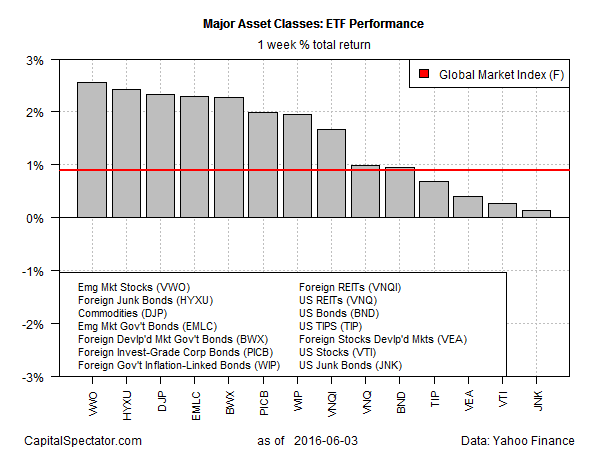

In a rare display of uniformly bullish behavior, all the major asset classes posted gains last week, based on a set of proxy ETFs. Emerging-market stocks led the field higher during the shortened US trading week. For the second week in a row, the Vanguard Emerging Market ETF (VWO) was the top performer, posting a 2.6% total return for the four trading days through June 3.

The weakest performer among the major asset classes last week: US junk bonds. The SPDR Barclays High Yield Bond ETF (JNK) inched ahead by a thin 0.1%.

The upside bias lifted an ETF-based version of the Global Markets Index (GMI.F), an investable, unmanaged benchmark that holds all the major asset classes in market-value weights. The index increased 0.9% last week, marking its second straight weekly rise.

For the trailing one-year return, US real estate investment trusts (REITs) continue to hold the top spot. The Vanguard REIT ETF (VNQ) is up 13% in total return terms for the 12 months through June 3—comfortably above the median gain for its historical one-year performances over the last three years.

Meantime, broadly defined commodities remain dead last among the major asset classes on a one-year-performance basis. The iPath Bloomberg Commodity ETN (DJP) is down nearly 16% for the year through last week’s close. Note, however, that DJP has made progress this year in paring its losses, courtesy of the strong rally that has prevailed since late-February. In fact, the Financial Times today notes that commodities overall are outperforming global stocks and bonds so far in 2016.

Pingback: 06/06/16 – Monday’s Interest-ing Reads | Compound Interest-ing!