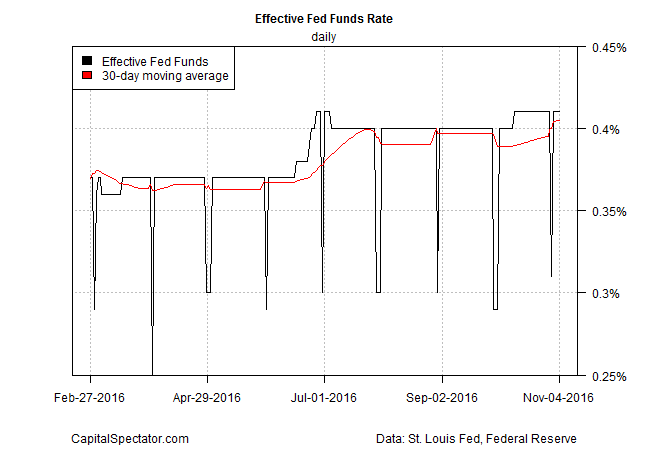

Against this backdrop, the Federal Reserve appears to be planning on raising interest rates at next month’s FOMC meeting. The 30-day moving average of the Effective Fed Funds rate continues to inch higher, rising to an eight-year high of 0.405% at the end of last week.

Deciding if inflation is really headed higher is still a work in progress, in part because economic growth overall is still relatively modest. But the early projections for Q4 GDP hint at the possibility that the expansion will continue to firm. The Atlanta Fed’s GDPNow model is currently projecting (as of Nov. 4) that US output will increase 3.1%, which would mark the fastest pace in more than two years and slightly above Q3’s 2.9% advance.

Yes, it could turn out to be another head fake. But for now, it’s reasonable to assume that every encouraging economic update from here on out will fuel more speculation that inflation’s picking up speed. Even if the hawks are right, a higher inflation rate in the months ahead will still look modest compared with the pre-2008 era. But after years of battling and expecting disinflation/deflation, a moderately elevated and sustainable inflation regime could come as a rude shock.

<\center>

Pingback: Inflation Chatter Is Bubbling Anew - TradingGods.net

Pingback: 11/09/16 – Wednesday’s Interest-ing Reads | Compound Interest-ing!