Job growth in March posted a solid gain, inspiring a new round of upbeat comments on the outlook for US payrolls and the economy generally. But newly minted numbers for two multi-factor measures of the labor market hint at a weakening trend. In contrast with the upbeat message in the latest data for payrolls, broadly defined benchmarks of the labor market published yesterday by the Federal Reserve and the Conference Board (CB) reveal a worrisome round of deceleration unfolding in the first quarter. The conflicting signals raise a question: Is the US labor market weaker than the nonfarm employment numbers imply?

Let’s take a closer look at the data for some insight, starting with the CB’s Employment Trends Index (ETI). This eight-factor benchmark (blue line in chart below) ticked down last month, touching its lowest level since last spring. ETI is still higher on a year-over-year basis, but by a thin 1.1%.

“The Employment Trends Index has been showing signs of weakening in recent months, suggesting that employment growth is likely to slow through the summer,” said Gad Levanon, Chief Economist, North America, at The Conference Board. “With GDP barely growing at a two percent rate, it’s difficult to see how employment can continue to expand by 200,000 or more jobs per month.”

In fact, a 2% rise in GDP constitutes wishful thinking at this point in the dark art of looking ahead to the “advance” first-quarter GDP report that’s scheduled for release at the end of this month. The Atlanta Fed’s GDPNow model as of Apr. 1 is projecting a weak 0.7% growth rate (seasonally adjusted annual rate) in Q1—down from the already sluggish 1.4% gain in last year’s Q4 GDP.

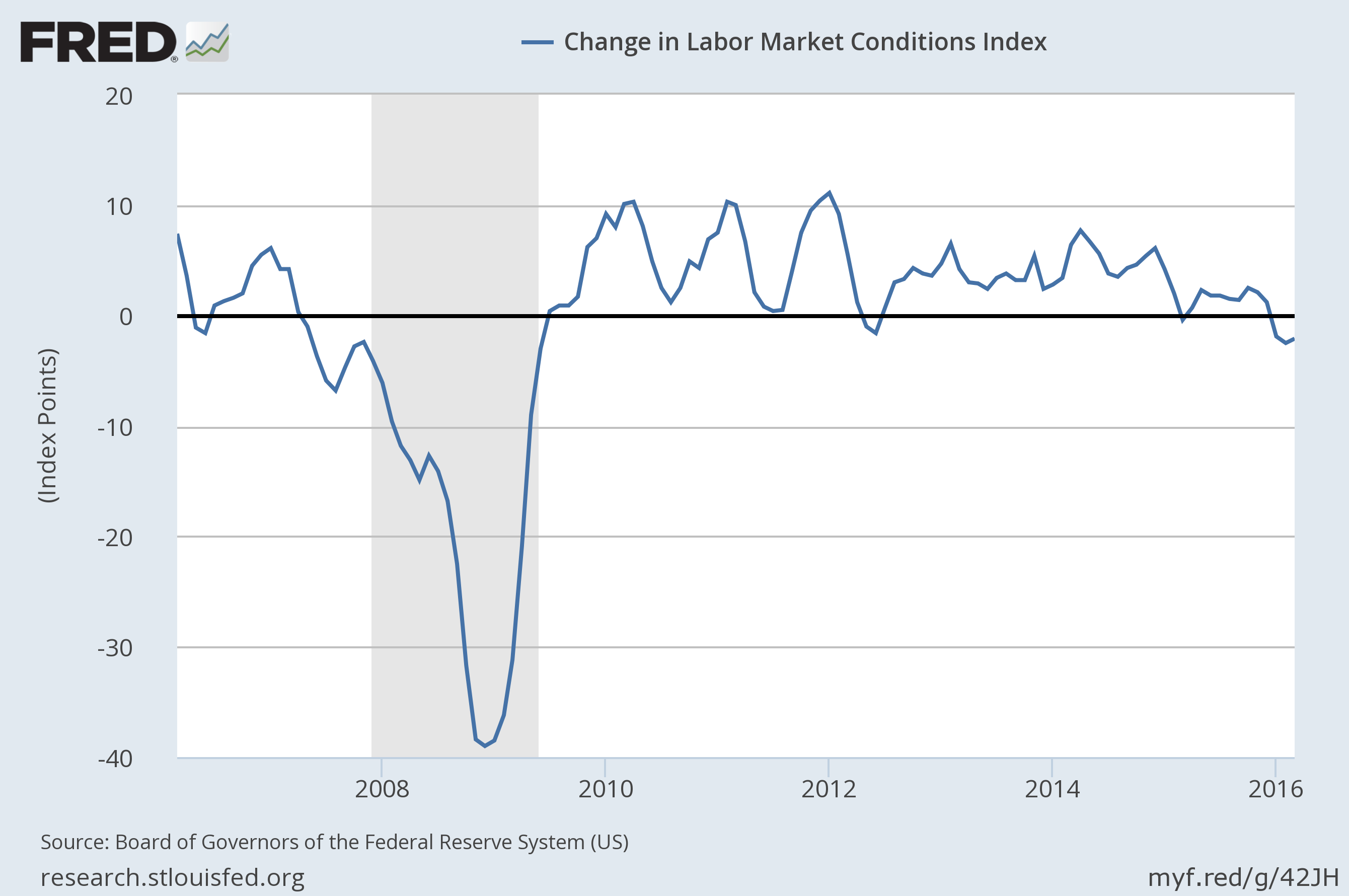

The Federal Reserve’s Labor Market Conditions Index (LMCI) inched up slightly in March, but continues to print at negative values. In fact, this 19-factor index has been below zero for three straight months–the longest stretch of red ink for LMCI since the last recession.

The main takeaway: the US labor market appears to be headed for a period of slower growth in the second quarter. Nonetheless, it’s premature to assume the worst for the economy. The good news is that a broad reading of macro and market indicators still point to low recession risk, based on data through February. The March profile is incomplete, although last week’s numbers on payrolls look encouraging. ETI and LMCI, however, beg to differ.

This much is clear: the case is still weak for expecting anything more than modest growth. The question is whether the macro trend in the US faces stronger headwinds in Q2? ETI and LMCI suggest as much. Confirmation (or rejection) await in the upcoming March numbers from other corners of the economy, including next week’s reports on retail sales and industrial production.

Keep in mind that by some accounts the outlook is improving. For instance, here’s CNBC’s report on the current state of macro analysis via the Carlyle Group:

David Rubenstein, co-founder and co-chief executive of private-equity giant The Carlyle Group, said Monday he’s recently shed his concerns about a U.S. economic slowdown in favor a “pretty optimistic” outlook.

He told CNBC’s “Squawk Box” that his change of heart developed over the past month or so. Rubenstein said he sees a “real pickup,” as the Federal Reserve appears to be on track for a less aggressive approach to hiking interest rates.

This change from the Fed is why he believes the economy is on track for stronger growth.

“Because the Fed is not likely to increase interest rates as much as thought [and] oil prices seem to be stabilizing [and] coming up, I think the global economy and the U.S. economy [are] in reasonable shape,” he said.

The question in the days ahead is whether ETI and LMCI represent an early clue that an attitude adjustment is lurking around the next bend.

Pingback: 04/05/16 – Tuesday’s Interest-ing Reads | Compound Interest-ing!