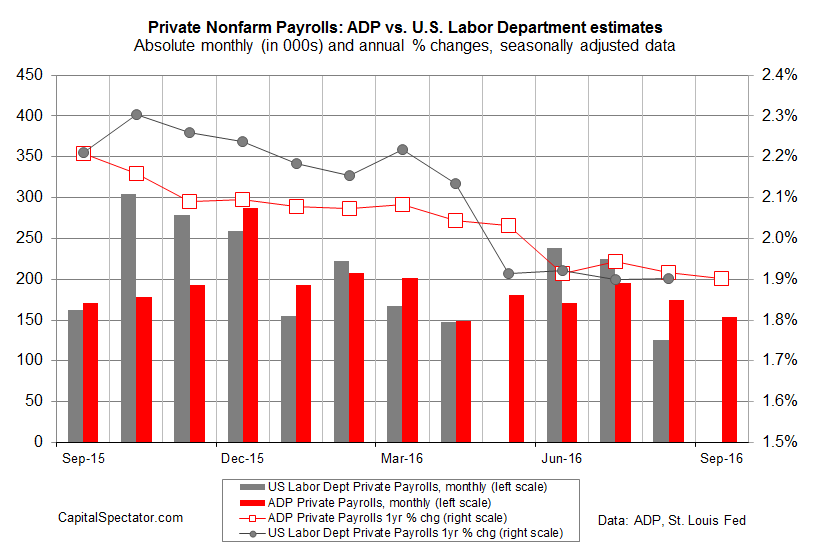

US payrolls rose less than expected in September, according to this morning’s release of the ADP Employment Report. Private-sector jobs increased by a seasonally adjusted 152,000 last month, moderately below Econoday.com’s 170,000 consensus forecast and well below the 175,000 gain in August, based on ADP’s numbers. The softer rise, which left the year-over-year gain for payrolls at a three-year low, raises questions about expectations for a rebound in growth in the government’s labor market report for September that’s scheduled for this Friday.

“Job gains in September eased a bit when compared to the past 12-month average,” said Ahu Yildirmaz, vice president and head of the ADP Research Institute. “We also observed softening this month in trade/transportation/utilities, possibly due to a continued tightening U.S. labor market and lackluster consumer spending.”

The trend in job growth has been decelerating since early 2015 and today’s report shows that the downside bias endures. The 1.90% year-over-year rise through September is still a respectable rate, but it’s becoming clear that the labor market’s forward momentum is downshifting. That’s not surprising given that the economic expansion is now the fifth-longest on record, according to NBER data. It’s debatable if the risk of a new recession rises simply because the recovery is relatively old. But it’s obvious that the economy’s capacity for minting new jobs is facing stronger headwinds and an aging recovery probably isn’t helping.

But at least one economist asserts that today’s release still offers a positive outlook for employment. “With job openings at all-time highs and layoffs near all-time lows, the job market remains in full-swing,” says Mark Zandi, chief economist of Moody’s Analytics, which co-produces the ADP figures. “Job growth has moderated in recent months, but only because the economy is finally returning to full-employment.”

Friday’s numbers from the Labor Department for September will put Zandi’s optimism to the test. The crowd’s looking for a moderate bounce in private payrolls for last month. Econoday.com’s consensus forecast sees a 170,000 increase, a solid improvement after the disappointing rise of just 126,000 in August via the government’s reckoning.

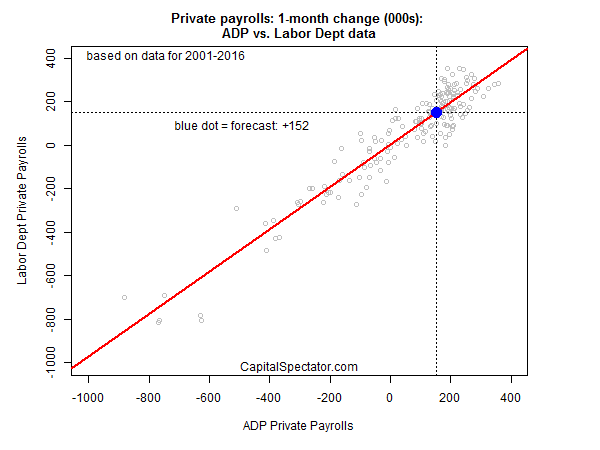

Should we manage expectations down a bit for Washington’s upcoming report in light of today’s mildly softer ADP results? Let’s run both sets of numbers through a simple regression model in search of answer. According to the historical relationship between the ADP and Labor Department data on private payrolls, today’s update implies that Friday’s report will show that US companies added modestly fewer jobs than economists are currently projecting: +152,000 vs. +170,000 via the consensus estimate.

Even if Friday’s results match the regression model’s forecast, the gain would still be relatively healthy. But a 152,000 increase, give or take, in private payrolls would also imply that the future path of growth remains biased to the downside, if only on the margins.