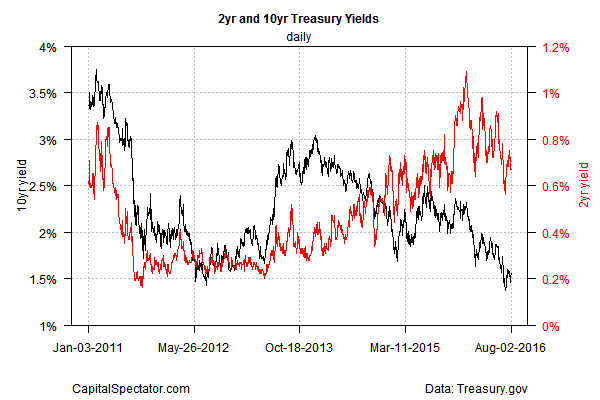

For the last several years, the 2-year Treasury yield has been trending higher. It’s been a slow crawl higher from a low base for this maturity, which is said to be the most sensitive for rate expectations, but the upward sloping directional bias has been clear. The same can be said for the benchmark 10-year yield, but the trend has been moving in the opposite direction—down. But this long-running divergence appears to be fading as the 2-year yield succumbs to gravity. If the shift continues, the implied message amounts to a sturdier forecast of lower economic growth and inflation.

Consider how the two yields compare in recent years. From roughly mid-2013 through early 2016, the 2-year yield cut a path higher. Rising from 0.2% to nearly 1.1% in January of this year, this slice of the Treasury market has effectively been pricing in expectations of firmer growth and higher inflation. But the 10-year yield rarely embraced this narrative. Although there have been brief interruptions, the 10-year yield has been drifting lower during much of the time that the 2-year rate has been trending higher.

But 2016 appears to be a watershed year for breaking the divergence in favor of the darker forecast bound up in the 10-year’s slide. For much of the year so far, the two yields have been tightly correlated as they move lower (see next chart below). The 2-year held at 0.67% yesterday (Aug. 2), according to Treasury.gov.—well below the nearly 1.1% level in January. The downward bias is no less conspicuous in the 10 year, which is currently 1.55%, which is nearly 70 basis points lower vs. the yield on the first trading day of this year.

In short, it appears that the 2-year yield’s relatively upbeat outlook is waning, giving in to the darker inclinations suggested by the 10-year’s downward-sloping trend.

The antidote to the gloom, of course, is stronger growth. Exactly that was on display in the surprisingly strong employment report in June. But the crowd’s looking for only a modest increase in this Friday’s update from the Labor Department. Econoday.com’s consensus forecast calls for a respectable increase of 175,000 in private-sector employment for July vs. the 265,000 gain in the previous month. That’s still a decent gain—enough to keep worries about recession in the near future at bay. But if the consensus forecast for July holds, the advance translates into another round of slower year-over-year growth that dips under the 1.90% mark for the first time in three years.

Slower growth is a factor in keeping inflation in check, as yesterday’s June update on personal income and spending shows. Although consumer spending posted another solid gain in the final month of the second quarter, inflation remained subdued. The PCE index, which is said to be the Fed’s preferred inflation benchmark, held steady at a low 0.9% year-over-year rate. Ditto for core PCE, which was unchanged at 1.6% for the past 12 months. The optimistic spin: efforts to raise inflation to the Fed’s 2% is still a work in progress.

But the 2-year and 10-year Treasury yields are now speaking with one voice in raising doubts about the Fed’s prospects for success. An NBER-defined recession still looks like a low-probability event for the near term. But the Treasury market’s telling us that the prospects for stronger economic growth are equally low.

No wonder that Dallas Fed President Robert Kaplan yesterday recommended that any tightening of monetary policy should unfold in a “gradual manner.” But using the 2- and 10-year yields as a guide suggests that even a modest plan for gently raising rates is still too aggressive for an economy that may be destined for an extended run of slow (and slowing) growth.

Pingback: 2-Year Treasury Yield Trending Higher - TradingGods.net

Pingback: Daily Reading: August 4th, 2016 – The Aspirant Investor

Pingback: 08/04/16 – Thursday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Weekend Reading: The Global Dichotomy | RIA

Pingback: Weekend Reading: The Global Dichotomy | David Stockman's Contra Corner

Pingback: Weekend Reading: The Global Dichotomy | Earths Final Countdown

Pingback: Weekend Reading: The Global Dichotomy - BuzzFAQs

Pingback: Weekend Reading: The Global Dichotomy -

Pingback: Weekend Reading: The Global Dichotomy | Political American

Pingback: Linkfest - Kairos Capital