Private-sector job growth in the US remained modest in May, according to this morning’s update of the ADP Employment Report. Although companies added slightly more workers last month vs. April, the monthly increase—173,000 175,000—was still close to the slowest advance on a month-to-month basis over the last three years. Two other employment releases—the government’s jobless claims data and Challenger Gray’s job cuts report—offer more encouraging data. Overall, it’s fair to say that the latest employment figures offer an upbeat profile, but with several caveats.

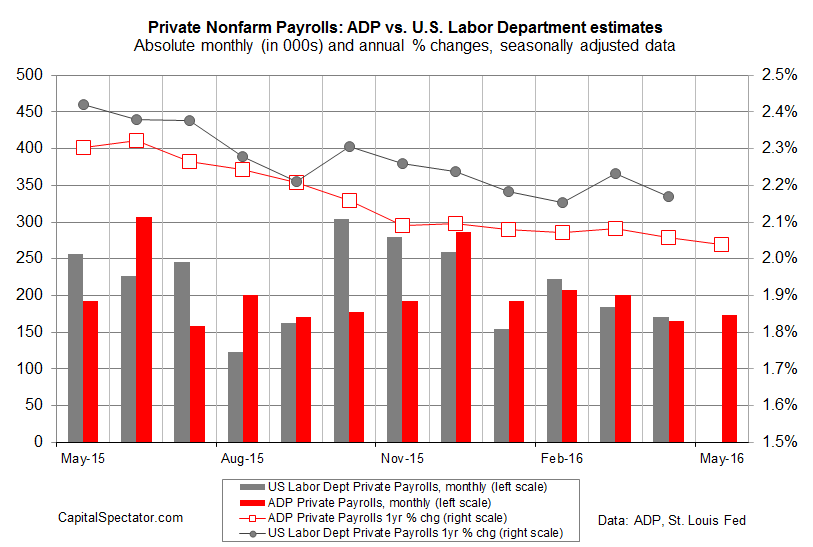

Let’s start with the ADP report. The main takeaway: job growth is still forging ahead, but the trend continues to slow, albeit marginally so. The year-over-year growth in private-sector employment ticked down again in May, rising 2.04% vs. a year ago. That’s still a solid pace, but it’s also the slowest rate in two years. That’s a sign that the labor market recovery is aging. The deceleration phase could roll on for some time before dipping to a critical level that triggers a recession warning. In any case, the evidence is mounting that the strongest phase of job growth is behind us. That’s not the end of the world, but it’s a reminder that the margin for disappointment is narrowing. Weaker-than-expected economic news in the months ahead will be harder to dismiss when labor-market growth is easing.

“Job creation appears to have slowed as we move further into 2016,” says Ahu Yildirmaz, head of the ADP Research Institute. “Challenging global conditions affecting hiring at large companies and a tightening labor market for skilled workers are among the factors that may be contributing to the slowdown.”

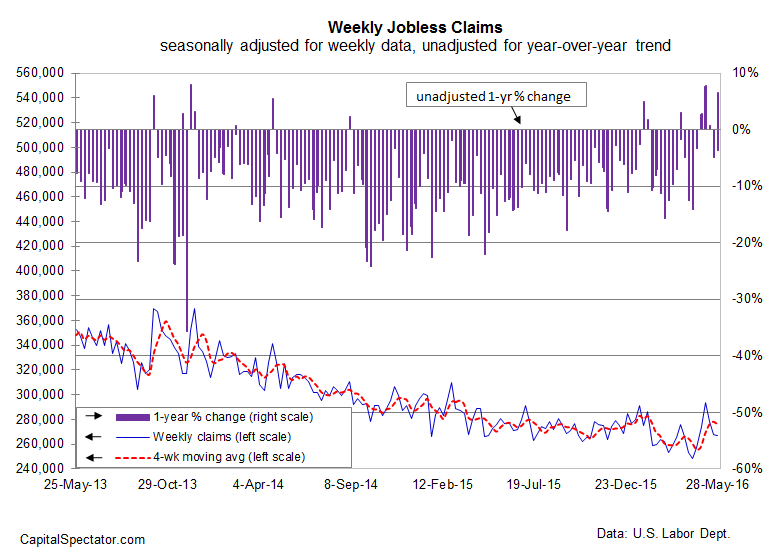

Meanwhile, jobless claims ticked lower last week, the Labor Department reports. The 1,000 decrease to a seasonally adjusted 267,000 for the last week of May marks the third straight weekly slide. That’s an encouraging sign after the recent spike in late-April and early May that raised fears that the labor market was stumbling. But note that the year-over-year change in jobless claims (in unadjusted terms) popped higher in today’s update, posting a 6.6% increase vs. the year-earlier level. That annual rise is the fourth time in the past five weeks that claims headed higher vs. year-ago figures. That’s an unwelcome sign if it continues. Indeed, if new filings for unemployment benefits rise again in annual terms over the next several reports, this leading indicator will effectively be forecasting trouble for the business cycle.

Finally, Challenger, Gray & Christmas Inc. reports today that job cuts fell in May to a five month low. “May could be the start of a summer slowdown in the pace of job cutting as companies take a pause following the period of heavy downsizing that started the year,” the firm’s CEO John Challenger explains.

Some of the weakness in the recent employment numbers is said to be due to the Verizon strike, which ended this week but not before pushing employment-growth data lower, albeit on a temporary basis. Reportedly that’s one reason why economists are looking for Friday’s official jobs report from Washington to reflect another slowdown in private-sector employment: a gain of just 150,000 for May, down from an already slow 171,000 rise in April, according to Econoday.com’s consensus forecast. If the prediction holds, the Verizon excuse will come in handy for dismissing what otherwise would be a worrisome update for the employment profile.

Nonetheless, some analysts think that there’s still enough support in the data to convince the Fed to raise interest rates again, perhaps as early as this month’s FOMC meeting, which concludes on June 15.

“Labor market conditions are stable, which is all the reassurance the Fed will need to act soon,” says Paul Ashworth, chief U.S. economist at Capital Economics.