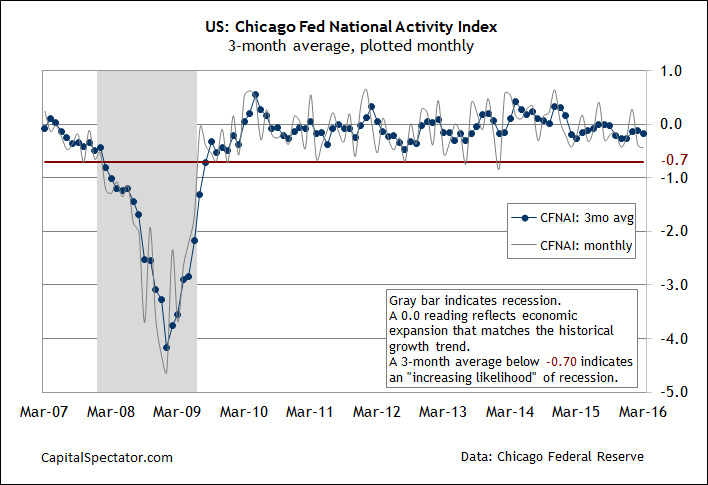

US economic activity continued to decelerate in March, according to this morning’s update of the Chicago Fed National Activity Index (CFNAI)—a multi-factor benchmark that tracks dozens of indicators. The index’s three-month average (CFNAI-MA3) eased to -0.18, a three-month low. That’s still well above the tipping point (-0.70) that marks the start of new recessions. Yet today’s update reaffirms the view that US growth slowed in the first quarter—a slowdown that’s expected to deliver a disappointing Q1 GDP report when the Bureau of Economic Analysis publishes its “advance” report next week.

Meantime, the negative print for CFNAI-MA3 reflects economic growth that’s below the historical trend. Today’s revised numbers show that CFNAI-MA3 has been at or below zero for the past 14 months. In other words, US output overall has been relatively weak for more than a year. And it may get even weaker, or so the monthly data implies.

Note that the monthly reading of CFNAI for March tumbled to -0.44—the lowest in more than two years. Although the monthly data tends to be noisy vs. the comparatively reliable three-month values, last month’s value emphasizes that the sluggish macro trend of late deteriorated sharply at the end of the first quarter.

Nonetheless, let’s not lose sight of the fact that the US continued to avoid a recession in March, according to the latest Chicago Fed report. That’s also the message in yesterday’s profile via The Capital Spectator’s proprietary model. But it’s clear that the economy has lost forward momentum lately. Is that an early sign of trouble for the second quarter?

No, according to today’s weekly update of initial jobless claims, which dipped to the lowest level in more than 40 years. By some accounts, the bullish signal in the claims data trumps everything else. “Claims are probably the single best indicator of the health of the economy,” Mike Englund, chief economist at Action Economics, tells Bloomberg. “We assume the labor market will continue to outperform most measures.” Some analysts would beg to differ, but for the moment this leading indicator for the labor market–and arguably for the economy overall–is predicting a firmer trend in April and beyond.

If Englund’s optimistic view is accurate, we’ll see the evidence in the April macro profile, which for the moment is still largely a mystery. But if you’re inclined to pin expectations to the implied forecast via the claims numbers, a brighter reading of the economy will unfold in the first round of early Q2 economic reports that will begin rolling in over the next several weeks.

Pingback: US Economic Activity Continued to Decelerate - TradingGods.net

Pingback: 04/21/16 – Thursday’s Interest-ing Reads | Compound Interest-ing!