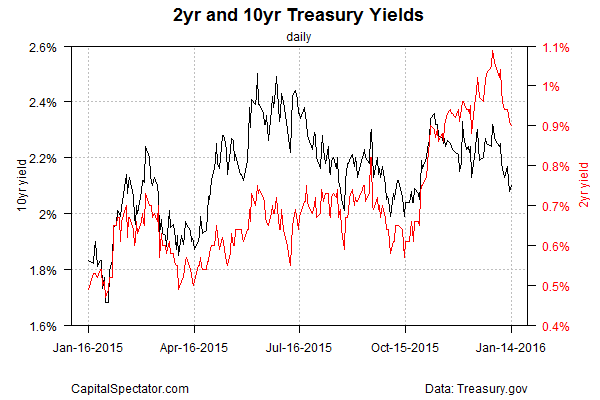

Treasury yields have made a sharp U-turn lately. The 2-year yield—considered the most sensitive to rate expectations—has been sliding this month, falling to 0.90% yesterday (Jan. 14), based on daily data via Treasury.gov. That’s the lowest in about a month. The benchmark 10-year yield has lost even more ground, slipping to 2.10%–the lowest since late-October.

The softer yields so far this year reflect renewed worry about a variety of factors that may weigh on economic growth in the US and around the world. The short list includes concern about China’s economy, ongoing instability in the Middle East, and a fresh round of concern that the US recovery has decelerated… again.

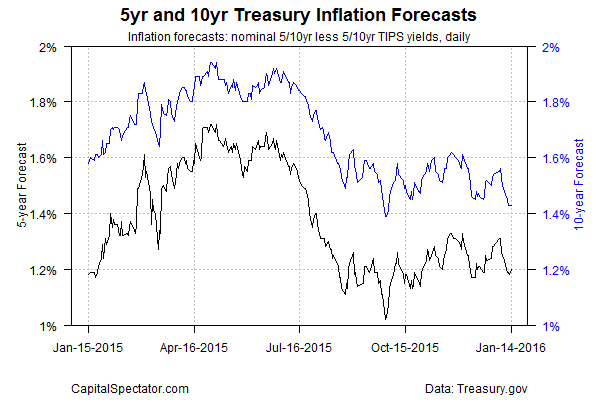

Market-based inflation expectations are in retreat again too. The implied estimate via the yield spread on the conventional 10-year Treasury less its inflation-indexed counterpart has been bumping along at 1.43% in recent days—the lowest since late-September and well below the Federal Reserve’s 2% target for inflation.

The counterpoint to all this: the US economy doesn’t appear to be sliding into a recession, based on the current numbers (see yesterday’s analysis for details). Nonetheless, growth has softened lately, perhaps sharply. The Atlanta Fed’s GDPNow model projects that fourth-quarter GDP growth weakened to just 0.8% (as of Jan. 8)–less than half the rate in Q2.

A new survey by The Wall Street Journal highlights the current state of macro:

Most economists think the American economy will continue to expand, but weakness abroad is heightening their concern about U.S. growth. Forecasters in The Wall Street Journal’s latest survey of economists say there is a 17% chance the U.S. will enter recession in the next year, the highest risk in three years. And 80% of forecasters said they see risks to the economy to the downside.

But if there’s reason for concern, there was no sign of distress in the US stock market yesterday. The S&P 500 surged nearly 1.7% on Thursday, albeit after previously falling sharply since the start of the year.

One fundamental reason for thinking that US growth will endure and perhaps pick up: the upbeat data in the labor market in recent months. The three-month average for growth in private payrolls through last month is a robust 276,000—the strongest gain for that rolling time frame since January.

The healthy gain in job creation implies that anticipated soft patch in last year’s fourth quarter will give way to firmer comparisons in 2016’s first half. The Treasury market, however, is skeptical.

Economists at Northern Trust this week labeled current conditions as a “Tale of Two Economies.”

U.S. economic growth appears to have shifted to a lower gear in the final months of 2015. It has left many concerned about the well-being of the economy and raised questions about the Federal Reserve’s recent hike of the policy rate. In this context, it is important to note that the recent slowing reflects a lopsided development not a widespread deceleration of economic activity.

Northern Trust’s Carl Tannenbaum and Asha Bangalore add that favorable “domestic fundamentals support hiring and consumer spending trends.” As a result, they predict that “the fourth-quarter deceleration is most likely a passing event, with growth predicted to pick up in 2016.”

Yesterday’s stock-market action certainly supports their outlook. The question is whether the Treasury market will fall in line with the outlook for an acceleration in growth? That may be a tall order, given the weakness in China, which favors a risk-off environment that’s likely to keep demand for Treasuries high and yields low. Until the crowd’s convinced that China’s recent turbulence has passed and the macro outlook is stable, the global demand for the safe haven of Treasuries will remain firm.

“The market perception of China remains fragile and the pressures on emerging markets remain significant,” Guillaume Tresca, a strategist at Credit Agricole in Paris, tells Bloomberg. “It is still not yet time for an EM turnaround as the uncertainties lingering ahead are still numerous.”