Fed Chair Janet Yellen, testifying in Congress on Tuesday, said that Brexit risks are a risk factor for the US economy. “A UK vote to exit the European Union could have significant economic repercussions,” she said. Yellen noted that the US macro outlook for the long term was encouraging, but in the short run weak economic growth could delay any plans for raising interest rates. “Proceeding cautiously in raising the federal funds rate will allow us to keep the monetary support to economic growth in place while we assess whether growth is returning to a moderate pace,” she explained.

Brexit polls show that tomorrow’s UK referendum are too close to call. According to Bloomberg: “A YouGov poll of 1,652 voters for the Times newspaper published late Monday showed ‘Leave’ at 44% and 42% for ‘Remain,’ while a survey of 800 people by ORB for the Daily Telegraph had ‘Remain’ at 53 percent and ‘Leave’ at 46% once ‘don’t knows’ were stripped out.”

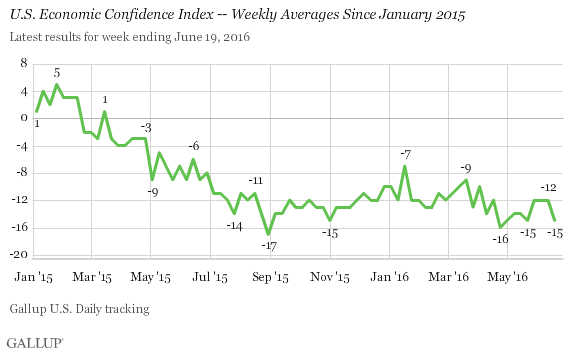

Gallup’s US Economic Confidence Index slipped last, easing to the lowest level since early April. The decline was “driven by [Americans’] worsening views of the economy’s direction,” Gallup advised.

Retail spending in the US inched higher in the third week of June vs. the year-earlier level, according to the Redbook Index. The benchmark increased 0.9% in the week through June 18 vs. the same week in the previous year, according to TradingEconomics.com.