The US economy is struggling to regain momentum after GDP growth stumbled in the first quarter to the slowest pace in two years. The preliminary numbers available to date for last month paint a mixed profile for Q2’s start (see here and here, for instance), but economists are expecting that today’s employment report for April (due later today at 8:30am eastern) will reaffirm that moderate growth will prevail. If the crowd is wrong and labor-market growth falters—as it did in ADP’s estimate for April—the news will add more stress to an already wobbly macro trend.

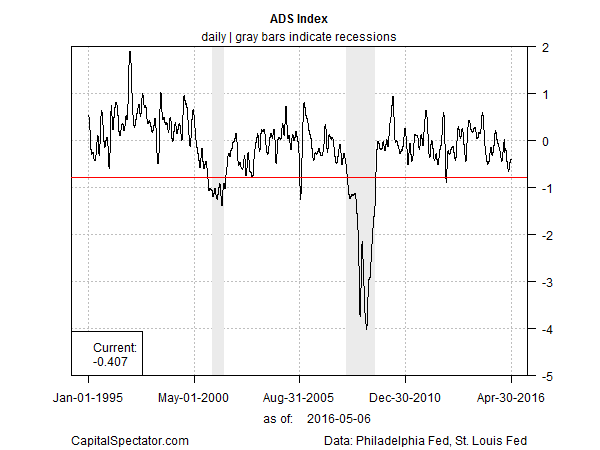

Consider the latest update for the Philly Fed’s ADS Business Conditions Index, which estimates the US macro trend based on six indicators. Yesterday’s update, based on data that reflects economic activity through Apr. 30, is close to a three-year low. Although the data doesn’t signal that a new recession has started, the ADS index’s current value—negative 0.407—is moving closer to the tipping point (negative 0.80) that marks a formal downturn, based on analysis by the San Francisco Fed.

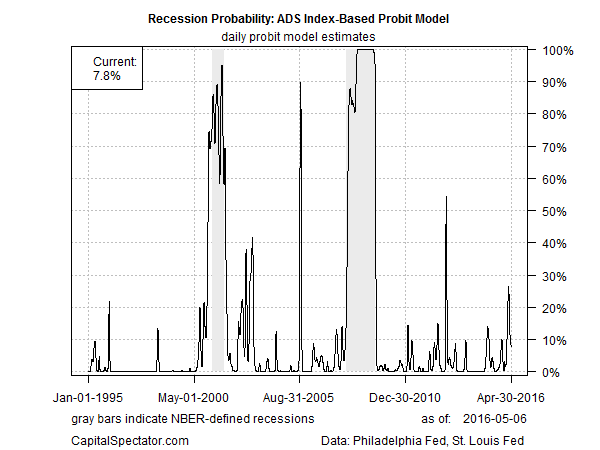

Running the ADS data through a probit model suggests that the probability is still low—less than 10%– that an NBER-defined recession has started.

Today’s April update on payrolls isn’t likely to tip the scales over to the dark side. On the other hand, a surprisingly weak report will further weaken the macro trend and effectively leave no room for further disappointment in the weeks ahead. The Atlanta Fed’s nowcast for Q2 GDP is currently projecting a sluggish 1.7% rise (as of May 4). The estimate represents a bounce after Q1’s stall-speed increase of just 0.5%, but the current Q2 forecast serves as a reminder that another round of deterioration for the incoming data updates could push the macro trend to the edge.

If today’s employment report fans the flames of worry, the next major hurdle that may constitute a tipping point: the April update of the Chicago Fed National Activity Index (3-month average), which is due for release on May 19. Note that this index, which is arguably the most reliable benchmark for timely macro signals, is well above its tipping point for March. The three-month average for the index dipped to a three-month low and reflected below-trend growth. But the March data doesn’t show that the business cycle turned dark.

The question is whether the remaining numbers for April will push the Chicago Fed index closer to its tipping point? Today’s update on payrolls won’t offer a definitive answer, but the numbers du jour will make it easier to anticipate what the Chicago Fed index will reveal in a few weeks.