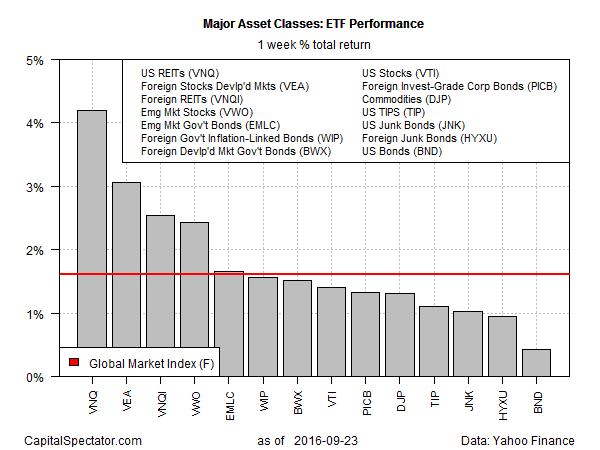

All the major asset classes posted gains last week, based on a set of ETF proxies. Thanks in part to another decision by the Federal Reserve to forgo an interest-rate hike, investor sentiment turned bullish, driving up prices for the five trading days through Friday, Sep. 23.

Last week’s big winner: US real estate investment trusts (REITs), which surged 4.2%, based on Vanguard REIT (VNQ). The bounce is the biggest weekly advance in three months for the interest-rate sensitive REIT market.

There were no losers last week, although US investment-grade bonds delivered the smallest advance. Vanguard Total Bond Market (BND) edged higher for the second week in a row, earning a 0.4% total return.

The buying spree lifted an ETF-based version of the Global Markets Index (GMI.F), an investable, unmanaged benchmark that holds all the major asset classes in market-value weights. GMI.F posted a solid 1.6% total return last week, the first weekly advance in three weeks.

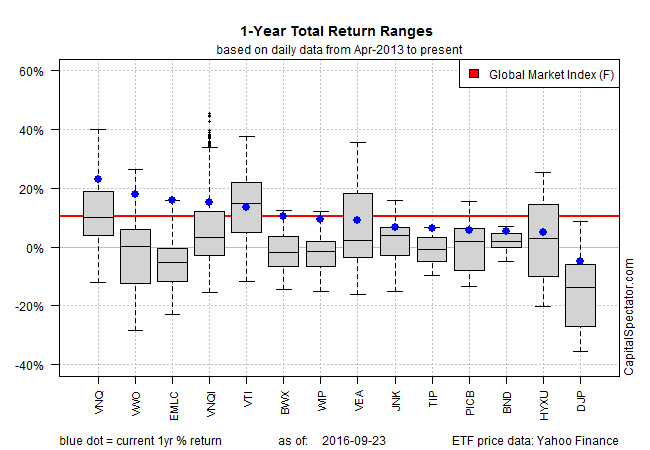

The bullish bias last week kept all but one of the major classes in positive terrain for the trailing one-year ledger. US REITs (VNQ) remain in the top spot, posting a sizzling 21.8% total return for the past 12 months.

Broadly defined commodities are still the only loser for one-year results. iPath Bloomberg Commodity (DJP) is down 4.1% for the 12 months through last Friday’s close.

Meantime, GMI.F’s one-year total return moved into double digits last week. The benchmark is up a robust 10.5% over the 12 months through Sep. 23.

Pingback: 09/26/16 – Monday’s Interest-ing Reads | Compound Interest-ing!