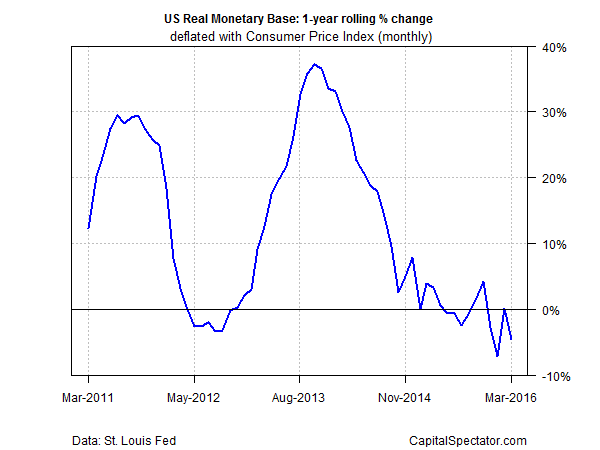

There’s no chance that the Federal Reserve will announce a rate hike at its monetary meeting next week, according to the Fed funds futures market. The implied probability that the central bank will lift the current 0.25%-to-0.50% range at the Apr. 27 FOMC confab is effectively nil via CME data (as of Apr. 19). It’s another story, however, when we look at the year-over-year change in the real (inflation-adjusted) monetary base (M0). By this measure, the central bank’s shift to a policy tightening stance continued in March.

Real M0 fell 4.6% in year-over-year terms last month vs. the year-ago level. That’s the third decline in the last four months. A rate hike may be an unlikely scenario at next week’s FOMC meeting, but behind the scenes it appears that the groundwork is being laid for squeezing policy in the months ahead.

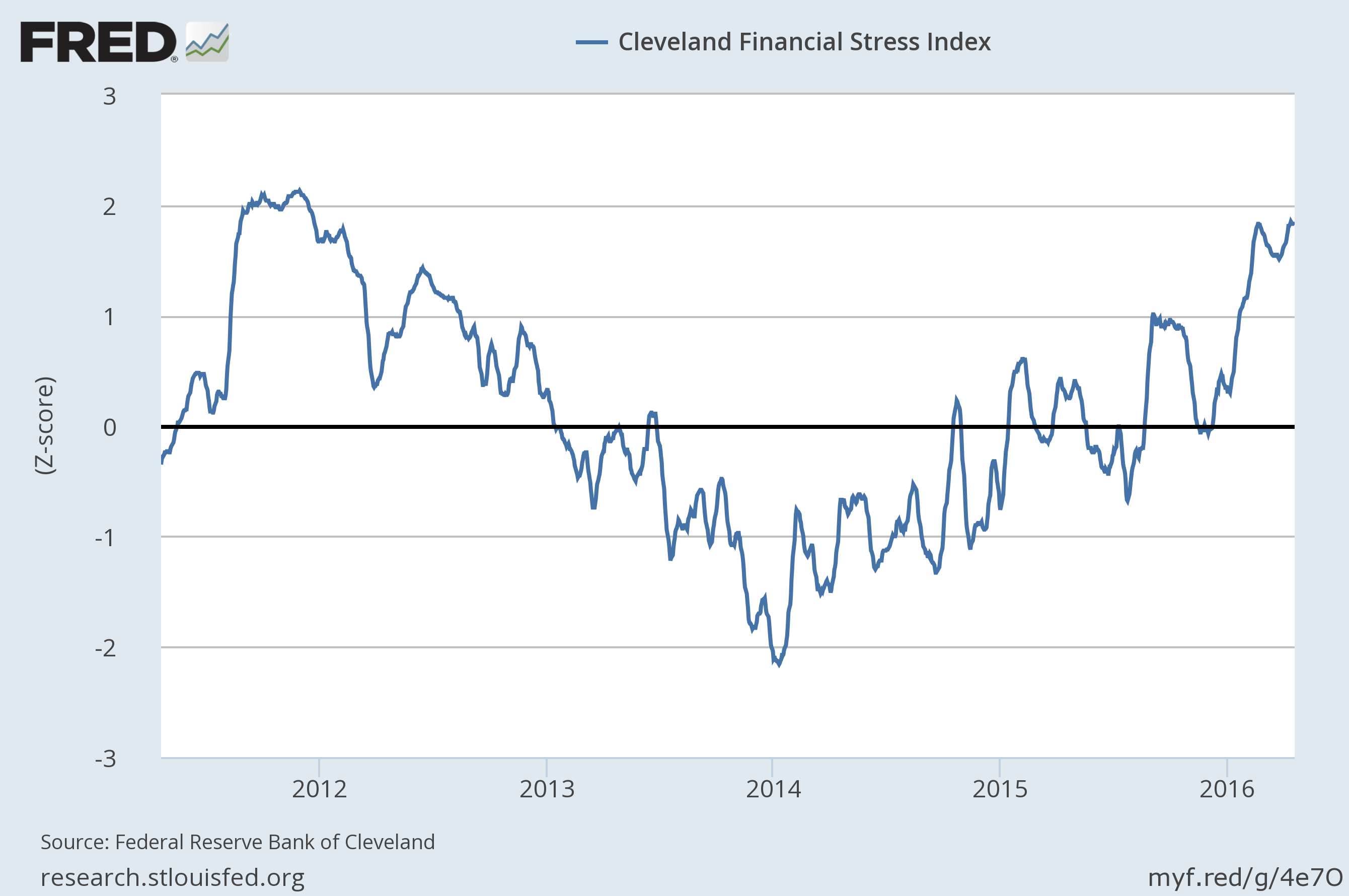

Note, too, that US financial stress has increased substantially this year, according to the Cleveland Fed Financial Stress Index. This daily multi-factor benchmark has recently been printing at four-year highs–levels that reflect a “significant stress period,” as of Apr. 18.

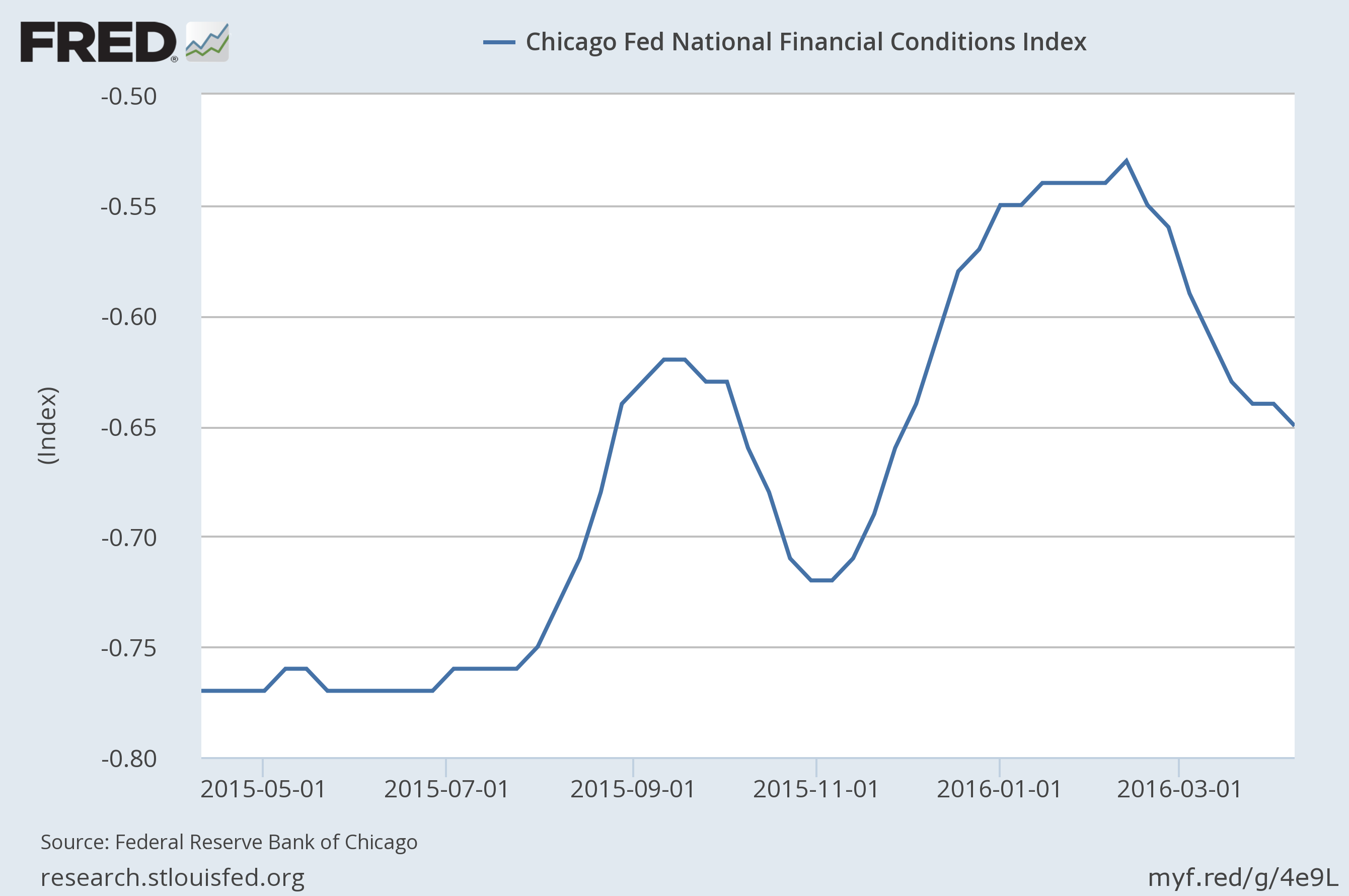

But another broadly defined measure of liquidity in the economy begs to differ. The weekly data for the Chicago Fed National Financial Conditions Index shows that financial conditions have become looser since February. Huh?

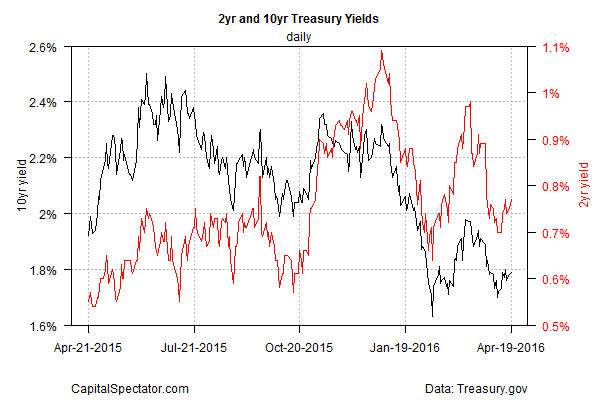

How is the Treasury reacting? For the moment, a wait-and-see stance prevails, which isn’t surprising. With so many conflicting signals in the economic numbers, comments from Fed officials, and monetary data, it’s hardly a shock to find that the bond market’s less than decisive these days. The 2-year yield—considered the most sensitive on the yield curve for rate expectations—is more or less holding at a middling level relative to recent weeks—0.77% as of yesterday (Apr. 19), based on daily data from Treasury.gov.

The next opportunity for a major attitude adjustment arrives in the April payrolls update, due on May 6. Recent numbers for the labor market point to solid growth, although data from other corners of the economy look soft. The stock market, however, is inclined to think positively. The S&P 500 has recovered all its losses from earlier in the year and now looks poised push higher.

Meantime, the key question: What does the Fed think? A rate hike next week is off the table, but will the central bank drop fresh clues about the prospects for a June hike in the FOMC statement? Stay tuned.