Commodities delivered a solid performance last week, posting the strongest gain among the major asset classes via a set of proxy ETFs. Firmer prices in raw materials are widely considered a plus for emerging market economies, but there was no sign of a positive connection last week in the associated equities, at least in US dollar terms. Indeed, last week’s big loser among the major asset classes: emerging market stocks.

Broadly defined commodities gained 1.4% for the trading week through Apr. 8 via the iPath Bloomberg Commodity ETN (DJP). Meanwhile, emerging market equities—Vanguard FTSE EM (VWO)–shed 2.3% last week, marking the biggest weekly decline for the fund since mid-January.

Equities the world over were mostly lower last week, which weighed on the Global Market Index (GMI), a passively managed benchmark that holds all the major asset classes in market-value weights. An investable version of the index via ETFs (GMI.F) slumped 0.4% for the five trading days through Apr. 8.

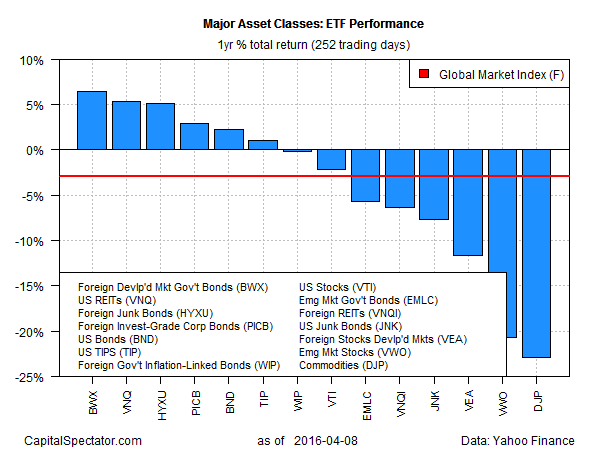

There’s still a degree of upside bias for one-year trailing returns, but the gains on this front are limited to bonds and US REITs. Note that foreign government bonds in developed markets (BWX) remain the leader for one-year results. Meantime, commodities (DJP) are still dead last vs. year-earlier prices, fading nearly 23%.

GMI.F remains under water as well, slumping 2.9% for the year through Apr. 8. Over the longer term, GMI.F is expected to generate a modest 3.0% risk premium, based on this month’s projections. The case for optimism over the long run, however, finds little support in the current trailing one-year numbers–unless you’re expecting the bounce-back effect via mean reversion to kick in at some point.

Pingback: 04/11/16 – Monday’s Interest-ing Reads | Compound Interest-ing!