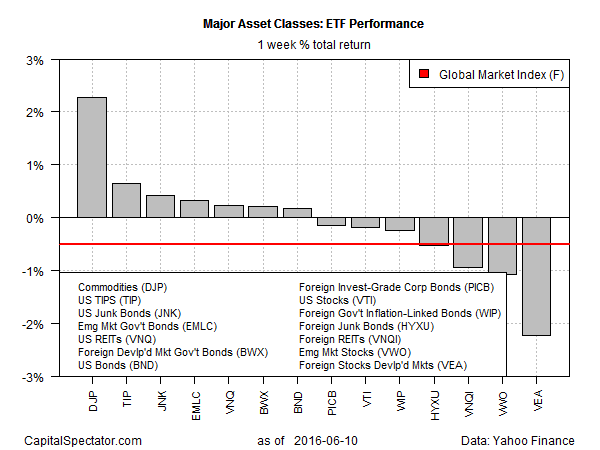

The rebound in commodities rolled on last week, delivering the biggest return for the five trading days through June 10 among the major asset classes, based on a set of exchanged-traded products. For the fifth consecutive week, the iPath Bloomberg Commodity ETN (DJP) posted a gain, rising 2.3%.

The biggest loser last week among the major asset classes: foreign equities in developed markets. The Vanguard FTSE Developed Markets ETF (VEA) lost 2.2% in total-return terms.

Despite the impressive rally in commodities and several other corners, there was a negative bias overall in markets last week. An ETF-based version of the Global Markets Index (GMI.F) — an investable, unmanaged benchmark that holds all the major asset classes in market-value weights — fell 0.5% last week. The setback marks the first weekly loss for the index in three weeks.

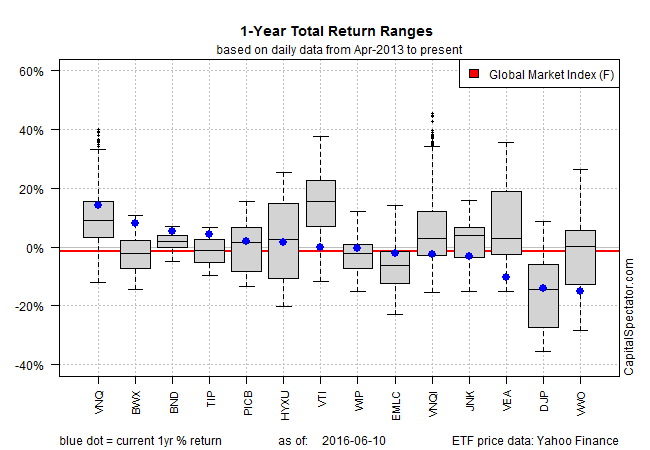

For the trailing one-year return, US real estate investment trusts (REITs) continue to hold the top spot. The Vanguard REIT ETF (VNQ) is ahead by roughly 15% in total return terms for the 12 months through June 10.

Note, too, that broadly defined commodities are no longer dead last for the trailing one-year period. For the first time in recent history, DJP’s performance wasn’t at the bottom of the 12-month ranking—a distinction that now goes to emerging-market stocks. After last week’s slide, Vanguard FTSE Emerging Market (VWO) has tumbled more than 15% for the year through June 10, earning the title of the biggest setback for one-year return among the major asset classes.

For perspective, note that GMI.F is down fractionally for the past year, shedding 0.8% for the 12 months through June 10.