The 2-year Treasury yield surged yesterday (Dec. 29), rising to 1.09%–the highest since April 2010, based on daily data published by Treasury.gov. The increase in this key rate—considered to be the most-sensitive spot on the yield curve for rate expectations—suggests that the market’s confidence is rising that the Fed will continue to tighten monetary policy in 2016.

Yet some analysts warn not to read too much into the latest pop in rates, explaining that light trading volume this week may be a factor in the sudden spike in the 2-year yield. “Markets in the last week of December are thin and a lot of people have already closed their books for the year, so that’s part of why we had a weak auction,” Justin Lederer, Treasury strategist at Cantor Fitzgerald, told Reuters on Tuesday.

Another factor that raises questions about the sustainability of higher yields is the weak outlook for economic activity. Expectations for fourth-quarter US GDP remain soft, based on last week’s update of the Atlanta Fed’s fourth-quarter estimate for US economic growth. The bank’s Dec. 23 nowcast slipped to a sluggish 1.3% (seasonally adjusted annual rate) for the Q4 GDP report that’s scheduled for release next month. The projected gain represents a moderate deceleration from Q3’s 2.0% pace.

A sluggish pace of growth is also on track for the global economy next year, according to IMF Managing Director Christine Lagarde. “Global growth will be disappointing and uneven in 2016,” she wrote in the German newspaper Handelsblatt, Reuters reports.

That doesn’t sound like the foundation for rising yields. Nonetheless, rates along much of the Treasury yield curve are higher at the moment relative to 30 trading days previous.

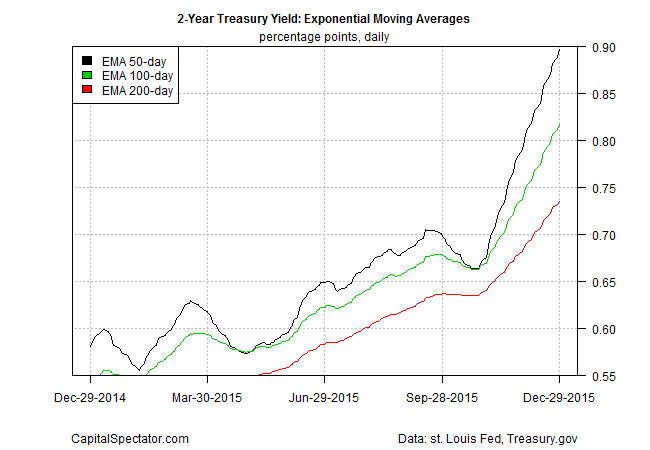

Meantime, the directional change in momentum for the 2-year yield is striking these days. Although it’s open for debate if this widely followed rate will continue to rise, the numbers to date certainly paint a bullish profile, based on exponential moving averages (EMAs).

Even the benchmark 10-year yield is starting to perk up, based on an EMA profile. For the first time in several months, the 50-day EMA for this influential rate has made a convincing run above its 100- and 200-day counterparts.

As for next month’s monetary policy meeting, the crowd’s expecting the status quo to hold. CME data for Dec. 29 shows that Fed fund futures are pricing in an 88% probability that the current 0.25%-to-0.50% target range will prevail in the FOMC statement that’s due on Jan. 27. Earlier this month the Fed raised rates by 25 basis points—the first hike in nine years.

Ultimately, it’s all about the economic data. The next major hurdle for deciding if the latest increase in market rates is based on the fundamentals: the December update on US payrolls, scheduled for Jan. 8. Taking this week’s jump in the 2-year yield at face value, the crowd is effectively betting that the news will continue to warrant a gradual but steady rise in Fed funds in 2016.

Pingback: 2-Year Treasury Yield Surged on Tuesday