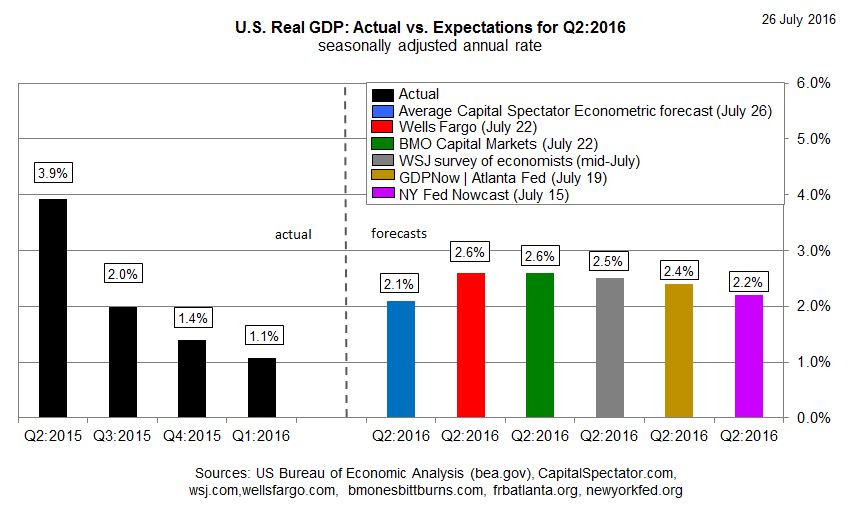

US economic growth is on track to post an encouraging rebound in this Friday’s “advance” GDP report for the second quarter. By most estimates, the Bureau of Economic Analysis is expected to report that output will rise by 2%-plus in Q2, well above the subdued 1.1% rise in Q1 GDP (seasonally adjusted annual rates).

The 2%-plus outlook for growth is “an OK pace,” says Gus Faucher, senior economist at PNC Financial Services. “It’s not fantastic. It keeps the economy moving forward.”

But that still represent progress when you consider that recession worries were widespread earlier in the year.

Expecting that the government’s first estimate of Q2 GDP will improve over Q1 draws support from a variety of recently published indicators, including last week’s bounce in the Chicago Fed National Activity Index (CFNAI) for June. Although national economic activity was slightly below its historical trend, according to CFNAI’s three-month moving average, the pace of economic activity was considerably firmer at this year’s midway point vs the previous month.

A key piece of last month’s rebound is linked to job growth, which surged in June. The surprisingly strong gain eased fears that May’s unusually weak rise in payrolls was a warning sign for the economy.

Economists overall are looking for a 2.5% increase in Q2 GDP (gray bar in chart below), according to The Wall Street Journal’s mid-July survey data. If the forecast holds, the US economy will expand at the highest quarterly rate in a year.

A pickup in growth will be all the sweeter because it will mark the first acceleration in quarterly growth since 2015’s Q2.

Although the outlook for Friday’s GDP data is expected to bring relatively upbeat news, the Federal Reserve is still expected to leave interest rates unchanged in tomorrow’s FOMC policy announcement, scheduled for 2:00 pm eastern (Wednesday, July 27). “We have just come through too much volatility for the Fed to be able to reach a definitive conclusion about raising rates in July, but by September they will have more data,” advises Sung Won Sohn, an economics professor at California State University, Channel Islands.

Meantime, the Capital Spectator’s GDP nowcast for Q2 growth of 2.1% is at the low end of most estimates. But in line with most analysts, the nowcasts have been inching higher in recent months, offering support for thinking that the macro trend has been strengthening lately, albeit moderately.

Pingback: US Economic Growth Expected to Post a Rebound for Second Quarter - TradingGods.net

Pingback: The Effective Fed Funds Rate Ticks Higher, Hinting At A Rate Hike – Seeking Alpha | Globall News

Pingback: The Effective Fed Funds Rate Ticks Higher, Hinting At A Rate Hike – Seeking Alpha – Complex Mathematics News Archive

Pingback: The Effective Fed Funds Rate Ticks Higher, Hinting At A Rate Hike – Seeking Alpha | 10Breaking News