Retail sales eased 0.1% in February and a previously reported gain for January was revised down to a 0.4% loss, according to this morning’s update from the Census Bureau. Is the slide a sign of trouble for the consumer sector? Maybe, although looking through the short-term noise via the year-over-year trend still looks encouraging.

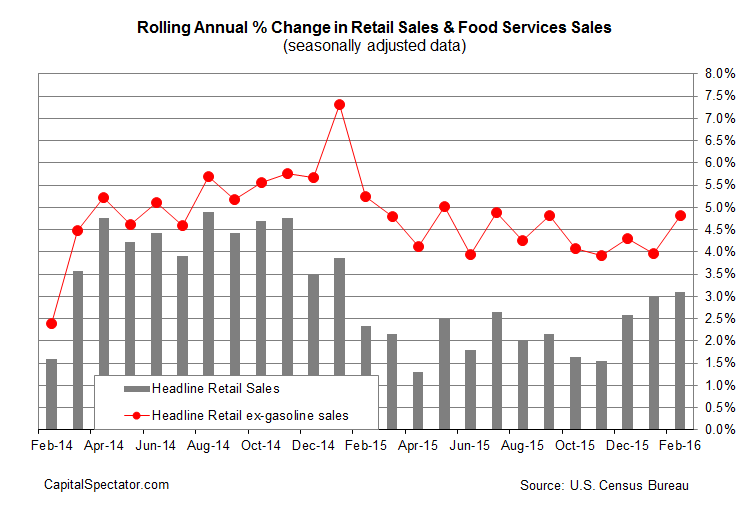

Retail spending actually inched higher in annual terms last month, rising 3.1% vs. the year-earlier level—the best gain in more than a year. The annual trend is even stronger after stripping out gasoline sales, which fell sharply last month (mostly due to lower energy costs). As a result, retail spending ex-gas accelerated to 4.8%, the best pace since last September, a clue for thinking that consumption still has a decent tailwind that will keep spending habits in the growth column for the near term.

Yet the tendency to focus on the latest monthly changes inspires a wary outlook for consumption. “Consumers remain cautious and hesitant to spend despite an improving jobs picture and evidence of accelerating wage increases,” Alan MacEachin, an economist at Navy Federal Credit Union, tells Reuters.

Perhaps, although the year-over-year trend implies that any hesitancy will be limited to restraining the growth rate rather than cutting spending outright.

Bricklin Dwyer, an economist at BNP Paribas, also reads today’s update as a speed bump for the macro outlook, as AP relates: “Today’s report is decidedly negative for both the economy and the probability of a near-term rate hike from the Fed.”

Nonetheless, until we see retail spending fading in the annual comparison, there’s still a reasonable case for arguing that the latest weakness may be noise.