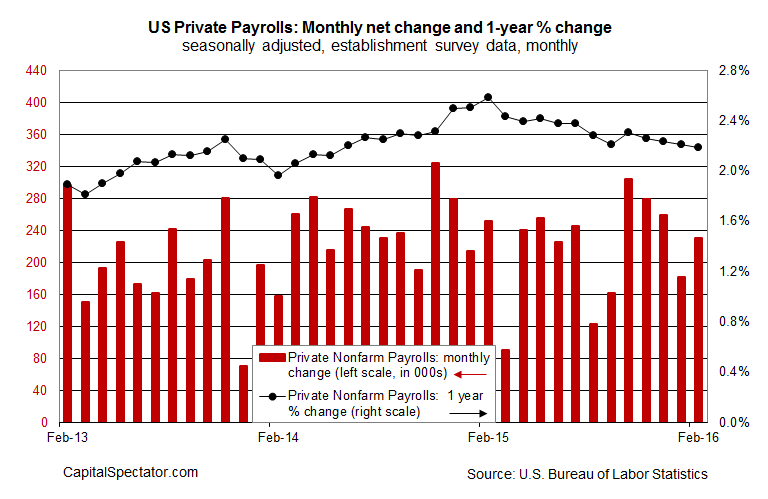

American companies added 230,000 workers to payrolls in February, a solid improvement over the upwardly revised 182,000 gain for January (based on seasonally adjusted data). Today’s update from the Labor Dept. handily beat the consensus forecast for a rise in the low 180k range. The year-over-year growth rate for private-sector jobs continued to tick lower, but the annual pace of 2.18% through last month continues to reflect a bullish tailwind for the labor market.

Today’s release offers another upbeat round of macro data that raises doubts on the veracity of recent worries about the US economy. Wage growth was soft, however. Average hourly earnings dipped 0.1% last month vs. January, marking the first drop in more than a year–a drop that throws cold water on the prospects for firmer wage growth.

From a top-down perspective, however, today’s update sends a strong signal that February’s economic profile will remain firmly in the growth column once all of last month’s numbers are published. The January review of the US trend pointed in that direction and today’s figures certainly strengthen the case for anticipating that forward momentum will prevail for the foreseeable future.

Michael Feroli, chief US economist at JPMorgan Chase, tells Bloomberg that the news “indicates the resilience of the economy. The labor market doesn’t appear to be hurt by financial market volatility.”

Does this mean that a rate hike is back on the table for the Fed’s monetary meeting that’s scheduled for later this month? Well, sure. Today’s numbers juice the odds in favor of the hawks. With recession risk off the table via the spectrum of numbers in hand at the moment, squeezing policy no longer looks like a low-probability event.

“This is the best news the Fed could have expected going into the meeting,” Chris Rupkey, chief economist at MUFG Union Bank, explains via Reuters. “With jobs bouncing back, you can be sure that rate hikes are just around the corner.”

Pingback: American Companies Add Workers to Payrolls in February