AQR Capital Management’s Cliff Asness has launched a healthy discussion about the trials and tribulations of factor timing with a new essay (“The Siren Song of Factor Timing”). He’s recommends that investors steer clear, which is good advice because the crowd’s record, in the aggregate, to successfully engage in market-timing activities generally is overwhelmingly poor. But Asness isn’t an absolutist. Instead, he notes that sometimes the perceived opportunities for engaging in a bit of timing are just too compelling to pass up.

“If you do decide to time factors, not something that I rule out entirely, and if timing is a ‘sin’, then you should ‘sin’ only a little,” Asness recently wrote on his firm’s web site. In the “Siren Song” paper, which is forthcoming in the Journal of Portfolio Management, he points to the extreme excesses of the tech bubble in 1999-2000 and the related decline and fall of the value factor as an example.

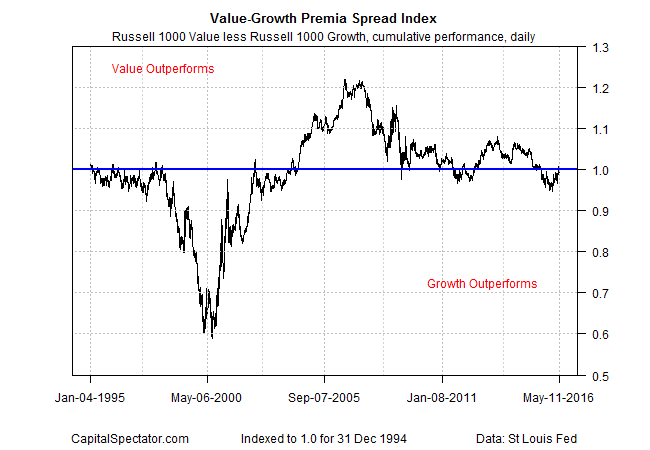

Let’s take a stab at quantifying that event by measuring the cumulative change in large-cap US value stocks less their growth counterparts via the relevant Russell 1000 benchmarks. As you can see in the chart below, the late-1990s and early 2000s were extraordinary in terms of value’s acute fall from grace relative to growth. The slide culminated in the spring of 2000, when growth’s outperformance (and value’s underperformance) was in overdrive.

The question is whether a bit of factor timing in early 2000 was warranted? Yes, of course! When Mr. Market offers unusually ample expected returns in one piece of the asset pie, there’s a reasonable case for accepting the gentleman’s generous gift. In short, the case for overweighting value to a degree (and underweighting growth) in early 2000 looked compelling… albeit with the benefit of hindsight. Indeed, value did quite well in subsequent years, in relative and absolute terms compared with growth.

On that note, it’s worth pointing out that value and growth’s prospects for outperformance relative to the other looking decidedly neutral at the moment. In fact, this is a good point to remind that extreme spreads between value and growth—and other factors, for that matter—are the exception. That’s another way of saying that the odds aren’t usually stacked in our favor for timing factors (or anything else).

But sometimes it may be wise to ignore an otherwise reasonable bit of advice. That doesn’t mean you have to go off the deep end. Factor timing is available in a thousand shades of gray and so it’s prudent to customize factor bets—when appropriate—to match a particular risk tolerance, time horizon, etc.

The lesson, then, is that factor timing should be avoided… except when market conditions scream otherwise.