Financial stress in the US has been creeping up this year, based on four benchmarks published by Federal Reserve banks. One of the indexes is now signaling a “moderate” stress level for the US, although the other three metrics have yet to confirm the change. As such, the composite reading for all the indexes still reflects stress that’s average to below average. The key question is whether the gently rising trend for all the benchmarks of late will roll on in the weeks ahead?

Meantime, let’s get up to speed on the current numbers. The St. Louis Fed’s FRED database collects the data on four indexes that quantify stress in the financial system across a range of factors. Each benchmark uses a different methodology and dataset and so reviewing all of the indexes offers a relatively robust, diversified profile of risk in the US financial system. Here’s a summary of current readings, based on figures collected this morning (Feb. 4).

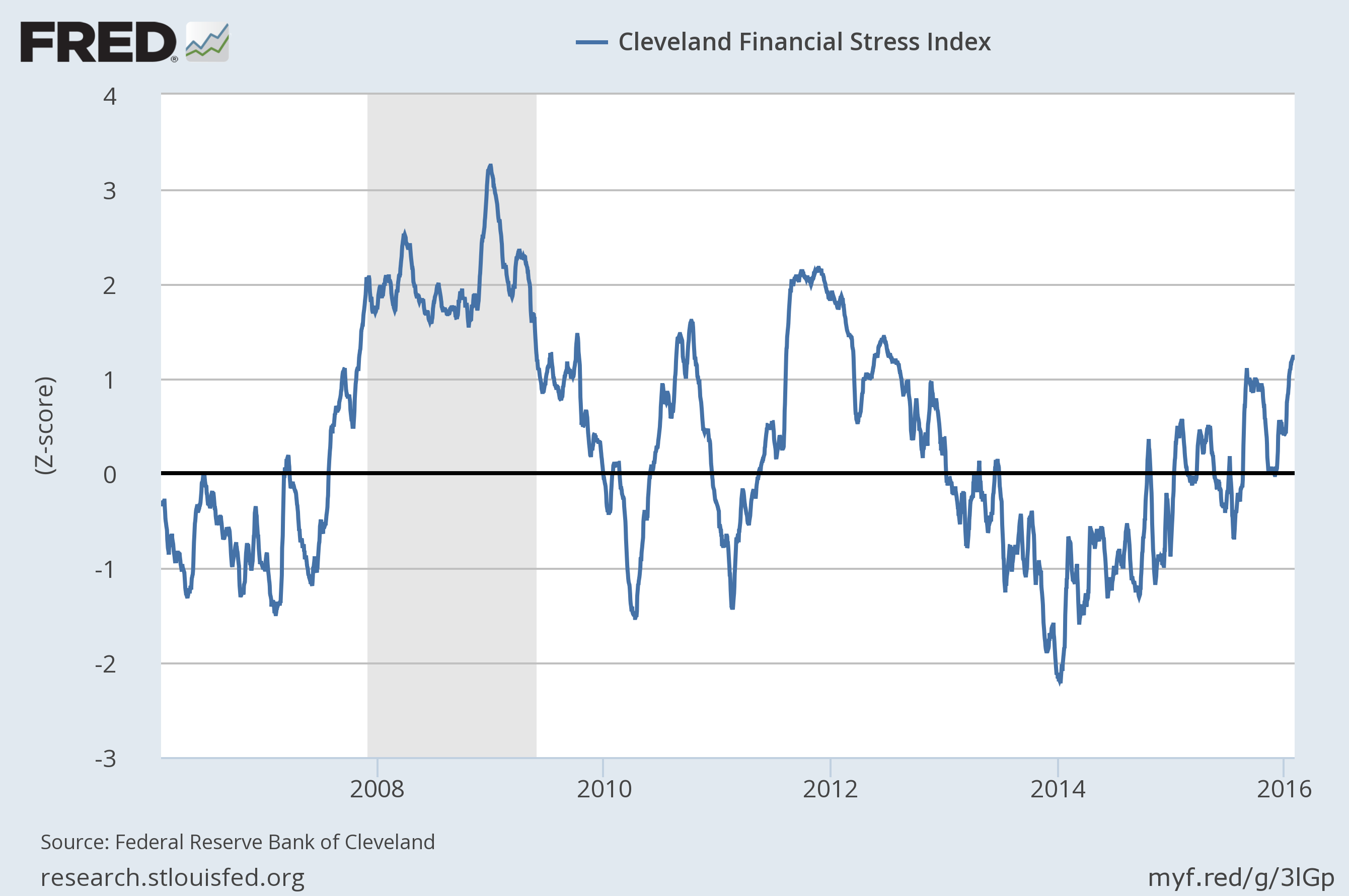

Cleveland Fed US Financial Stress Index

This daily index from the Federal Reserve Bank of Cleveland has been trending up lately, reaching its highest levels since 2012 in recent days. The +1.22 reading for Feb. 3 is considered a “moderate” stress level. A value at or above +1.82 for the index would be labeled “significant” stress.

St. Louis Fed US Financial Stress Index

This weekly measure of financial stress is trending higher too, reaching -0.34 for the week through Jan. 22—the highest since late-2011. Nonetheless, the current level isn’t threatening–readings below zero reflect “below-average market stress,” according to the St. Louis Fed.

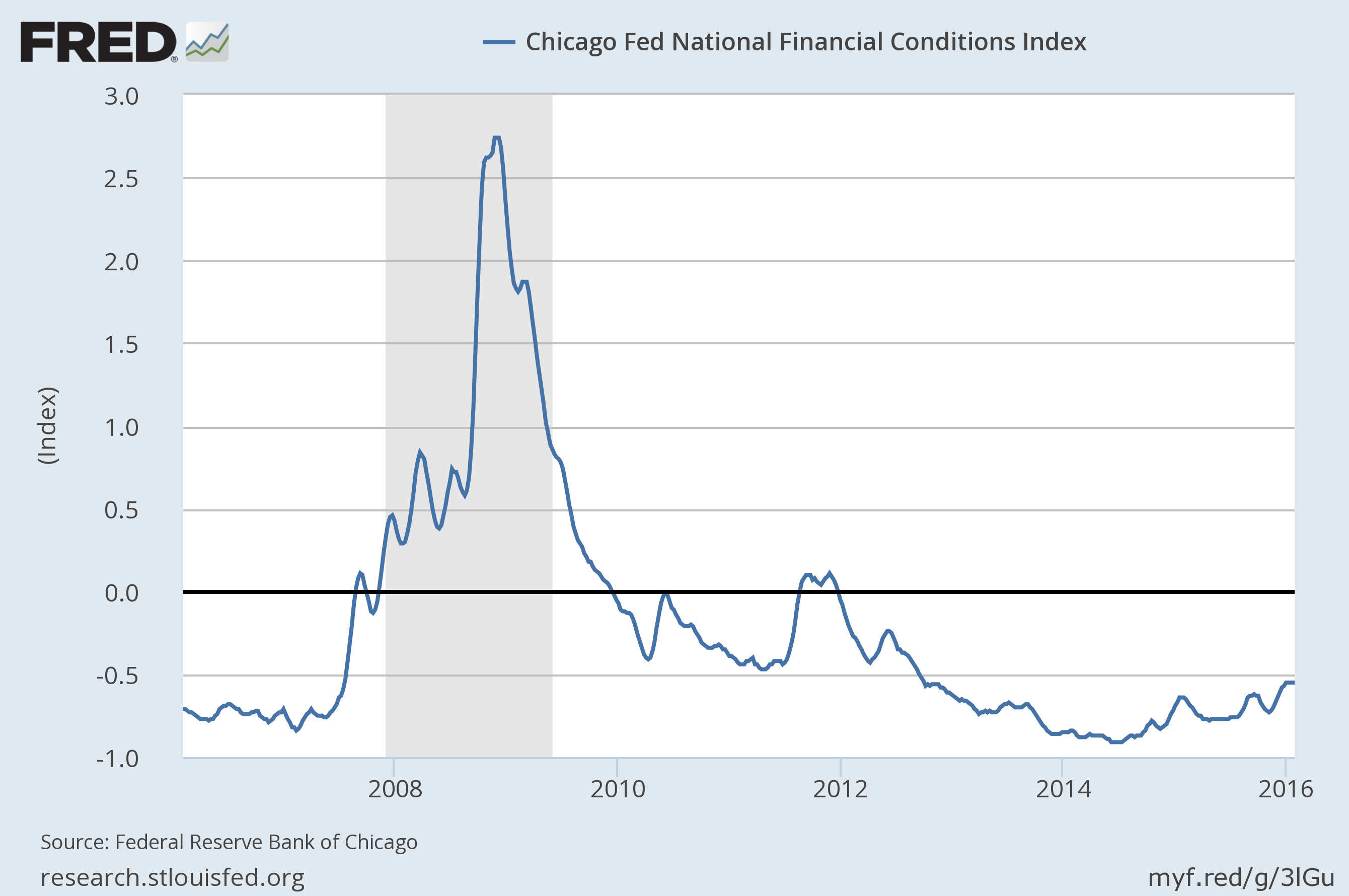

Chicago Fed National Financial Conditions Index

The Chicago Fed’s weekly measure of US financial stress has climbed recently and is currently at the highest reading in over three years. The latest update shows the index at -0.55 for the week through Jan. 29. Despite the uptrend of late, the current level still reflects “loose” conditions, as per readings below zero. Only values above zero indicate financial conditions that are tighter than average.

Kansas City Fed US Financial Stress Index

This monthly benchmark of financial stress ticked higher in December, close to a three-year high. Reviewing the latest data in context with the last several business cycles, however, suggests that the current reading is still below levels that have previously signaled high risk.

Pingback: Despite Recent Strength, Bonds Remain Vulnerable | Gold IRA Guide