The 10-year Treasury Note’s term premium (an estimate of the extra compensation that the market demands for holding longer rather than shorter maturities) has been moderately negative for most of 2016, and there’s no sign that the red ink will fade any time soon. The sub-zero readings, based on New York Fed data, aren’t surprising in the current economic climate. The appetite for safe havens remains strong, largely because growth is expected to remain modest at best—in the US and around the world. But as the term premium ticks lower, the slide suggests that the bond market is moving deeper into uncharted territory.

One way to think about the term premium is to view its ebb and flow as a sentiment measure related to the various concerns that traditionally drive the bond market: inflation expectations, the outlook for monetary policy, and a willingness (or a lack thereof) to forgo the potential for earning higher returns in other asset classes. By that standard, the dive in the 10-year term premium quantifies what’s been clear in the years since the 2008-2009 financial crisis: the crowd is anxious about the prospects for economic growth.

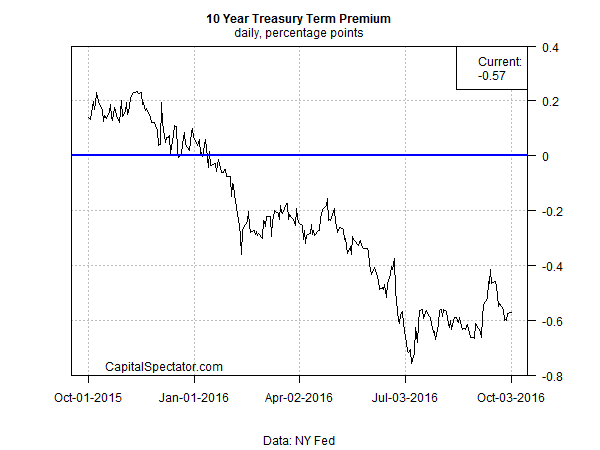

To the extent that the term premium captures the mood, the year so far has been a milestone. As the chart below shows, the 10-year term premium dipped below zero in January and proceeded to trend lower in subsequent months, dispatching an unprecedented run in negative territory relative to the track record over the last half century. As of Oct. 3, 2016, the New York Fed’s estimate of the 10-year term premium: -0.57 percentage points. That’s modestly above the -0.76 reading that was briefly reached in July, but it’s reasonable to wonder if we’ll see even lower levels in the months ahead.

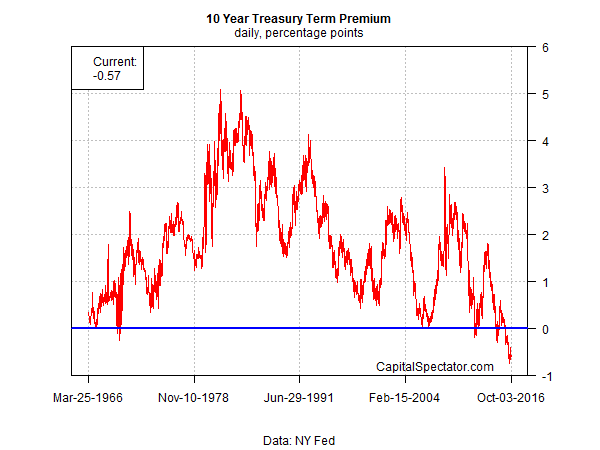

For historical perspective, consider the term premium’s record for the last 50 years. Although there have been two brief dips below zero in the past, the current slide into negative territory is a first in the modern era in terms of endurance.

It’s worth pointing out that estimating the term premium is a slippery concept because it’s unobservable directly and therefore requires a model to estimate the values. In addition, there’s a variety of methodologies for quantifying the term premium. In turn, the various models can deliver a wide range of results, as the San Francisco Fed pointed out in a 2007 research note.

Meantime, some analysts question the validity of the term-premium concept. Jeffrey Snider at Alhambra Investment Partners last week raised doubts, insisting that “once the world stops believing in the superstitions of term premiums and then stimulus that can’t even live up to their own conditions only then will recovery be possible.”

Perhaps, although The Wall Street Journal recently advised that “it looks as if the decline in term premiums is being driven by rising demand for Treasurys rather than changing risk assessments.” Aaron Kohli, a fixed-income strategist at BMO Capital Markets, told Bloomberg in the spring that “it’s a confluence of effects for the collapse in the term premium, including globally that there’s very little yield. The market isn’t really convinced the Fed can create the sorts of conditions where buyers in the long end would demand a risk premium. You really need to have some positive risks to growth and upside for inflation.”

The third-quarter GDP report for the US that’s due at the end of the month is expected to provide a degree of support for “positive risks to growth.” The Atlanta Fed’s GDPNow model is currently projecting (as of Oct. 3) that output will rise 2.2% in Q3, roughly double the rate in each of the previous three quarters. Note, however, that the nowcasts have been sliding, which suggests that it’s premature to assume that a Q3 rebound of any significance is written in stone.

When and if there’s a genuine revival in the growth outlook, it’s likely that the 10-year term premium will stabilize and perhaps return to positive territory. It’s encouraging to see some progress on that front via the term premium’s generally sideways movement in recent months. But the stability still reflects a negative term premium and it’s debatable if the incoming economic data will be strong enough to deliver a positive change any time soon.

Indeed, for all the concerns about low yields in the US, by global standards Treasuries still look relatively attractive. The current yield on a 10-year Treasury is comparatively rich 1.70% at the moment, miles above the slightly negative yields on the 10-year government bonds for Germany and Japan. In a world that’s still hungry for safety—and desperate for yield—that’s a clue for thinking that the yields will remain under pressure generally, which suggests that the US 10-year term premium’s slide will roll on.

Pingback: 10/05/16 – Wednesday’s Interest-ing Reads | Compound Interest-ing!