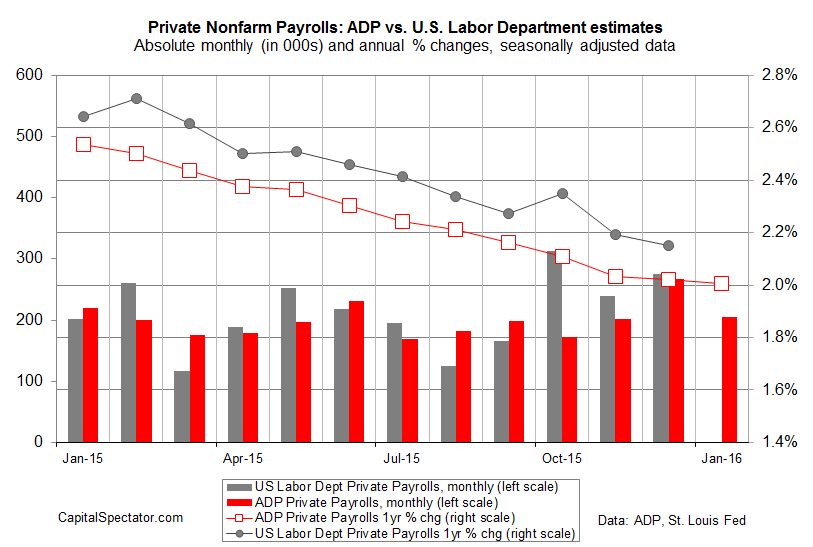

US companies added 205,000 workers last month, according to the ADP Employment Report. As expected, the gain was well below December’s advance, which was revised up to a 267,000 increase. The numbers still show that the labor market is expanding at a healthy pace, so let’s not lose sight of this fact. But it’s also clear that the trend is slowing, based on the latest downtick in the year-over-year change.

Private payrolls increased 2.0% in January vs. the year-earlier level. That’s still a solid gain, but the latest annual increase marks the lowest year-on-year advance since the summer of 2013. The key takeaway: the annual growth rate continues to decelerate. It’s a slow descent, virtually undetectable in the latest round of numbers. Nonetheless, the slide is ongoing.

Today’s release marks the 13th consecutive month of slightly slower growth in annual terms. The persistent deceleration isn’t particularly troubling at this point, but it’s a reminder that the strongest phase of job growth has probably peaked for this cycle. It’ll be interesting to see if Friday’s official data from the Labor Department for January reveals otherwise, but analysts are expecting a similarly slower but still respectable gain.

The good news is that the numbers still betray few signs of stress for the labor market for the immediate future. “Job growth remains strong despite the turmoil in the global economy and financial markets,” says Mark Zandi, chief economist at Moody’s Analytics, which co-produced today’s ADP data. “Manufacturers and energy companies are reducing payrolls, but job gains across all other industries remain robust. The US economy remains on track to return to full employment by mid-year.”

Maybe so, but the relatively strong growth in payrolls appears to be fading, albeit slightly. There’s no reason why decent gains can’t continue for some time. But for those who believe in a natural aging process for the business cycle that leads to a familiar denouement, today’s update hints at the possibility (likelihood?) that labor-market growth will continue to ease. If so, a critical source of support for economic growth overall will deliver diminishing returns. The effects will be difficult to spot on a month-to-month basis, but the collective drag may become obvious as we move into 2016’s second half. As a result, the macro trend will be modestly more vulnerable to future shocks.

But that’s an issue for another day. Meantime, today’s update offers a degree of relief for the immediate worries that the January economic profile for the US is set to tumble into darkness. Using today’s ADP data as a guide, there’s still no sign of sudden death for the recovery at the kick-off to 2016. On the other hand, the rebound that began in 2009 is beginning to show its age, if only slightly.

Pingback: 02/03/16 – Wednesday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Dash of Insight| Weighing the Week Ahead: Is a Recession Looming?

Pingback: Weighing The Week Ahead: Is A Recession Looming? | Traders For Cash Flow

Pingback: Weighing The Week Ahead: Is A Recession Looming? | Investing Lab

Pingback: Looming Recession?