The Federal Reserve yesterday raised its target range for the Fed funds rate by 25 basis points to 0.25% to 0.50%–the first hike in nine years. The reasoning, as the Fed explained, is the “considerable improvement in labor market conditions this year” and the outlook for inflation “will rise, over the medium term, to its 2 percent objective.” But the economic data is mixed, as yesterday’s sharply divergent US macro updates remind. Housing starts rebounded smartly in November, but industrial production tumbled 0.6% last month—the biggest monthly decline in more than three years. As a result, output is now contracting by more than 1% a year.

The obvious question: does the resumption of monetary tightening coincide with the start of a new recession? No, based on the numbers available at the moment. But the latest run of data looks worrisome… again. The labor market betrays no sign of trouble, and that may be enough to keep the business cycle in the positive column. There are other encouraging signs as well, including robust 4%-plus year-over-year growth in real personal income ex-transfer receipts. But the latest dip in the Philly Fed’s ADS Index—a quasi real-time business-cycle benchmark—comes at an awkward moment. Indeed, the symbolism of a rate hike at a point when the US economy appears to be stumbling doesn’t inspire much confidence.

After yesterday’s round of macro updates, the ADS Index was revised down to a weak -0.58. That’s still above the tipping point of -0.80 that marks the start of recessions, based on the San Francisco Fed’s analysis (“Diagnosing Recessions”). Nonetheless, the latest slide in this index in the current climate raises new questions about the wisdom of yesterday’s policy change.

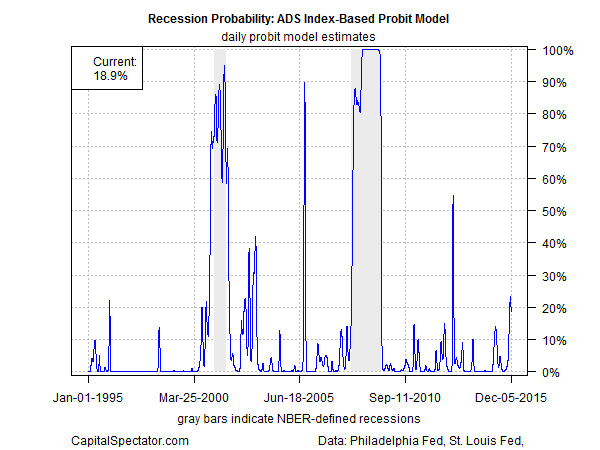

Translating the ADS data into probability estimates of recession risk via a probit model reveals a sharp jump in macro risk after yesterday’s updates. The implied probability that an NBER-defined recession for the US has started this month jumped to roughly 20%–the highest since early 2013. That’s still low enough to reserve judgment about what comes next. Until (or if?) we see confirmation in other business cycle indicators and economic data in the days ahead it’s fair to stay that the case for modest growth in the near term is still a reasonable working assumption.

But now there’s a new risk factor that’s been added to the mix: Fed rate hikes. The plan at the moment is to squeeze policy gradually in 2016, although nothing’s written in stone. Nonetheless, the tortured history of Fed rate hikes and recessions came up in yesterday’s press conference. A reporter asked Fed Chair Janet Yellen about the track record of raising the policy rate and the onset of economic downturns—a history that tends to manifest itself in the early warning signal of an inverted yield curve, i.e., short rates rising above long rates.

The curve is still comfortably positive and so by this yardstick recession risk is low. The 10-year Treasury yield is currently 2.30%–nearly 200 basis points above the new 0.25%-0.50% target range. The question, of course, is whether this upbeat yield-curve signal is still valid in the strange new world of post-2008 monetary policy? The answer? To be determined.

Meantime, Janet Yellen yesterday advised that one rationale for raising rates at this point is to minimize recession risk by rolling out a tighter policy relatively early so as to allow more time for gradual increases. She reasoned that “an abrupt tightening could increase the risk of pushing the economy into recession.” Responding to a reporter’s question about the tendency for Fed rate hikes to trigger downturns, Yellen framed that history as a function of waiting too long to squeeze policy to combat rising inflation. By that standard, the Fed is now set on a course to keep the expansion bubbling longer by starting the rate-hike cycle earlier… or so we’re told.

That’s a controversial interpretation of the historical link between Fed policy and recessions and so it remains to be seen if rolling out a rate hike at this point in time will prove to be prescient or problematic. What is clear is that the arrival of tighter policy in the current climate is a bit of a gamble. A broad reading of the data available to date still suggests that we’ll see moderate growth for the foreseeable future. But the forward momentum has decelerated lately, raising the possibility that the Fed’s latest policy decision is a mistake.

No, history doesn’t repeat, but sometimes it rhymes. It’s unclear if the Fed has set the economy on a short cut to recession, but it’s too early to rule out the possibility. The solution? Watch the incoming data… carefully and frequently. That’s not much of a solution for the here and now, of course. Then again, it’s the only game in town.

Pingback: Fed Funds Rate Hike and Risk of Recession

Pingback: Zinsschritt der Fed – unbedeutend und weitreichend